- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 10.12.2025

This Week in Barrons: 10.12.2025

Release the Volatility ...

To subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Circle of Life Investing … Meta signed a $14.2B deal with Core Weave. Core Weave buys exclusively from Nvidia. Nvidia is an investor in Core Weave. OpenAI partners with Core Weave. Microsoft invests in OpenAI. Oracle gets money from OpenAI – who doesn't actually have any money to give. Every company in this ecosystem sits one degree of separation from every other company. It's a massive, interconnected circle of investments where everyone owns everyone else and nobody is actually making any real money. The risk is easily between $5T and $50T depending upon derivatives. - Nobody knows where the actual money is or who owns what – because of the circular structure. If/when something breaks, the first move down will be violent and will trigger a rally almost back up. Then it will move lower again, and then almost back - etc. According to MS, - “The key players in the AI space are becoming increasingly interwoven, with suppliers funding customers, using revenue sharing to fund a build-out, and all-the-while manipulating take-or-pay contracts and vendor repurchase agreements.” Per Phil Rosen, the AI economy operates as its own feedback loop, and the result will resemble the 1999 - 2000 ‘Dot Com bust’.

Since 1988, if you invested only at all-time highs … your returns would be far superior to buying at any other point.

“That horse has left the barn” … Morgan Stanley CIO Michael Wilson just came out with an investment strategy that includes a 20% allocation to gold. [FYI: Can you say: ‘A Day late and a Dollar short.’]

The Market:

Per Howard Lindzon: “In Italy, you eat, exercise, enjoy, and slow down.”

o Italians say: ‘Rome was not built in a day’.

o Traders say: ‘In Italy, the VIX is always 4’.

o Americans say: ‘Raise some capital. Do it cheaper-faster-better. And sue the supplier(s) when it takes too long’.

o The Chinese say nothing. They just build it in a day.

Gold ‘n Silver … are NOT a flash in the pan. Gold surged past $4,000/oz. for the first time last week, reinforcing its role as a hedge against ‘accelerating fiat destruction and global fiscal instability'. Gold is up over 50% in 2025, fueled by currency debasement, geopolitical tensions, sustained central bank buying, and a new shift on Wall Street that has investment houses swapping bonds for gold. As long as we keep printing money, expanding our debt, and as long as the dollar keeps getting crushed – let the good times roll. Silver is now trading less than a dollar below its epic $50 all-time high. Bullion-backed ETFs just saw their largest inflows in more than three years, reflecting growing retail and institutional participation. Gold’s major breakouts have all coincided with periods of global stress. Goldman Sachs lifted its 2026 gold price forecast to $4,900/oz., citing persistent central bank accumulation, further Fed easing, and rising ETF demand. They called it a “structural shift in global reserve management likely to endure for years”.

Deloitte goes all-in on generative AI … coincident with a massive rollout of Anthropic’s Claude to over ~500,000 employees across 150 countries. This is a high-stakes test of whether “constitutional AI” can meet the strict demands of domains like auditing and consulting. Will clients and regulators accept AI-assisted work as being as reliable, accountable, and standards-compliant – as the human-only version?

Things I Read… The Rundown AI improves my AI knowledge in 5 min./day … Try-for-Free … R.F. Culbertson

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

Info-Bits…

OpenAI launched their no-code agent automation platform. The “Agent Builder” will let anyone design autonomous agents without coding or third-party integrations. Users can automate workflows, connect MCPs, and embed widgets – all within OpenAI’s ecosystem.

AI startups have gotten over half of all global VC funding this year … Most of the funding flowed to top players like Anthropic and xAI. Investors are concentrating capital on established names, leaving sectors like healthcare, mobility, and climate to fend for themselves.

OpenAI has acquired Roi … an AI-powered personal-investing app, to accelerate its push into consumer-focused AI products.

Since 2020, the US dollar’s purchasing power has fallen more than 20% … inflation has increased 25%, the S&Ps are up 106%, and home prices have appreciated 52%.

Since 2020, U.S. home prices have fallen -25% in gold terms.

AMD signed a deal with Open AI … to provide its GPUs to the AI leader. The 5-year agreement will provide OpenAI with hundreds of thousands of AMD’s chips == enough to power ~5m U.S. homes.

IBM is adding Anthropic’s Claude to its applications … starting a developer toolkit.

NYSE owner ICE will invest up to $2B in Polymarket … valuing it at $9B. ICE said it would pay for the deal in cash and would become a distributor of Polymarket’s event-driven dataset.

AstraZeneca licensed CRISPR for $555m … gaining exclusive rights to develop and commercialize gene therapies discovered via Algen’s AI‑powered gene‑editing platform - CRISPR. Pharma believes that AI can solve drug development's 90% failure rate and decade-long timeline by finding biological insights that humans miss. Then of course come the gauntlet of clinical trials – where biology has the final say.

“I believe gold should be ~15% of a portfolio.” … Ray Dalio.

A Tiny Recursion Model (TRM), developed by a Samsung researcher … is outperforming much larger AI models on complex reasoning tasks. They did it by repeatedly refining their own predictions rather than relying on raw computational power. The breakthrough suggests that careful architectural design could potentially drive the next wave of AI innovation.

Crypto-Bytes:

Grayscale just got the go-ahead … to enable staking inside its spot ETH funds, ETHE and ETH. This is a huge deal, and I’d expect a stupid amount of staking focused tickers and ETFs to hit the market. After all, HODLing crypto passively in an ETF is great - but getting the yield on it too? Yes please.

BlackRock’s bitcoin ETF IBIT … is now the company’s most profitable ETF.

(Micro)Strategy surpassed Coinbase in market cap … to become the 104th largest US public company.

Deutsche Bank predicted that central banks … will add bitcoin as a reserve currency by 2030.

Paul Tudor Jones called bitcoin … one of the biggest winners in this bull market

“When you hear: America can grow its way out of debt ... They’re talking about currency debasement and being bearish the U.S. Dollar.” … Citadel’s Ken Griffin.

Things I Read… Morning Brew as it helps me keep an ‘edge’ to my trades … Read-n-Learn… R.F Culbertson.

Business news as it should be.

Join 4M+ professionals who start their day with Morning Brew—the free newsletter that makes business news quick, clear, and actually enjoyable.

Each morning, it breaks down the biggest stories in business, tech, and finance with a touch of wit to keep things smart and interesting.

Morgan Moment(s):

Per Torsten Slok, Slower job growth will be due to:

o Reduced Immigration … as the growth rate of our foreign-born labor force has been weaker than normal.

o AI Implementation … is we are improving productivity with less workers.

o Fewer Government Jobs … as they were artificially high from 2022 to 2024 and are now returning to more normal levels.

Looking at Ethereum as a ‘glass-half-full’ = Bullish Scenario:

o Oct 20–24: ETH needs to close above $2,985. A clean break out here targets $3,420 to $3,810 and would reset momentum for November.

o Nov 22–26: If ETH pushes past $3,810, expect an acceleration wave toward $4,200 to $4,560.

o Dec 28–31: Holding above $4,560 would signal that ETH is ready to complete the full rotation toward $4,957 to $5,280.

o TIP #1: ETH remains bullish while it’s closing above $2,985, and strength through $4,200 to $4,500 would confirm a new bullish cycle.

Looking at ETH as a ‘glass-half-empty’ = Bearish Scenario:

o Oct 20–24: A drop below $2,720 turns the structure bearish. That break usually unleashes a 20%+ drawdown toward $2,320 to $2,040 and sets up a weak November.

o Nov 22–26: Falling under $2,040 to $1,785 deepens the breakdown and would cause a slide into $1,785 to $1,585.

o Dec 28–31: If ETH closes below $1,585 to $1,385, it will collapse back to the April base ~$1,250. This would signal capitulation and a new bearish stance for 2026.

o Tip #2: ETH turns decisively negative if it can’t defend $2,720, and below $2,040 means that the next stop is the low $1,000s.

Next Week... Release the Volatility …

Gold completed its seventh consecutive week … of either hitting or exceeding its expected move. 7-straight weeks of mathematical chaos while the dollar rallies right alongside. That's not a rotation or momentum, but rather institutional money flooding into the ultimate hedge – preparing for catastrophic risk. At this point in the cycle, smart money is de-escalating positions, building cash reserves, and using options spreads for bullish exposure.

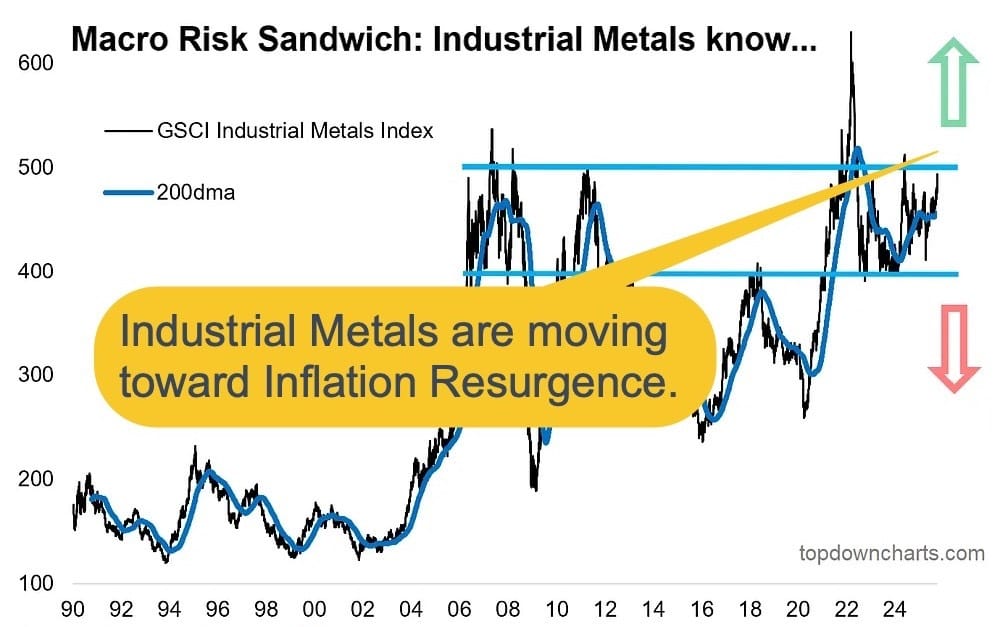

The major macro risks right now are … Recession (+deflation) vs Inflation Reacceleration (+resurgence). Industrial Metals have been making moves towards the Inflation Reacceleration and resurgence side. Keep a close eye on this indicator as it will give a real-time heads up on the next big macro theme for markets (Inflation Resurgence if it breaks higher, or Recession if it rolls over and breaks down)

Follow the volatility (VIX) … While everyone was fixated on the S&P dropping ~3% on Friday, something far more dangerous occurred = volatility exploded +30% in 4 hours. Currently, there’s one-third more risk priced into world markets than there was Friday morning. Moves like this normally take weeks of sustained stress to develop – but we got there in one session. When November volatility is trading within 2 pennies of December’s – this sell-off was NOT normal profit-taking.

Per Don Kaufman, next week’s SPX expected move … more than doubled from $94 to $175 - $200. That's not a gradual market repricing, but rather an explosive recognition that the calm we've enjoyed for months – is over. Friday continued to sell-off way below its expected move, and when that happens – the market structure itself becomes a selling accelerant.

Tip #3: Do NOT buy Calls in this market … because when stock inevitably bounce, the first thing that happens is a volatility crush. You'll watch your stocks rally 5% and your Call Options lose money. It’s mathematical torture. This bubble won't pop overnight with a dramatic 20% crash that gives everyone clarity. Nope, it's going to rally and then sell-off, rally higher and sell-off lower – an environment built to lure people in and shake them out.

Tip #4: I’m expecting prolonged turbulence, and watching 3 things:

o Will crypto ‘dig its own grave’ over the weekend?

o Will we actually hit backwardation on Monday?

o Will dealer gamma risk continue to force systematic selling on Tuesday?

This is where careers are made and destroyed. Traders who understand volatility structure will profit, and those chasing momentum with naked calls will get obliterated.

TIPS...

Factually: (a) Seasonally, it’s not unusual to see volatility flare-ups this time of year. You tend to see a dip and then a year-end-rally. (b) Speculators are already buying the dip. (c) Several indicators focused on speculative excesses are displaying fragility. And (d) High valuations warn against complacency. Overall, it’s 1999 == ‘Déjà vu all over again.’

HODLs: (Hold-On for Dear Life)

- (+) IBIT – Blackrock’s Spot Bitcoin ETF ($64.1 / in at $24)

- (+) ETHA – Ethereum ETF ($30.2 / in at $13)

- (+) Physical Commodities = Gold @ $4,035/oz. & Silver @ $47.5/oz.

- Bitcoin (BTC = $111,800 / in at $4,310)

- Ethereum (ETH = 3,800 / in at $310)

- (+) GLD – Gold ETF ($369 / in at $212)

Options for Income: De-Risking a Portfolio… (using IBIT for example)

- BUY-n-HOLD the IBIT ETF

- BUY PUTs: 1 Std. Dev. Lower, Expiring = 3-weeks away, OTM (out-of-the-money) for protection.

- SELL Covered CALLs: 0.75 to 1 Std. Dev. Higher, Expiring = 2-weeks away, OTM for income and to finance the PUTs.

More ‘De-Gen’ Economy holdings:

- AAVE (crypto) == ($237 / in at $254)

- GDX (gold miners) == ($75.6 / in at $52)

- SLV (silver ETF) == ($45.2 / in at $27)

AI / Data-Center market basket:

- NVDA ($183 / in at $168)

- RXRX ($5.1 / in at $4) == moves w/ NVDA, but it only costs $5.

- IREN ($59.7 / in at $25)

- NBIS ($129.5 / in at $114)

- HUT ($43.5 / in at $30)

- APLD ($33.9 / in at $20)

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson