- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 1.25.2026

This Week in Barrons: 1.25.2026

Resolution #4 == "It gets weird ... before it gets worse."

—To subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

The Dodgers Payroll vs. Wealth Tax conundrum: The back-to-back champion Dodgers just signed top free agent Kyle Tucker to a 4-year, $240M deal—pushing their 2026 payroll (including guarantees) to 67% above the next-closest team. So much for money not buying titles. The timing is notable, as California enters a heated debate over a new wealth tax. [FYI: If MLB won’t impose a salary cap, voters may create the next best thing.]

Financial advisor attrition … as headcount fell again in 2025 – but unevenly. Independents remain the clear winners, while wire-houses lost fewer advisors than in prior years, hinting at a shift in how large firms are retaining talent. The classic “start at a wire-house, then leave” career path is changing.

The Better Mousetrap fallacy … We’ve seen almost no meaningful mousetrap innovation in 100 years despite massive effort. As Seth Godin notes: jumping headfirst into a new market rarely produces a better anything – but it often reveals a small group with a specific, unsolved problem. By solving that specific problem you will earn trust, energize word-of-mouth, and ignite sales momentum.

The Markets:

Ray Dalio & Gold … Ray Dalio said that investing today looks like the early 1970s and argue investors should hold up to 15% in gold. Gold just hit a new high near $5,000/oz, which he frames as protection against monetary debasement and geopolitical risk.

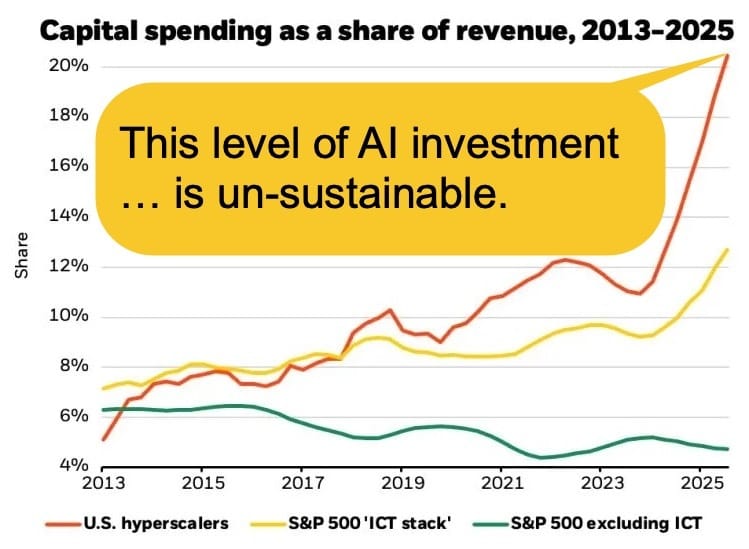

“Self-ware” vs Software … Anthropic’s Claude Code is having a breakout moment, pressuring traditional software stocks and accelerating the shift toward AI-built “Self-ware.” Hype or not, SaaS now faces real disruption from tools that have turned users into developers.

The Capitulation sequence … Markets bottom by following a pattern: volume shifts … then sentiment breaks … then options flows flip … and finally the technicals confirm the move. Buyers need to remember:“Institutions don’t buy strength – they buy capitulation (forced selling).”

Growth … U.S. GDP grew 4.4% in Q3, the fastest pace in two years (vs. 3.8% in Q2).

Inflation / consumer … The Fed’s preferred inflation gauge sits a little higher at 2.8% (Nov), with incomes up 0.3% and spending up 0.5%.

Metals explosion … Gold jumped ~9% to $4,983 - almost $5,000. Silver stole the show, breaking $100 and ending at $103 (+14% on the week, +36% in three weeks). Platinum rose 19%, and palladium increased by ~11%.

Things I Use… I use Wispr Flow to get investment updates via voice … take it on a test ride … R.F. Culbertson

Ship the message as fast as you think

Founders spend too much time drafting the same kinds of messages. Wispr Flow turns spoken thinking into final-draft writing so you can record investor updates, product briefs, and run-of-the-mill status notes by voice. Use saved snippets for recurring intros, insert calendar links by voice, and keep comms consistent across the team. It preserves your tone, fixes punctuation, and formats lists so you send confident messages fast. Works on Mac, Windows, and iPhone. Try Wispr Flow for founders.

Info-Bits…

It’s a Customer Support rebuild … Bland AI is replacing phone trees with brand-aware AI voice agents that resolve calls end-to-end – no menus, no hold music, just faster outcomes.

Canada opens the door to Chinese EVs … Canada slashed its tariff on Chinese EVs from 100% to 6.1%, turning Toronto and Vancouver into a North American test market for BYD, Geely, and Xiaomi. [FYI: If Chinese brands win Canadian consumers, U.S. tariffs get harder to defend.]

Silver’s historic surge … After a 200% one-year run, silver’s market cap hit $5.35T, making it the world’s second-most valuable asset.

The Tesla Insurance signal … Lemonade cut Tesla insurance rates 50%, citing data showing Full Self-Driving materially reduces accidents.

Housing freeze … U.S. pending home sales fell in December to their lowest level since April 2020.

Apple’s next wearable device … might be a wearable AI pin (2 cameras, 3 mics, speaker, magnetic charging), roughly AirTag-sized, launching in 2027.

Corporate AI layoffs continue … Amazon will cut thousands more corporate roles as early as next week – another data point for AI-driven white-collar compression.

Crypto & AI-Bytes:

OpenAI growth … OpenAI hit $20B in annualized 2025 revenue (up from $6B YoY) as daily active users continue making new highs.

Vibe coding goes full-stack … Vibecode launched what it calls the first full-stack vibe-coding platform – turning plain English into complete web and mobile apps (frontend, backend, database) powered by Claude Code.

AI moves into Health … Anthropic added four health integrations to Claude (Apple Health, Health Connect, HealthEx, Function Health) enabling cross-platform medical summaries and pattern detection. Amazon followed with Health AI for One Medical – a 24/7 in-app assistant trained on your records, labs, and meds.

Things I Use… International hires (even for gig work) are challenging. Use Dell for the right templates … R.F Culbertson.

Equipment policies break when you hire globally

Deel’s latest policy template on IT Equipment Policies can help HR teams stay organized when handling requests across time zones (and even languages). This free template gives you:

Clear provisioning rules across all countries

Security protocols that prevent compliance gaps

Return processes that actually work remotely

This free equipment provisioning policy will enable you to adjust to any state or country you hire from instead of producing a new policy every time. That means less complexity and more time for greater priorities.

Morgan Moment(s): Are u kidding me?

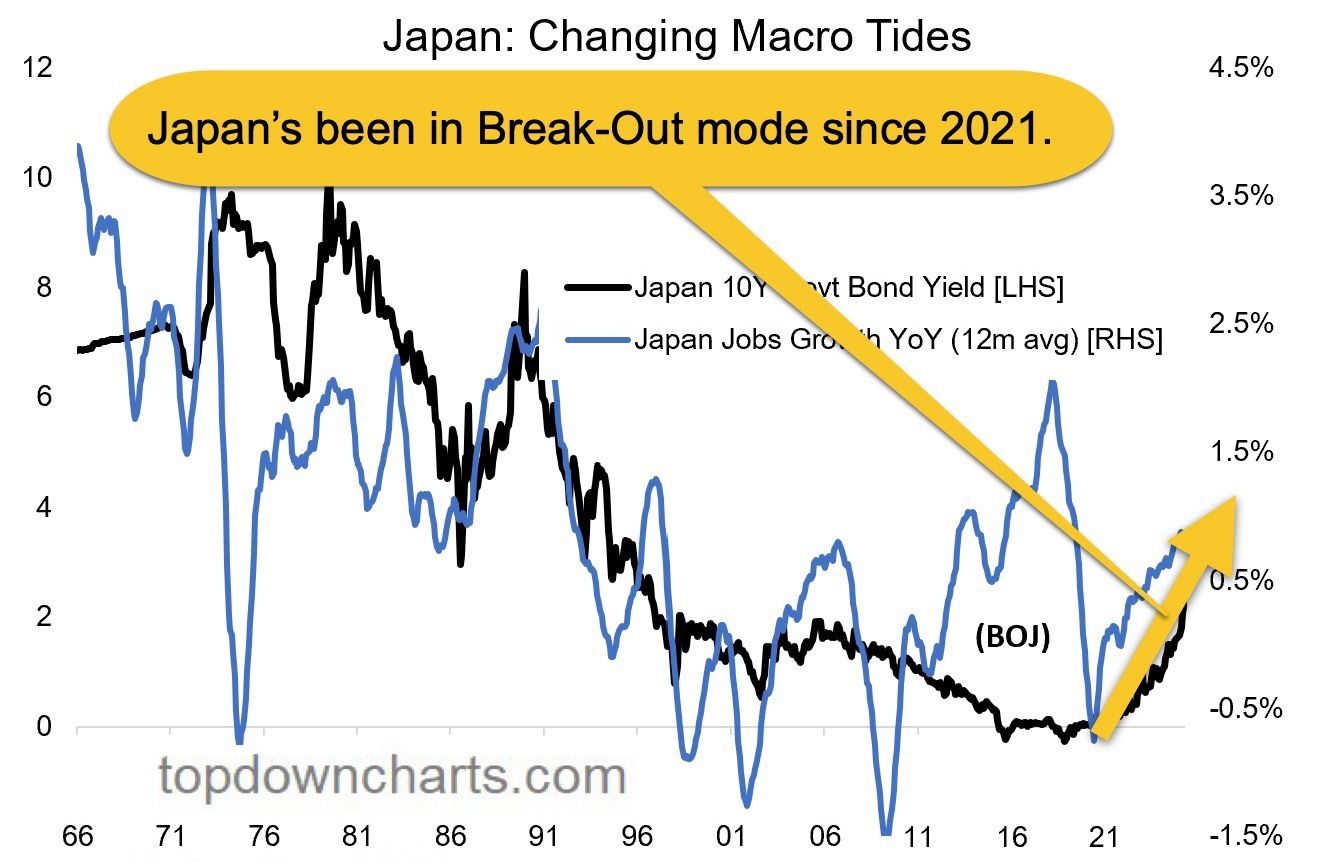

For the first time since 2007, Japan’s 40-year yield hit 4% - marking the end of Japan’s three-without penalty.

o This confirms a global carry-trade unwind and likely marks the start of the next phase of the U.S. Dollar’s (USD) instability.

o If Japan can’t anchor its own curve, the shock transmits through FX, energy pricing, and global risk models.

o This is the opening move in the Grand Repricing of Safety – as markets are operating under liquidity assumptions that are no longer valid.

Next Week... It gets weird, before it gets worse…

Tip #1: Silver markets are behaving like a sudden, upside Re-pricing is coming.

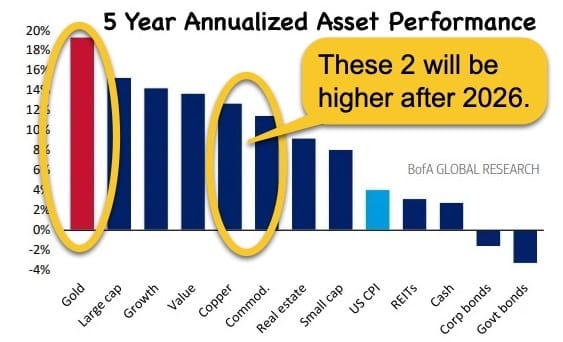

Top 5 Macro Economic Themes per C. Thomas:

o Bearish U.S. Dollar (medium/long term): expensive, fading yield support, weakening long-term technicals mixed with short-term countertrend rallies.

o Bullish Emerging Market equities: attractive valuations, monetary tailwinds, improving earnings, light positioning, strong technicals.

o Bullish China equities: strong technicals, cheap valuations, sentiment turning, early macro/monetary tailwinds.

o Bullish commodities: cheap, supply-constrained, improving fundamentals, under-owned, skeptical sentiment, strong trends.

o Bullish commodity equities: technicals supportive and leverage to higher prices, though valuations – especially in precious metals – are rising.

0DTE (Zero Days ‘Till Expiration) options are expanding into single-stock names … (TSLA, NVDA, AAPL, AMZN, META, MSFT, GOOGL, AVGO, IBIT) will gain Monday, Wednesday, and Friday expirations. This isn’t just more contracts – it’s a structural change in how these stocks will trade.

o Mega-caps will behave like the indexes … After 0DTE launched on the indices, price stopped respecting weekly expected moves and began trading off daily gamma exposure. We had:

§ Massive intraday dealer hedging,

§ Volatility + compression divorcing themselves from news and fundamentals, and

§ The Daily Expected Move (EM) > Weekly EM

o Applying that to the most actively traded stocks. NVDA normally trades ~2.3m options/day, add expirations and:

§ Volume will explode, gamma will spike,

§ Intraday price action will become flow-driven by 0DTE hedging, and

§ Traditional technical and swing setups will get destabilized

o This impacts everyone, even non-0DTE traders.

§ Overnight holders must understand embedded gamma.

§ Weekly option traders will see liquidity pulled into daily expiries.

§ Buy-‘n-Hold (Forever) will be the only approach largely insulated from these changes.

o Conclusion: 0DTE is becoming the dominant market microstructure for anything that drives U.S. equity indices.

TIPS...

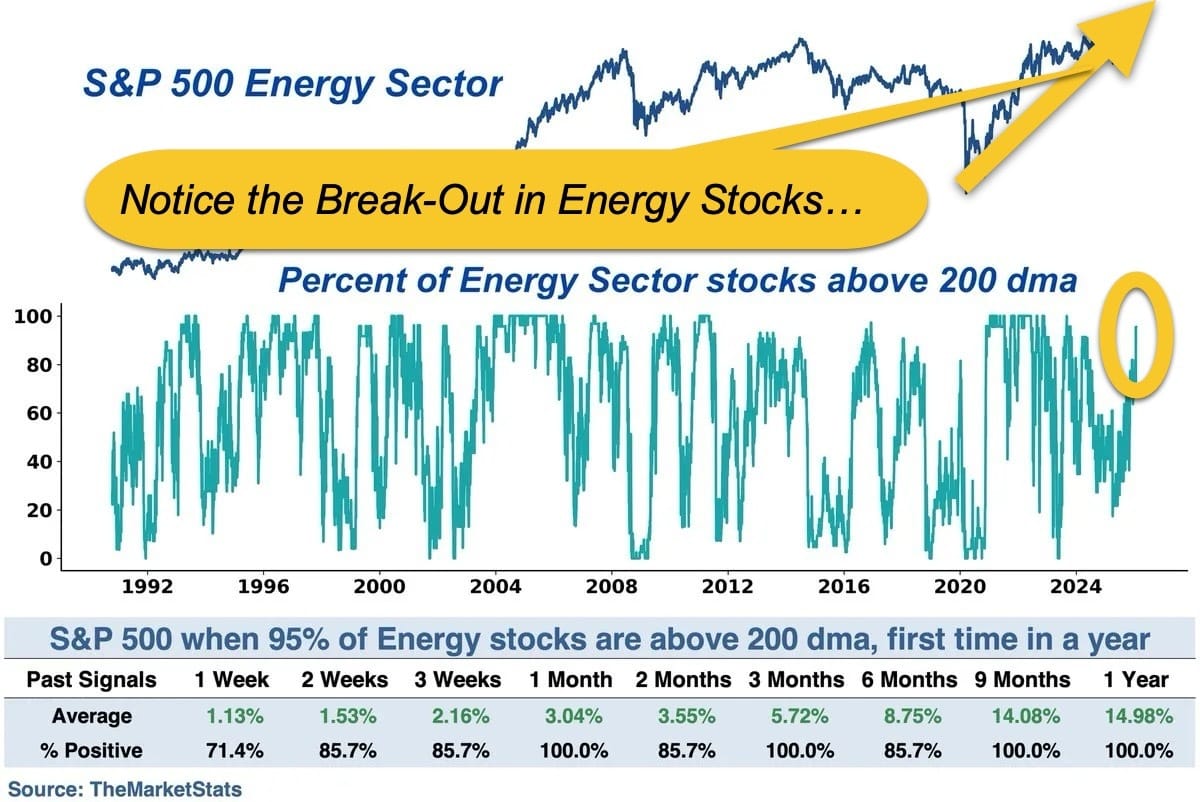

Factually: (a) Bears have the statistical edge in mid-term election years. (b) The global equity bull market is going strong and getting stronger. (c) Implied correlations are low which is a risk signal – like the dot-com era. (d) High valuations are supported by high expectations on profitability. (e) The energy sector is undervalued, under allocated, and under-estimated. Overall, per Callum Thomas: There are a fair amount of risk signals going off: seasonal headwinds, correlations, surging sentiment, and lofty expectations. However, markets are showing strong momentum, bullish rotation, and compelling fundamental narratives. Amongst all this there are some very interesting opportunities developing.

Trading TIPS:

- Tip #2 = BOT VZLA (small silver miner) @ $6.62 now = $6.65

- Tip #3 = BOT ATXRF (small copper & gold miner) @ $2.07 now = $3.15

- Tip #4 = BOT more HYMC (small gold miner) @ $20.21 now = $50.65

- Tip #5 = BOT more COPX (copper miner) @ 49.91 now @ $87.67

- Tip #6 = BOT more ILF (S. America Emerging Markets) @ $33.41 now = $34.99

HODLs: (Hold-On for Dear Life)

- Holding / Reducing:

o (o) Ethereum (ETH = 2,944 / in at $310)

o (o) Bitcoin (BTC = $89,340 / in at $4,310)

o (-) IBIT – Blackrock’s Bitcoin ETF ($50.7 / in at $24)

- Increasing:

o (+) Physical Commodities = Gold @ $4,983/oz. & Silver @ $103/oz.

o (+) SLV (silver ETF) == ($92.99 / in at $27)

o (+) HYMC (gold & silver miner) == ($50.6 / in at $11.8)

o (+) GLD – Gold ETF ($458 / in at $212)

o (+) GDX (gold miners) == ($107 / in at $52)

o (+) COPX (copper ETF) == ($876 / in at $55.3)

o (+) CCJ (uranium) == ($124 / in at $84)

o (+) ILF (EM for S. America) == ($34.9 / in at $27.8)

o (+) VZLA (small silver miner) == ($6.65 / in at $6.62)

o (+) ATXRF (small copper & gold miner) == (3.15 / in at $2.47)

o (+) QQQI (13% covered-call, QQQ’s divi. producer == pay mo.)

o (+) ICSH (short term bonds = 4.65% yield == pay mo.)

- Temp. Hedges:

o (+) HTZ (Hertz) == BOT 20 Feb: $6 Call

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson