- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 1.18.2026

This Week in Barrons: 1.18.2026

Resolution #3 == Patience... 80% of every problem is below the surface

—To subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Your Identity is becoming algorithmic ... If you don’t define who you are, your data trail will. Google just launched Personalized Intelligence, letting Gemini mine Gmail, Photos, Search, and YouTube histories to tailor responses. Google is finally weaponizing its installed base — a moat most AI rivals simply don’t have. [FYI: Humm, maybe that’s why my Gemini responses keep referring to KPop: Demon Hunters.]

China is decoupling from Western tech. Customs officials have effectively banned Nvidia’s H200 chips. Authorities also ordered firms to stop using U.S. and Israeli cybersecurity software (VMware, Palo Alto, Fortinet, Check Point, CrowdStrike). China is accelerating efforts to replace Western tech with domestic alternatives.

REM-sleep enhancement looks real. Bright Minds Biosciences reports a clinical-stage drug that boosts REM sleep ~90% without extending total sleep time. If replicated, this targets one of the most leverageable pathways for stopping cognitive decline, Parkinson’s, and Alzheimer’s.

Some dogs learn by eavesdropping. Researchers found gifted word learner dogs (Border Collies) could understand new toy names simply by overhearing human conversation. The dogs would retrieve the new toy 80% of the time correctly – on par with the cognitive abilities of an 18-month-old child.

The Markets:

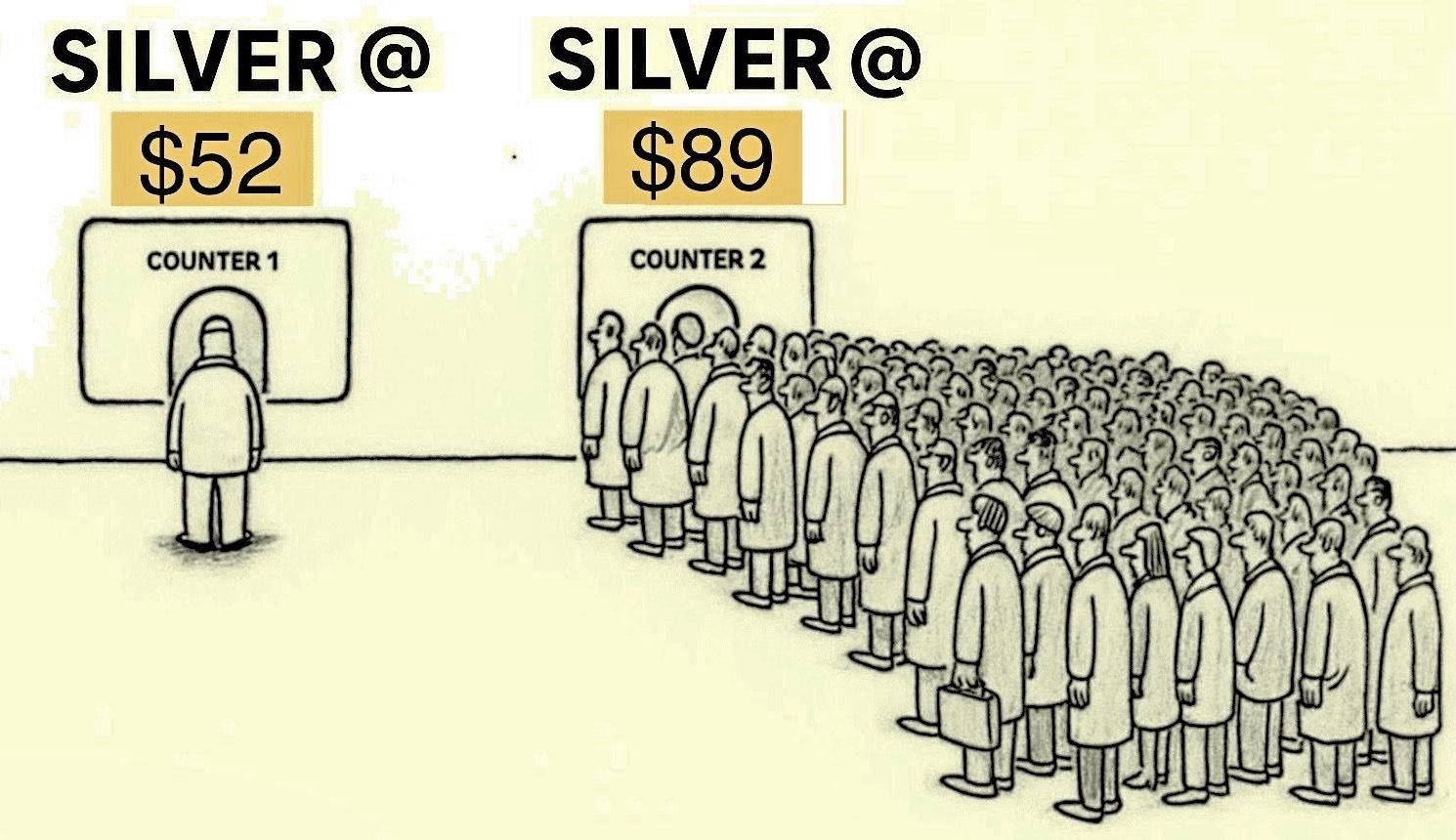

What Happens when the Silver runs out? Something is wrong inside the silver markets. By March 27, 751m oz of paper contracts are set to settle against just 440m oz of registered physical silver. The CME has allowed 170% more paper claims than metal in the vaults. That leaves a 311m oz delivery gap. This stress in physical delivery is already visible with major dealers as they pull products from their shelves. Local shops are seeing long lines for liquidation but are hoarding supply – because they know what’s coming.

Now layer in China, because when China stimulates its economy (as it’s doing now), it goes directly into factories and metals. China’s aggressive stimulation is causing silver demand to surge to a point that they’ve also restricted silver exports. All of this is happening, just as the CME is writing checks for silver delivery that the physical market can’t cash.

What happens next:

o The CME will keep raising margins as delivery risk spikes.

o ETF inflows (SLV) forces more physical buying into a tightening market. The real volatility will begin when retail and Reddit communities arrive.

o Paper silver contracts are quickly becoming the wrong instrument to use to guarantee physical delivery.

I don’t know how it ends. But it will start with a short squeeze that will make GameStop look like a ‘dress rehearsal’. This isn’t a meme trade. The physical product shortage is real. The demand is industrial. The math is simple:

o 751M oz was promised,

o 440M oz exists, leaving

o 311M oz short on March 27 delivery deadline.

Let the games begin.

Things I Use… I use Wispr Flow to get investment updates via voice … take it on a test ride … R.F. Culbertson

Investor-ready updates, by voice

High-stakes communications need precision. Wispr Flow turns speech into polished, publishable writing you can paste into investor updates, earnings notes, board recaps, and executive summaries. Speak constraints, numbers, and context and Flow will remove filler, fix punctuation, format lists, and preserve tone so your messages are clear and confident. Use saved templates for recurring financial formats and create consistent reports with less editing. Works across Mac, Windows, and iPhone. Try Wispr Flow for finance.

Info-Bits…

Gold has outperformed the S&P for 3 straight years.

Trump’s DOJ is suing Fed Chair Powell … officially over the Fed’s new building, but it’s widely viewed as pressure over additional rate cuts. [FYI: the next FED chair will (in everything but name) be Trump himself.]

Trump is pushing a 10% credit-card APR cap ... for 1-year starting Jan 20 versus the currently existing ~19.6% average APR (store cards ~30%). [If this gets enacted, credit access will be reduced to only the top-tier borrowers.]

Airbnb hires Meta’s former GenAI chief as CTO. Ahmad Al-Dahle (ex-LLaMA lead) signals a pivot toward an AI travel concierge.

2026 is shaping up as a “Mega-IPO” year. OpenAI, Anthropic, and SpaceX are preparing potential offerings with their $2T combined valuation, beating all of 2025s ~200 U.S. IPOs – combined.

Walmart is going all-in on drones … by partnering with Wing to build the world’s largest residential drone network in over 270 locations by 2027. In their test markets, drone deliveries have tripled purchases in the first six months as shoppers get used to getting everyday items delivered in minutes.

Crypto & AI-Bytes:

Apple confirmed a multi-year AI deal with Google … to power Apple’s AI features, including the long-delayed Siri overhaul. It will cost ~$1B/year but means that Siri’s major upgrade is now expected this spring. [BUY your new iPhones now.]

Do Anything just launched … new autonomous agents can work on projects for months – each with its own identity and email – acting independently from its host.

DeepSeek is releasing V4 for coding. Internal tests claim that it beats Claude and GPT on coding benchmarks, with major gains in ultra-long code contexts.

Signal’s founder launched Confer … an open-source, end-to-end encrypted AI assistant where even the platform can’t read your user data.

Anthropic rolled out “Claude for Healthcare” … complete with tools for providers, payers, and patients – synching data across platforms, phones and wearables. With ~230m weekly health queries already happening in ChatGPT, healthcare is becoming a primary AI battleground – with verification risk now becoming the central constraint.

OpenAI is testing ads in ChatGPT… with its free U.S. users seeing the ads first. Management is expecting ad revenue to be in the low billions for 2026.

Wall Street cut 10,600 jobs last week... as analyst roles are quickly becoming the first mass extinction event. It seems that AI is cheaper, smarter, and won’t embarrass the firm.

Things I Use… International hires (even for gig work) are challenging. Use Dell for the right templates … R.F Culbertson.

Equipment policies break when you hire globally

Deel’s latest policy template on IT Equipment Policies can help HR teams stay organized when handling requests across time zones (and even languages). This free template gives you:

Clear provisioning rules across all countries

Security protocols that prevent compliance gaps

Return processes that actually work remotely

This free equipment provisioning policy will enable you to adjust to any state or country you hire from instead of producing a new policy every time. That means less complexity and more time for greater priorities.

Morgan Moment(s): Are u kidding me?

The ABA, state banking associations … and the Bank Policy Institute are pressuring Congress to ban stablecoin yields. Their fear is simple: if USDC pays 4 to 5% while savings accounts pay ~0.6% - deposits will leave.

The banks’ own numbers paint the picture: (a) Treasury’s worst case = $6.6T in deposit flight, (b) Citi believes $1T will leave its own deposit coffers by 2030, and (c) our FED believes it will cause a $600B contraction in bank lending.

Meanwhile, banks continue to park ~3T at the Fed … earning ~4% as monies they neither lend nor pass through to depositors – and yet they claim that it’s the stablecoins are the threat to their lending.

The irony runs even deeper: The following 9 major banks were convicted of inappropriately restricting crypto firms between 2020–2023: JPM, BofA, Citi, Wells, U.S. Bank, Capital One, PNC, TD, BMO. In fact, Congress documented over 30 major crypto companies that were forced to debank during that time.

Major banks even debanked Pres. Trump himself: (a) Deutsche Bank ended a decades-long relationship, (b) Signature closed his personal accounts, and (c) Capital One shut ~300 Trump Org accounts. Now those same institutions want his administration to shield them from crypto competition.

In response … over 125 crypto firms have told Congress that their own GENIUS Act intentionally preserved stablecoin rewards.

The upcoming vote will be the first real stress test … as to whether crypto’s political momentum will hold. OR whether the banks that tried to kill the entire crypto industry get rescued by the same administration they walked away from?

Next Week... Commodities keep movin’ Higher…

Tech has overtaken healthcare as the top sector. This kind of rotation is rare and usually marks the start of multi-month momentum for technology stocks.

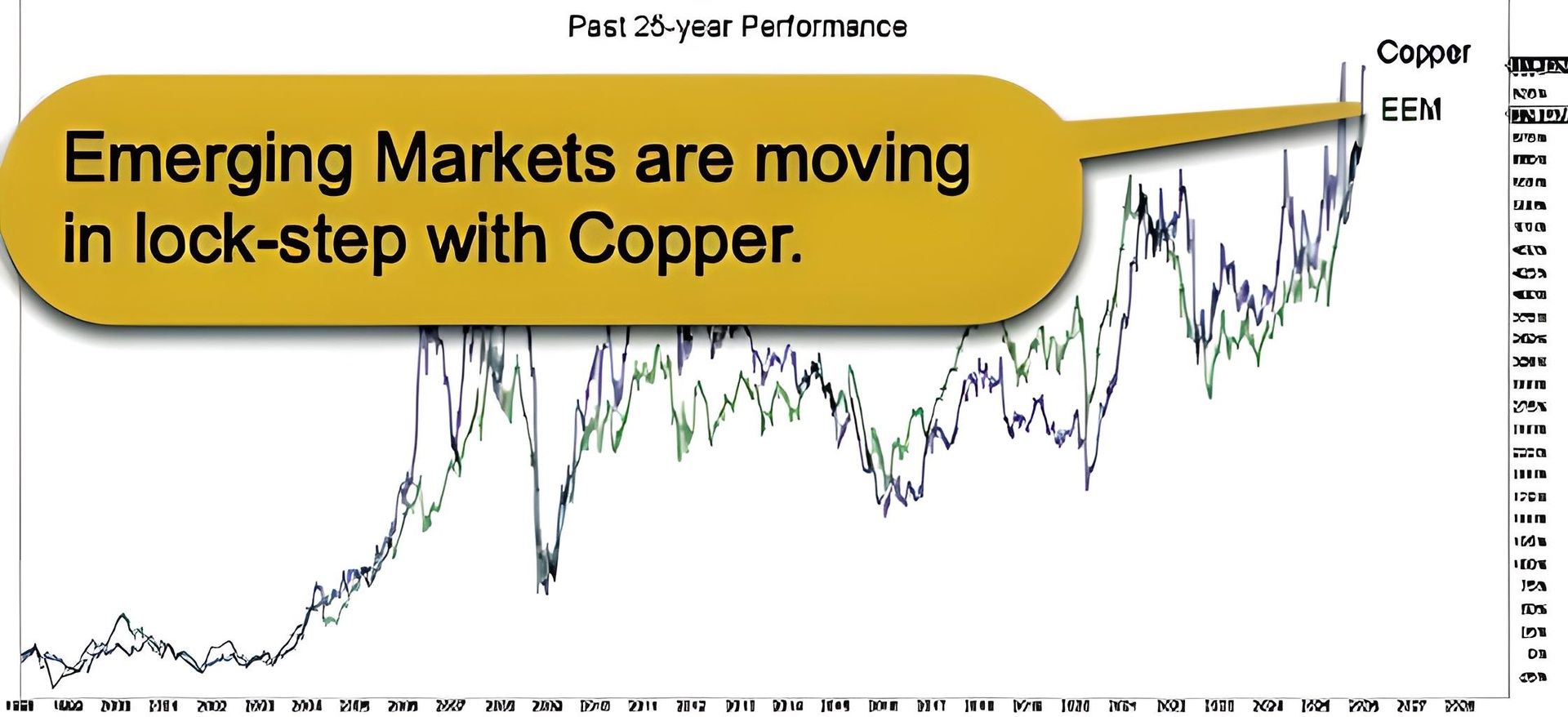

Basic Materials have surged into #2 sector ... which is a complete reversal from last quarter and a major regime shift. It’s a hedge against ‘dollar debasement’ and works nicely partnering with tech.

Silver’s fair-value target remains $120 to $130 … and my gold target is $5,400. Nothing is out of the ordinary; therefore, there’s no technical reason to stop buying.

Watch the gold-to-silver ratio ... a move below 35:1 would likely mark a major peak (1980 = 17:1, 2011 = 32:1). If silver hits $100 and gold pulls back, 35 is plausible, and historically where the move ends.

Resource inflation just hit an all-time extreme ... as gold, silver, copper, and most commodities all confirm inflation is running a lot hotter than 2.7%.

Oil’s Q4 drop masked inflation ... and artificially suppressed the CPI. Oil is rebounding, and a return to ~$63/barrel will completely erase the effect. [FYI: The next CPI could trend closer to 5.7%.]

Sector behavior confirms stagflation: Gold is +14.8% (3 months), utilities are −5%, bonds are down, and real estate is weak. Capital is abandoning defensives and crowding into inflation hedges – a classic growth-stall / price-rise pattern.

The FED isn’t cutting in Jan. and nobody’s buying the CPI story: Our Bonds and the FED funds futures haven’t moved, and policymakers know that real inflation is worse than the +2.7% goldilocks number that was just reported.

TIPS...

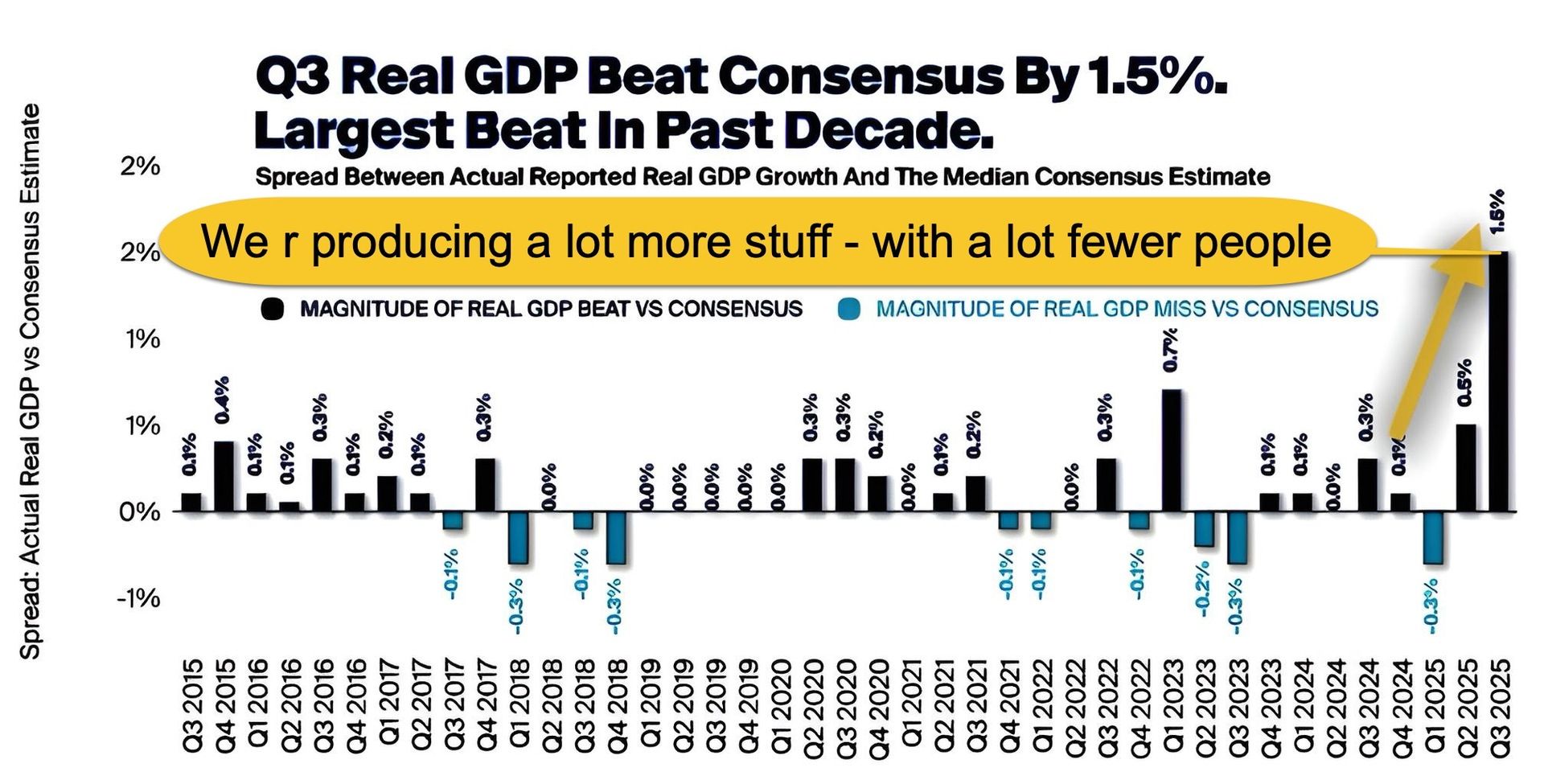

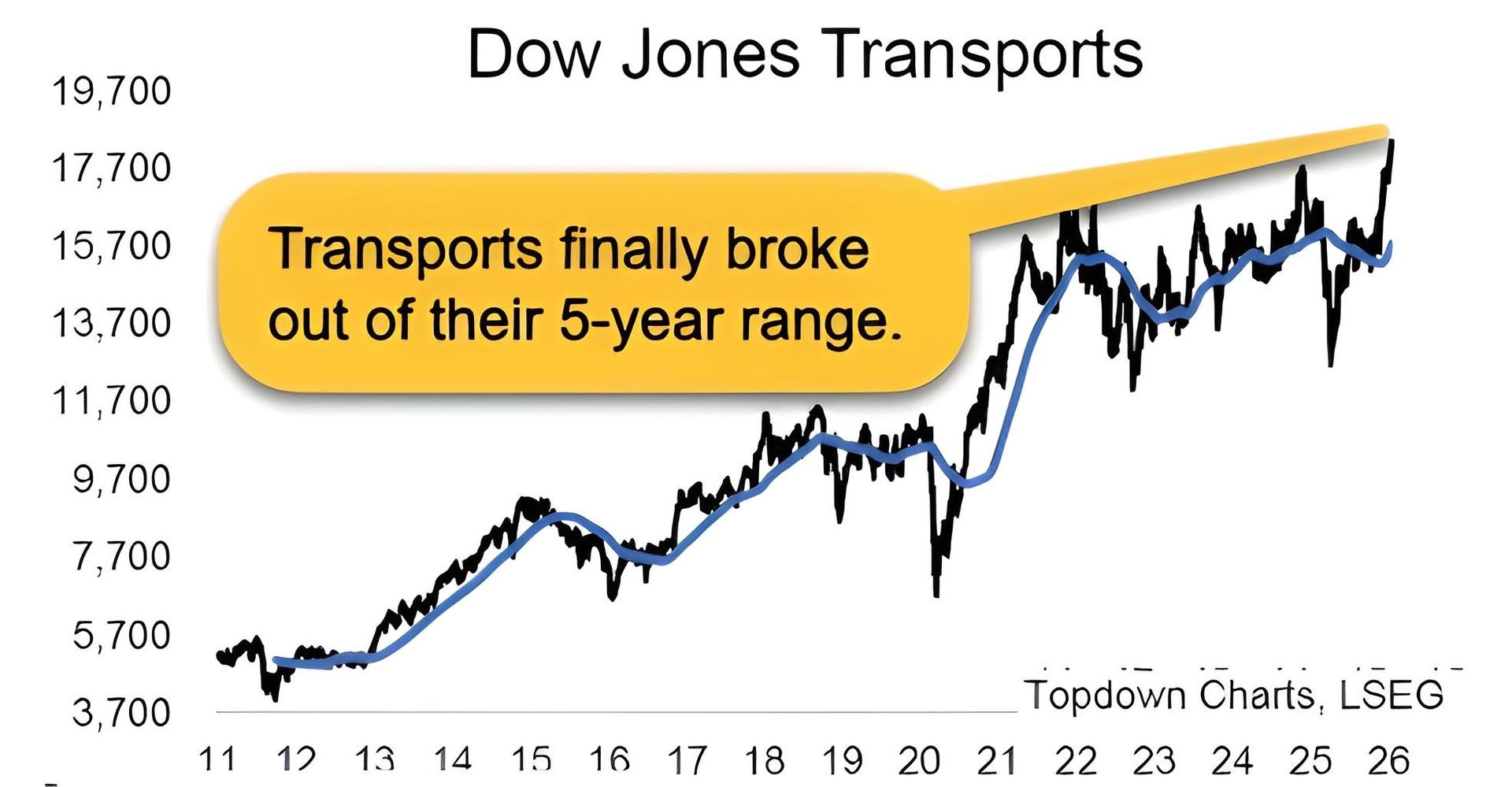

Factually: (a) Sentiment is becoming increasingly more bullish. (b) The VIX & Credit Spreads are at complacent/confident levels. (c) The transports, shipping stocks, emerging markets, and metals are all breaking out. (d) Value stocks are cheaper than usual vs history and vs growth stocks; conversely, growth stocks are more expensive vs history and vs value stocks. Overall, per Callum Thomas:The market’s mood remains distinctly bullish and perhaps justifiably so because: (a) more evidence is emerging in favor of a global growth reacceleration and (b) we’re seeing better performance from traditional cyclicals and risk-on assets. With growth stocks already expensive, and value still cheap – the next phase of this bull market may look a little unfamiliar to some.

Trading TIPS:

- Tip #1: ASTS (Patents for global Starlink = $115.77) … Buy 17 April +$115 / -$125 Call Spread.

- Tip #2: MLI (Mueller is Mining Infrastructure = $132.83) … Sell -$110 / +$105 Put Spread.

- Tip #3: WB (Weibo = $10.75) … Buy 17 April +$12 Call.

- Tip #4: UURAF ($6.80) - is a pure‑play bet on Western rare‑earth separation.

- Tip #5: HAFN ($5.87) - Hafnia moves refined fuels that power smelters, refineries, and industrial transport.

HODLs: (Hold-On for Dear Life)

- Holding:

o (o) Ethereum (ETH = 3,300 / in at $310)

o (o) Bitcoin (BTC = $95,600 / in at $4,310)

o (o) IBIT – Blackrock’s Bitcoin ETF ($54.2 / in at $24)

- Increasing:

o (+) Physical Commodities = Gold @ $4,600/oz. & Silver @ $88.5/oz.

o (+) SLV (silver ETF) == ($89.9 / in at $27)

o (+) HYMC (gold & silver miner) == ($34.6 / in at $11.8)

o (+) GLD – Gold ETF ($421 / in at $212)

o (+) GDX (gold miners) == ($97.2 / in at $52)

o (+) COPX (copper ETF) == ($80.7 / in at $55.3)

o (+) CCJ (uranium) == ($116.4 / in at $84)

o (+) QQQI (13% covered-call, dividend producer on the Q’s == paid monthly)

o (+) ICSH (short term bonds = 4.65% yield == paid monthly)

- Temp. Hedges:

o (+) HTZ (Hertz) == BOT 20 Feb: $6 Call

o (+) VIX (Volatility) == BOT 18 Feb: +$20 / -$25 Call Spread

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson