- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 1.04.2026

This Week in Barrons: 1.04.2026

Resolution #1 == Be Nice...

—To subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

New Year’s Resolution #1 = Be Nice: The following is from S. Forbes …

If you’ve ever worked the graveyard shift, you develop instincts. You learn the difference between boredom and trouble, between someone killing time and someone looking for an opening. So, when I saw a boy in a gray hoodie wandering the aisles at 3:15 a.m., every alarm I had went off. I’m 72 years old. I should be sitting by a lake with a fishing rod, not stacking cereal boxes and hauling dog food. But my retirement disappeared 10-years ago, and Social Security barely covers the basics. So here I am, working nights at a 24-hour supermarket, dealing with everything darkness brings: drunks, arguments, and people drifting in from the nearby hospital.

The boy didn’t fit. I first noticed him on the security cameras. He came in every Tuesday and Thursday, always around the same time. He grabbed a red basket and walked slowly through the store - produce, bakery, deli, dry goods – moving like he was studying the place. He’d pick up a box of macaroni, read it carefully, check the calories, look at the price, then put it back. Shampoo. Cereal. Cookies. Same routine. And every single time, he left without buying anything. After four weeks, I was convinced he was planning something. Studying schedules. Watching blind spots. I told myself that tonight I’d get answers.

At exactly 4 a.m., when he headed for the exit with his empty basket, I stepped in front of him and said: “You’ve walked more of this store than my staff does. Are you planning to buy something one of these days, or are you our new inventory specialist?”

He froze, raised his hands – shaking, and said: “I’m leaving. I didn’t take anything. You can search me.”

That’s when I really looked at him. He wasn’t dangerous or confident. He was exhausted with dark circles under his eyes. He was just a kid – about the age of my grandson. I said: “I’m not here to kick you out. I just want to know why you walk around the store with an empty basket.”

He stared at his shoes, at the automatic doors, and finally whispered, “It’s the noise.”

“The noise?” I asked.

He gestured toward the empty parking lot outside. “Out there, it’s too quiet. I sleep in my car, and every sound wakes me up. I can’t properly lock the back door.” He swallowed hard. “But in here… the lights, the music, the smell of rotisserie chicken – it feels like a home. If I take a basket and walk slowly, people think I’m just shopping. For 45 minutes, I can pretend I’m not homeless. Just a guy deciding what to make for dinner.”

It hit me straight in the chest. His name was Jackson. He was seventeen, and his mother had died of an overdose two years earlier. He never knew his father. When the rent went up, he was evicted. He was studying for his GED using the library’s Wi-Fi and slept in an old sedan parked at the far end of our lot – too scared to go to a shelter. He wasn’t casing the store but was just trying to feel human again. I told him to wait. I went to the break room and grabbed the turkey sandwich, apple, and bottle of water I’d packed for my lunch at 3 a.m. “Tuesdays and Thursdays,” I told him, handing him the bag. “Wait by the loading dock around 3:30. Walk the aisles as long as you want. If anyone asks, say you’re waiting for your grandfather. I’m your grandfather.”

That was 3-years ago. In small towns, secrets don’t last long, and sometimes that’s a blessing. Sarah, the night baker, noticed my sandwich disappearing twice a week. When she found out why, she started leaving “mistakes” - muffins and bagels that were suddenly too brown to sell. The produce guy added bananas and oranges. “Kid needs his vitamins,” he said. Soon, we had a quiet network of kindness: watching his car, letting him use the staff bathroom to wash up, making sure he always had something warm to eat.

Then a regional manager showed up. Ms. Galloway. Perfectly pressed suit, and clipboard in hand. One night, she found Jackson in the break room, studying from a book I’d bought him. She called me into her office. I walked in ready to hand over my badge. “Is that the boy sleeping in the silver sedan?” she asked.

“Yes, ma’am,” I said. “If someone needs to be fired, fire me. The others were just following my lead.”

She was quiet for a moment. Not angry, but rather tired. “My son went through something similar,” she said. “He lived on the streets one winter. He didn’t survive.”

She opened a drawer and pulled out an employment form. “We can’t hire someone without a permanent address,” she said. “But I have a room above my garage I only use for storage. If he uses that address, he qualifies. We need a night stacker. He starts Monday. You’ll train him.”

I have never seen anyone work harder. Jackson saved every paycheck. He finished his GED. Last month, I wore a tie (a big deal for me) and sat on a folding chair at a community college graduation. They called his name. Jackson. He had graduated with honors in HVAC technology. He gave the student speech. He didn’t talk about grades or professors. “When you’re poor in America,” he said, “you become invisible. People look through you because seeing you hurts. But one night, a 72-year-old man stacking soup cans really looked at me and made me visible again.”

There wasn’t a dry eye in the room.

What Jackson doesn’t know is that he wasn’t the last. Since then, we’ve noticed others – a single mother walking the aisles to keep her baby warm, a veteran sitting near the pharmacy just to hear voices, a man sleeping in his van who only needs a safe place to be. We have a system now: dented cans, day-old bread, forgotten coats. Tuesday and Thursday pick-ups at the loading dock.

Jackson has moved on, but there’s always someone. All because I stopped judging an empty basket and asked the only question that really mattered: “Are you okay? How can I help?”

The Markets:

Where was the Santa Claus rally? It didn’t show up. The pattern that worked 14 of the last 15 years failed, and that matters. When seasonal strength breaks, it’s usually a positioning problem: too many traders leaning the same way, and not enough capital to push through resistance. In a month, options flow confirmed it all: hedges were bought, volatility stayed elevated despite sideways price action, and smart money shifted from chasing upside to protecting downside.

Implications for January 2026 … The year began with the majority positioned for a rally that never came. With the Santa rally failing, January is unlikely to follow the usual post-holiday grind higher. Pattern breaks tend to precede sharp moves. We’re already seeing large prints in financials and hedges being rolled lower – signaling institutions preparing for volatility, not calm. Early January typically gets a boost from institutional reallocations, often into last year’s winners, but the current setup suggests a very different playbook.

Things I Read… Gladly is a cool customer experience platform … take it on a free test ride … R.F. Culbertson

The CX platform redefining AI’s next decade

In customer experience, cost savings don’t mean much if loyalty declines.

Gladly helps brands achieve both—maximizing efficiency and lifetime value.

With 240M+ conversations powered and $510M in cost savings delivered, Gladly has the evidence that customer engagement, not deflection, drives stronger economics. Our unified architecture and context-aware AI enable brands to serve customers faster, more personally, and with higher satisfaction—without compromising long-term profitability.

Explore the awards, research, and momentum behind this shift in our Media Kit.

Info-Bits…

Waymo + Gemini … Waymo is testing Google’s Gemini as an in-car AI assistant. A system prompt found in the app suggests Gemini would answer questions, adjust cabin settings, and reassure riders – but not control the vehicle. Waymo says it’s part of ongoing experimentation to improve rider experience.

ChatGPT now has a “Thinking” mode … OpenAI has launched a real Thinking mode for ChatGPT, letting users choose how much processing time the model uses – Auto, Instant, or Thinking – trading speed for deeper reasoning on complex queries.

Crypto & AI-Bytes:

Meta acquires Manus for $2B … Meta is buying AI agent startup Manus, whose agents handle research, coding, and data analysis. Manus will operate independently while its agents are integrated into Facebook, Instagram, and WhatsApp. Post-deal, Manus will cut all China ties to head off regulatory scrutiny.

Baidu AI chip unit files for Hong Kong IPO … underscoring China’s push for AI chip self-reliance amid tighter U.S. export controls. The listing also tests Hong Kong’s role as a capital hub for strategic tech and signals Baidu’s strategy to unlock hardware value while retaining control.

Things I Read… Google AdSense helps me reach out to prospects - wherever they are … R.F Culbertson.

Banish bad ads for good

Google AdSense's Auto ads lets you designate ad-free zones, giving you full control over your site’s layout and ensuring a seamless experience for your visitors. You decide what matters to your users and maintain your site's aesthetic. Google AdSense helps you balance earning with user experience, making it the better way to earn.

Morgan Moment(s):

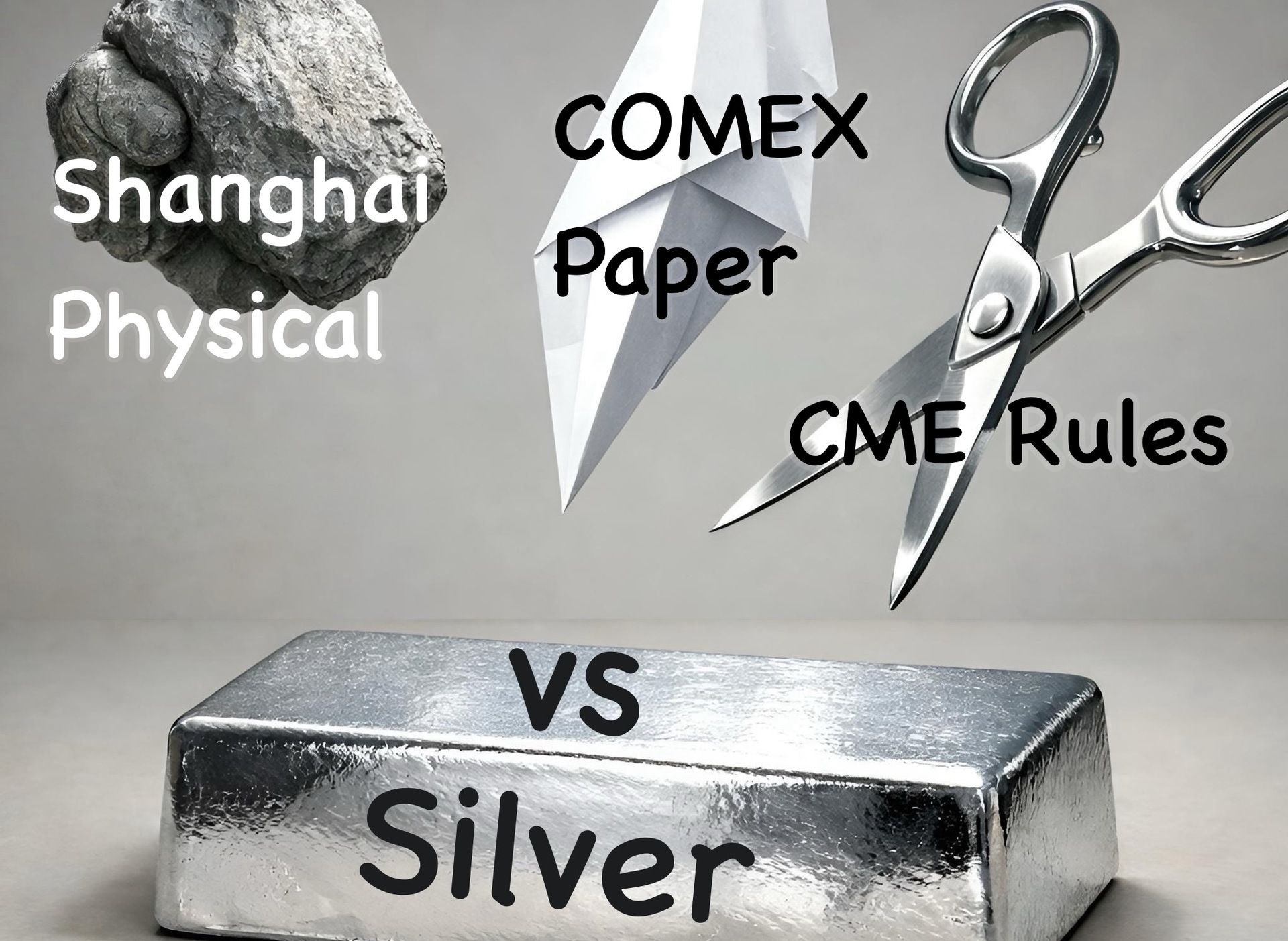

Gold and silver had surged hard … so profit-taking was inevitable, but the selloff was triggered by policy, not sentiment. Last week, the CME raised margin requirements on futures, forcing leveraged traders to either post more cash or reduce positions. For longs who couldn’t add capital, selling was the only option. As futures sold off, spot prices followed, since dealers, ETFs, and hedgers reprice off the futures curve.

Notably, the selling pressure is U.S.-driven. Early Monday, gold was back above $4,400 and silver near $77 – until the U.S. markets opened and erased all the gains. That divergence suggests a bullish sentiment in Asia and Europe, with bearish positioning concentrated in North America.

Fundamentally, silver’s breakout looks structural. Five years of production deficits and expanding demand have finally forced silver out of the sub-$50 range that capped prices for 45 years. Similar regime shifts occurred in the 1970s silver market and in copper and lead in the mid-2000s, when decades of mispricing corrected violently. Fourfold moves happen when markets conclude a commodity was fundamentally underpriced.

That process is now visible in Asia, where silver is trading at a premium—especially after China, the world’s second-largest producer, restricted exports. Those premiums are pulling physical supply from the rest of the world, reinforcing higher prices.

The paper–physical disconnect is now extreme. Reports suggest physical silver traded above $120 in Japan while U.S. spot remained near $74—the widest gap on record. As delivery approaches, futures markets appear focused on shaking out longs ahead of March delivery. If physical demand overwhelms available supply, prices will likely be forced higher as contracts move toward settlement.

The implication is straightforward: paper volatility is tactical; however, the physical signal remains dominant.

Next Week... Institutions Push Commodities Higher…

Order flow dominates … As paper SLV traded ~400k option contracts by mid-Friday – billions in notional value. [FYI: Physical silver flows are negligible versus what options move every hour.]

Debt rollover risk is imminent … as COVID-era 5-year debt at ~1% now refinances near 3.6%. With a flat yield curve across, there’s no duration shelter – hence the push for zero rates.

Forward VIX is flashing higher vol … Spot VIX ~14, but 49-day /VX futures trade ~18.4. Options are pricing in a rise in volatility.

Consumer bifurcation broke retail … Same-category retailers diverged: Target collapsed while Walmart surged. Dollar General’s fastest growth came from $150k+ households. Demographics, not demand, explain the split.

Labor shift: gradual, then sudden … Microsoft cut ~20k, Meta ~10k – those jobs are not coming back. Walmart expects their headcount to fall from ~1.2m to ~600k by 2030, largely replaced by AI and robotics.

Energy transition setup … Oil looks technically washed out and near a cyclical low. A break above ~$60 in /CL would likely start a slow new energy bull market. Tip #1: Devon and Oxy are worth watching.

Healthcare rebound … Pharma was left for dead after policy noise, but the sector is turning. Tip #2: Leadership is emerging in names like Merck and Bristol Myers.

TIPS...

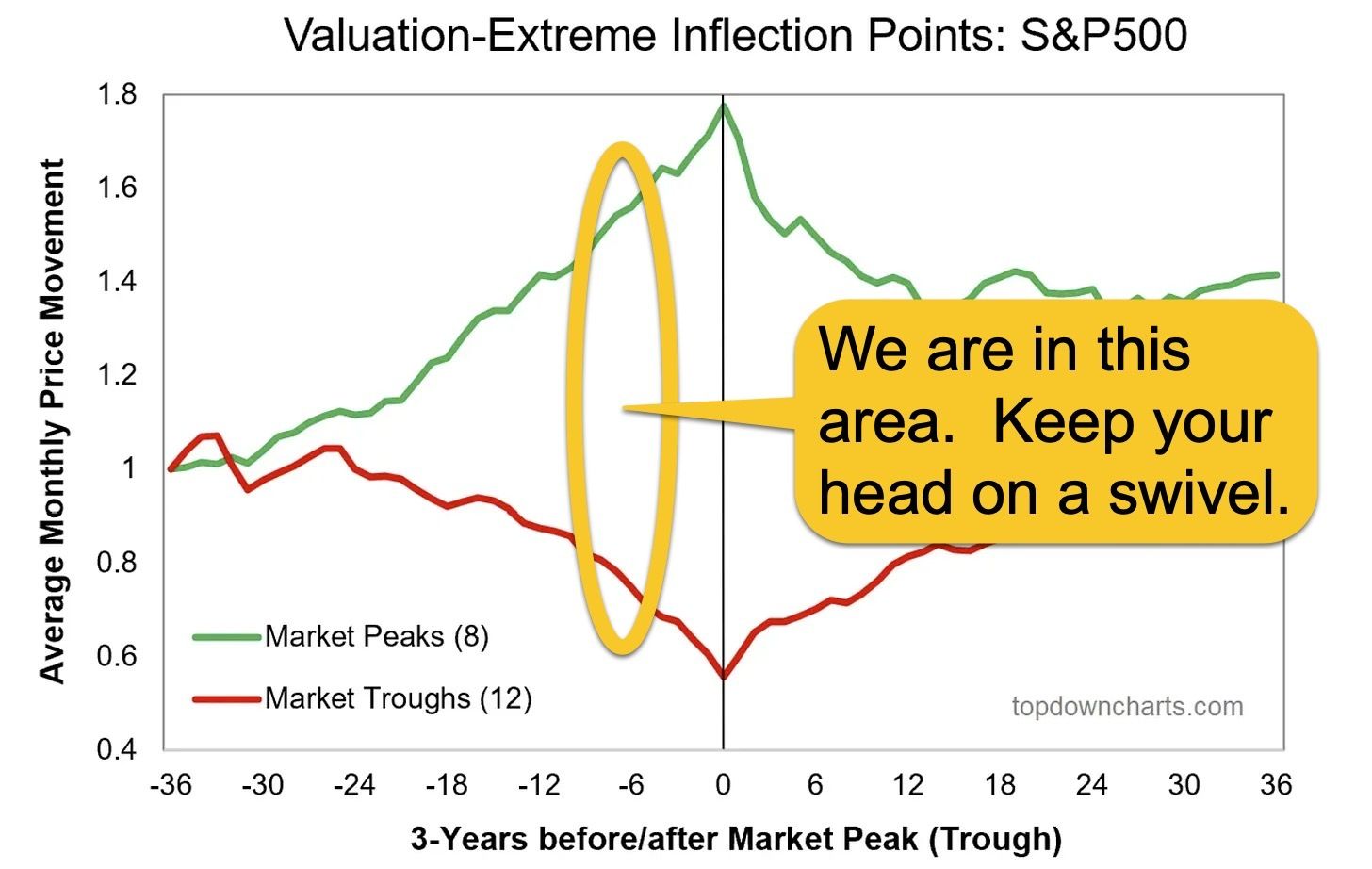

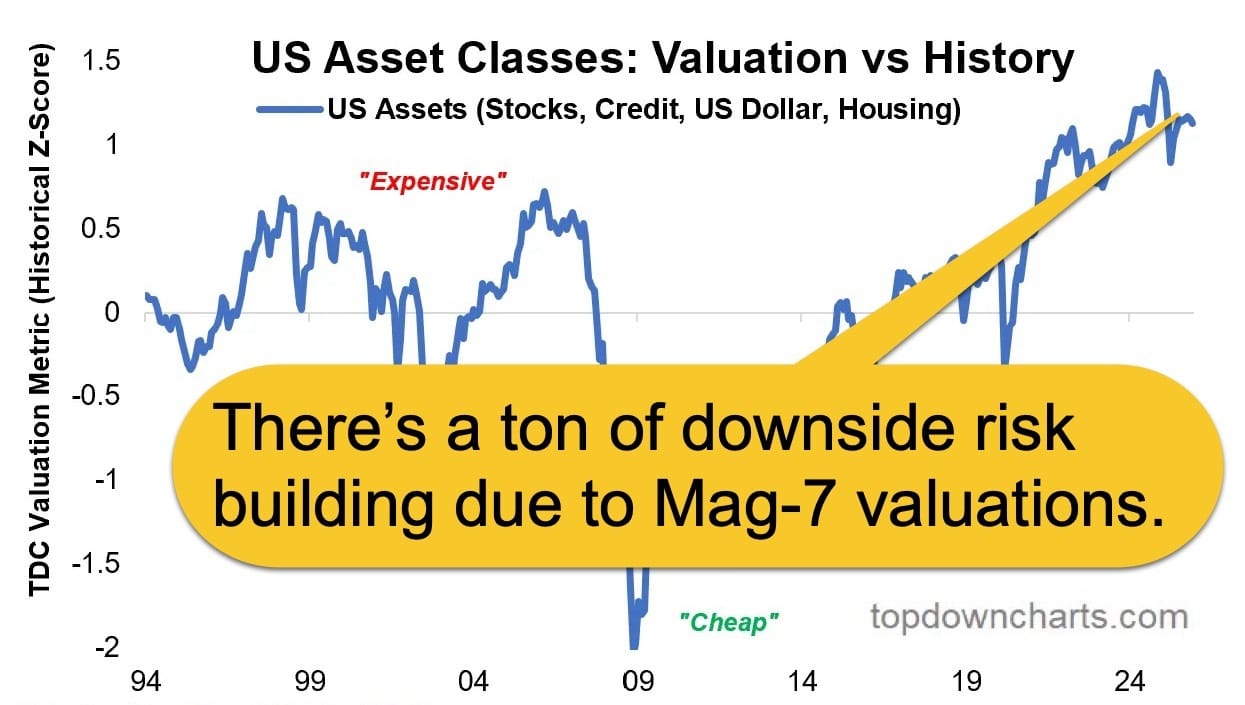

Factually: (a) The S&Ps gained +16.4% in 2025 (+17.9% including dividends). (b) The S&Ps lagged global stocks which saw 30%+ returns. (c) Investor sentiment is booming, yet economic confidence is gloomy. (d) Tech sector earnings are going vertical, and non-tech is going sideways. And (e) Tech/mega cap valuations are extremely expensive, and non-tech/small-to-mid-sized cap are cheap. Overall, per Callum Thomas: It turned out to be a good year for US stocks and a great year for global stocks. Sentiment is riding high as most everyone is patting themselves on the back following the gains of 2025. Keeping and building on those gains in 2026 is going to take a balance of optimism, trend following, and realism around some of the risks building up in the markets. Things are currently expensive, but the market will keep going up until it doesn’t; and when it peaks it will turn down faster than expectations – leaving little time to react.

TIPS on Trades:

- Tip #3: HYMC: Keep buying this Gold / Silver mining stock with Call Spreads.

- Tip #4: SLV: Silver has breached their expected move 5 weeks in a row with ~1m contracts being traded daily. Keep buying Call Spreads.

- Tip #5: Commodities & PMs: With everyone talking about last years’ push into semi-conductors, commodities and precious metals are showing strong institutional activity suggesting a big run through January.

- Tip #6: Hertz (HTZ): could be a massive, short-squeeze opportunity before January 16.

HODL’s (Hold-On for Dear Life) – Learn to like Commodities…

- Holding:

o (o) Ethereum (ETH = 3,153 / in at $310)

o (o) Bitcoin (BTC = $90,530 / in at $4,310)

o (o) IBIT – Blackrock’s Bitcoin ETF ($50.9 / in at $24)

- Increasing:

o (+) Physical Commodities = Gold @ $4,341/oz. & Silver @ $72/oz.

o (+) SLV (silver ETF) == ($65.7 / in at $27)

o (+) HYMC (gold & silver miner) == ($24.4 / in at $11.8)

o (+) GLD – Gold ETF ($398 / in at $212)

o (+) GDX (gold miners) == ($85.71 / in at $52)

o (+) COPX (copper ETF) == ($74.5 / in at $55.3)

o (+) CCJ (uranium) == ($98.5 / in at $84)

o (+) QQQI (divi producer on the Q’s ETF) == ($53.7 / in at $53)

o (+) ICSH (short term bonds = 4.65% yield == paid monthly)

- Temp. Hedges:

o (+) AG (PM miner) == BOT 16 Jan: +$15 / -$13 Put Spread

o (+) SLV (Silver) == BOT 16 Jan: +$61 / -$57 Put Spread

o (+) HTZ (Hertz) == BOT 16 Jan: $6 Call

o (+) HL (PM miner) == BOT 20 Feb: +$19 / -$17 Put Spread

o (+) RKT (Rocket Mort.) == BOT 20 Feb: +$21 / -$23 Call Spread

o (+) VIX (Volatility) == BOT 18 Feb: +$20 / -$25 Call Spread

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson