- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 10.19.2025 (2)

This Week in Barrons: 10.19.2025 (2)

This is just NOT normal...

To subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Every hiker is intimately aware of their own backpack … They can tell which straps are loose and which are digging into their skin. Per Seth Godin, they can even tell you if their bag is lopsided. And yet, they can’t tell you a thing about anyone else’s backpack – except that they have one. Empathy Step #1: Work to understand How everyone else’s backpack is different from yours. E-Step #2: Work to understand Why.

The long overdue correction in Gold and Silver kicked in Friday. You'll have people screaming that the top is in, the run is over, but it is not because this rise is structural – not speculative. We needed a shakeout and we're getting one, but the ultimate direction is still up. Tip #1: BUY the dip in Silver, and when the dip is over – BUY more physical silver. The top is not in by any means.

Institutional investors are buying more Gold than Mag-7 stocks.

Only 22% of professional fund managers are beating the market this year.

The Market:

A U.S. Housing Market Forecast:

Bottom Line: Our FED will end up cutting rates sharply, and that will pull mortgage rates from the mid to high 6 percent range toward the mid to high 4s. Housing prices will move last, after liquidity shifts, and unemployment rises. If unemployment is contained then lower mortgage rates bring opportunity and better prices; if not, the downturn deepens, patience wins, and timing becomes everything.

Details per A. Pompliano: The U.S. economy has shifted from late cycle wobble to clear deterioration. Job growth is anemic, and the latest ADP print turned negative. Household balance sheets are fraying, credit card and auto delinquencies are climbing toward Great Financial Crisis highs, student loan stress has re-emerged, and office vacancies are at record highs. Regional banks are sliding again, and the Treasury curve has broken lower. This mirrors past moments when the system began hoarding liquidity.

The 2-year Treasury yield has dropped from 4% to ~3.4%, its lowest level since 2022. Our FED will need to keep easing not because inflation is conquered, but because credit is tightening.

The 10-year Treasury is the economy’s anchor. It sets the base rate for nearly every long-term loan and reflects what markets believe about growth and inflation. Currently, the Treasury rally is telling us to brace for a scenario where the Fed must inject reserves faster than planned (QE).

Housing is showing poor affordability, uneven regional strength, and a heavy builder footprint. Just like 2006, sales volumes are beginning to crack and dramatic price decreases will follow. The biggest misconception is that Fed cuts fix affordability – they don’t.

Our FED is trained to follow unemployment first, and then inflation. From 2007 to 2008, the funds rate fell 5.25% in 15 months. From today’s 4.25 to 4.50% range, a sharper downturn points to another 2% of FED easing over 6 months, and a 3 to 4% reduction over 9 months would still fit the precedent. That would translate to a 4.8 to 4.9% mortgage rate.

Housing prices always follow sales volume decreases … with a lag. Demand needs to fade before sellers adjust. Inventories build, listings sit longer, and price reductions follow. A 10% national decline over the next year is reasonable as unemployment climbs, with deeper drops in the South and West.

Our own government has issues over the next 12 to 18 months. They need to refinance $9 – 12T in Treasury debt and $2T in commercial loans. That narrows our FED’s room to maneuver. Our FED will end QT, favor shorter term bill issuance, and expand repo operations – but those steps alone won’t bring mortgage rates sharply lower. To narrow mortgage spreads, look for our FED to help with calmer market volatility and/or renewed QE in the form of MBS support, as in 2009 and 2020.

Things I Read… The Rundown AI improves my AI knowledge in 5 min./day … Try-for-Free … R.F. Culbertson

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

Info-Bits…

The co-founder of Mira Murati’s Thinking Machine Lab … just rejoined Meta. His compensation package is reported as $1.5B over 6 years.

Elon Musk's xAI recruited Nvidia specialists … to develop world models that can generate interactive 3D gaming environments. xAI is targeting a playable AI-created game release before 2026.

Delta's bet on wealthy Americans driving the economy is working … as Delta’s premium seat revenue is set to overtake the main cabins for the first time in history.

Swift is working with Consensys and 30 global banks … to move cross-border payments and tokenized assets onto blockchain rails. With 11,500 institutions across 200 countries, Swift’s pivot signals that on-chain settlements are going mainstream.

Powell signals another rate cut … as weak hiring pressures unemployment. “We’re at a place where further declines in job openings may very well show up in unemployment.” The market is pricing it a 97% chance of a -25bps cut at the FED’s Oct. 29 meeting.

OpenAI is venturing into pornography. [FYI: BEWARE: The line between intimacy and illusion blurs faster than what can be policed.]

JPM will begin to finance and take stakes in companies … it deems critical to U.S. national security. It will invest up $10B into companies: in defense, aerospace, AI tech, quantum computing, batteries, and advanced supply chain / manufacturing software.

Conventional Wall Street wisdom likes a 60/40 portfolio … with 60 percent of the holdings in equities and 40 percent in fixed-income bonds. However, advisors are switching to a 60/20/20 strategy, swapping half of the bond portfolio for gold to serve as a “more resilient” inflation hedge.

Chatbot commerce: Soon users will be able to ask ChatGPT to generate ideas for topics, which can lead to purchases. For example, asking ChatGPT for “cheap Halloween costume ideas” will display actual products from Walmart and give you the option to buy inside ChatGPT without leaving the chat.

Per H. Thompson: “The Precious Metal trade is partly the physical issues which restrict paper arbitrage between markets AND the market looking into 2026 and seeing a plan to debase the U.S. Dollar when our FED and Treasury become more closely aligned.”

Crypto-Bytes:

Friday October 10 marked the largest liquidation in crypto history. ETF volumes will continue to grow because they are protected from automatic margin liquidation risks.

4 thoughts about that crypto blip last weekend …

o 1) If you sell bitcoin amid geopolitical uncertainty, you never understood what you owned. The decentralized, digital currency was built to give someone a place to save their hard-earned economic value without relying on a nation state to back it. That is an idea that should gain value as geopolitical uncertainty continues to increase in the coming years.

o 2) If bitcoin can fall $15,000 in a day, then it can also go up $15,000 in a day. The market is showing us what is possible.

o 3) If you were bullish on bitcoin and stocks then, you should be even more bullish now. None of the fundamentals have changed in a week. We simply got a healthy reset that wiped out the excess leverage in the system – clearing the market to go higher.

o 4) Imagine telling someone 10 years from now: “The $19B+ crypto liquidation (the largest in history) dropped Bitcoin’s price to $107,000 and I didn’t buy any.”

Morgan Stanley removed all restrictions … on which clients could invest in digital asset ETFs. Up until now, that had been limited to risk-happy clients with at least $1.5m in investable assets.

The U.S. DOJ seized $15B in crypto … marking its largest forfeiture ever and signaling a crackdown on industrial-scale fraud rings that blend crypto scams with forced labor.

Things I Read… The Daily Upside - in a world of hype and hot-takes … it helps me … R.F Culbertson.

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

Morgan Moment(s):

“The real-world impact has come much faster with AI than it did with mobile.” Unlike mobile, where cultural adoption preceded business transformation, AI is simultaneously disrupting both consumer behavior and enterprise operations. Companies need to think about their AI strategy NOW.

Waymo is bringing its robotaxis to London … It’s a bold bet on the UK rolling out its regulatory red carpet faster than the rest of Europe. Can Waymo’s tech handle left-hand traffic, densely layered infrastructure built over centuries, and a driving culture that is nothing like the U.S.? If it works, Europe’s robotaxi market cracks open, but if it stalls – then Waymo’s international expansion stalls with it.

Apple will manufacture its first tabletop robot in Vietnam … through a partnership with Chinese EV giant BYD. Slated for 2027, the tabletop bot follows Apple’s smart home hub and indoor security cameras. The move isn't just about leaving China behind but a bet that robotics, not just wearables or AR, will anchor Apple’s next decade of hardware. If the gamble pays off, Siri might finally get a body.

Next Week... This is NOT normal …

This week should have destroyed portfolios … but instead – the S&Ps closed higher. That's not normal, and it's definitely not safe. Last week we had volatility backwardation while the market was at all-time highs. I’ve seen virtually every major crisis: Dot Com, Housing collapse, COVID, Trump Tariffs, but never has volatility backwardation appeared simultaneously with market all-time highs.

Volatility Backwardation means … that the market is pricing MORE risk in the next 30 days – than in the next 60 days. That's backwards. Usually, more time equals more risk. Sixty days gives you twice as many opportunities for things to go wrong as compared to thirty days. But the market is telling us that the risks are imminent. Yet somehow, markets finished dramatically higher on the week.

Some Details:

o Last week the VIX spiked to 29, and the VVIX pushed past 120. Both indicators were screaming ‘Danger Will Robinson - Danger’ – while the S&Ps kissed new highs. That combination doesn't happen (and shouldn’t happen) unless something serious is brewing beneath the surface.

o The regional bank situation appears to be contained as Jefferies actually finished the week higher and KRE stayed inside its expected move.

o AI stocks remained unscathed as Google hit an all-time high, and Apple and Broadcom finished at the upper edge of their expected moves.

o Bitcoin cracked below $110,000 and is now down 18% from highs. That's near bear market territory for crypto.

o Gold is experiencing a massive gamma squeeze. GLD traded 2m option contracts on Friday – where the norm is 40,000 on a big day.

o This week’s’ expected move was $197, and next week’s is $143. Normal weeks are ~$90.

This is not sustainable … something must give. I'm not looking for a crash or predicting doom-n-gloom. I'm simply pointing out that markets displaying extreme volatility readings cannot co-exist with all-time highs.

o Either volatility comes down and we continue higher, or

o Volatility stays elevated and markets move down to reality.

o Traditionally, markets moving lower has been the more likely event.

o Watch early next week for signs of which direction we break.

The following type of trades & coordinated positioning occur … when traders are preparing for a credit crisis.

o Tip #2: BUY HYG (junk bond) PUT Options that expire Nov. 21st.

o Tip #3: BUY GLD CALL Option Vertical spreads that target the $415 price in GLD that expire Nov. 21st.

TIPS...

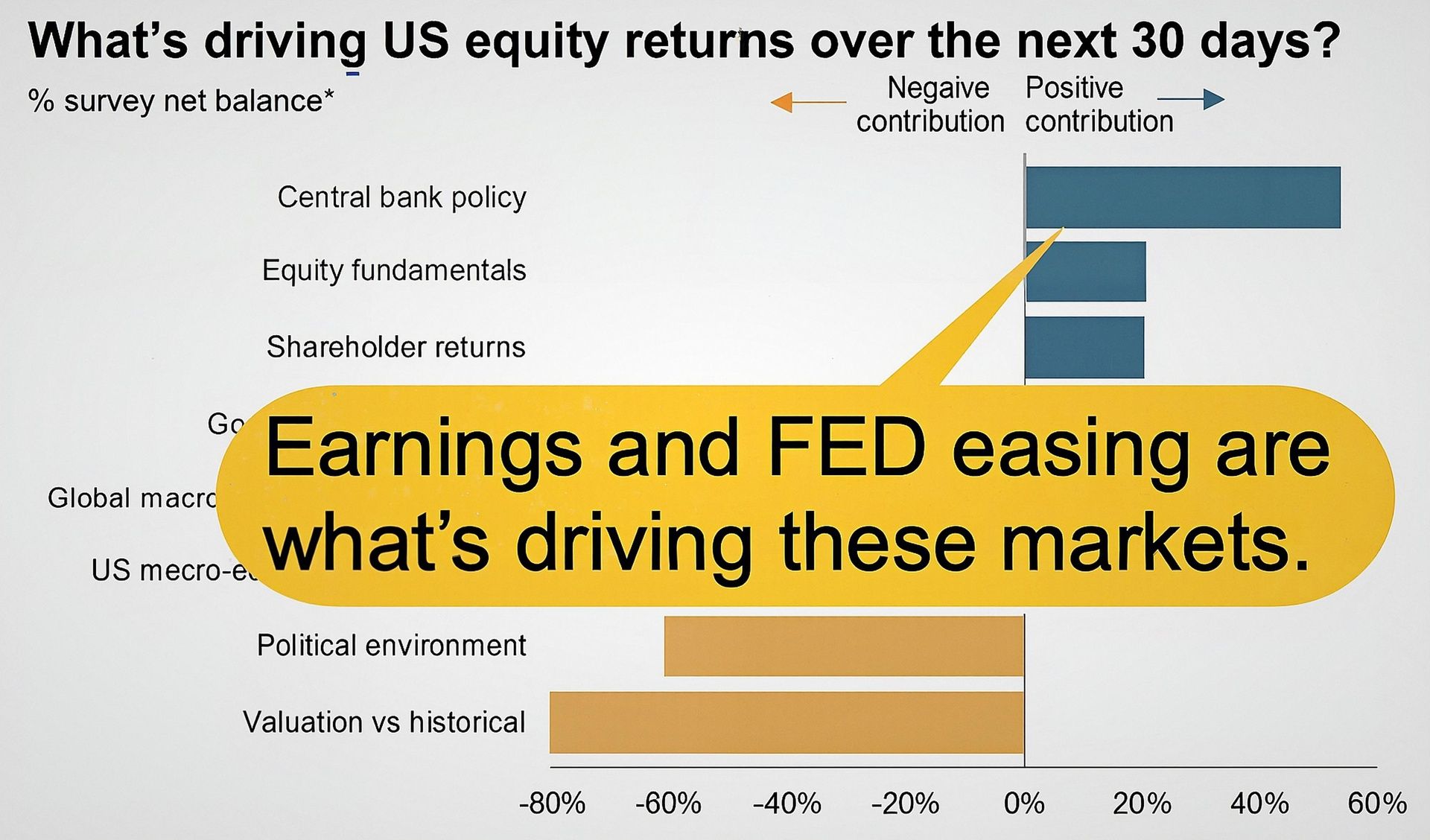

Factually: (a) Stocks found support at their 50-dma, seasonality is turning up, and the trend is intact. (b) FED policy support & earnings are outweighing politics & valuations. (c) Investor allocations to cash are at the low end of the historical range as investors are all-in on stocks. And (d) Early tech stock bubbles are showing repeating patterns of market psychology. Overall, per Callum Thomas: After the latest trade war scare selloff, the S&P500 has found support at its 50-dma, and the 200-dma remains upward sloping. Yes, stocks are expensive. Yes, (geo)political risk is in shambles with many a boogeyman lying in wait. Yes, the macro environment has been a little murky, but central banks are cutting rates, (tech) earnings are decent, and the trend is your friend. (The music’s still playing.)

HODLs: (Hold-On for Dear Life)

- (+) IBIT – Blackrock’s Spot Bitcoin ETF ($60.4 / in at $24)

- (+) ETHA – Ethereum ETF ($28.9 / in at $13)

- (+) Physical Commodities = Gold @ $4,267/oz. & Silver @ $50.6/oz.

- Bitcoin (BTC = $107,500 / in at $4,310)

- Ethereum (ETH = 3,900 / in at $310)

- (+) GLD – Gold ETF ($388 / in at $212)

- (+) ICVT – Convertible Bonds ($101.8 / in at $103.7)

More ‘De-Gen’ Economy holdings:

- AAVE (crypto) == ($220 / in at $254)

- GDX (gold miners) == ($78.7 / in at $52)

- SLV (silver ETF) == ($46.9 / in at $27)

AI / Data-Center basket:

- NVDA ($183 / in at $168)

- RXRX ($5.8 / in at $4)

- IREN ($60.7 / in at $25)

- NBIS ($113.4 / in at $114)

- HUT ($48.4 / in at $30)

- APLD ($34.4 / in at $20)

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson