- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 12.28.2025

This Week in Barrons: 12.28.2025

Rock ... Paper ... Scissors ...

To subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

If it takes three to five years … for a project to gain traction, it probably doesn’t pay to start a project to fix what the world needs to have fixed … right now. The challenge is picking something the world will need in 3 to 5 years. And the hard part is patiently and persistently sticking with that project – even though it’s not on everyone’s agenda – yet. Remember: “The best time to plant a tree was twenty years ago. The next best time is tomorrow.”

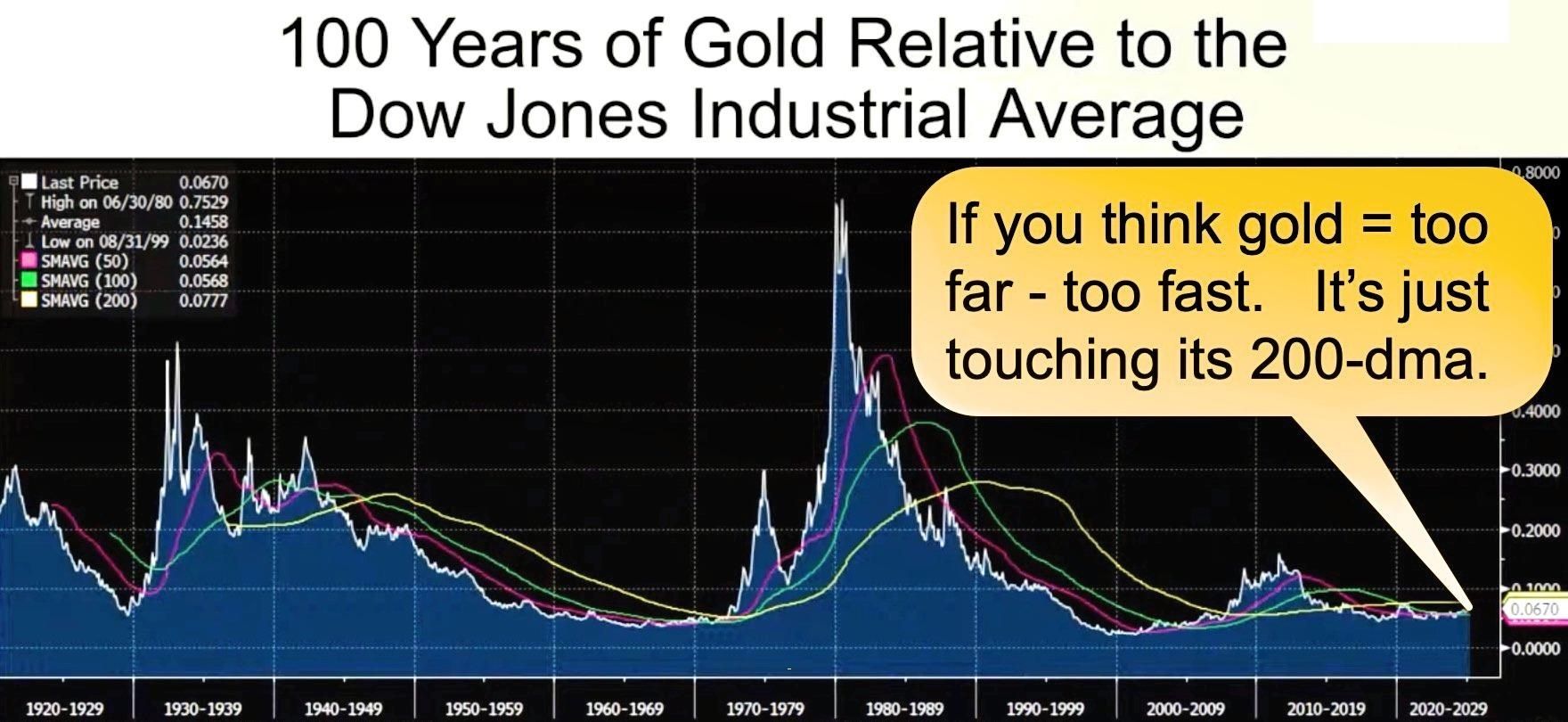

Per H. Thompson: “Andy Constan (@dampedspring-37m) believes the reason for precious metals going parabolic could be industrial uses, gamma squeezes, and short squeezes – but those all miss the mark by one simple fact. On Dec 10, our FED decided to buy 40B T-bills/mo. – further adding to the ongoing debasement of the U.S. Dollar. The obvious trade was to double your long allocation in commodities and gold. Dollar down = commodities and metals up.” It’s not rocket science.

The Markets:

It’s all about being in ‘the zone’ … "Sometimes, there’s this moment where everything goes quiet. The heartbeat slows... it’s peaceful. I can see everything. No one can touch me. I’m always chasing that moment. I don’t know when I’ll find it again, but man, I want to. I want to because in that moment, I’m flying." … Sonny Hayes: F1

I've been a Gold/Silver bug since 2007. Way back then, I took my PM cues from some very wise people, and I told anyone who would listen that eventually we would see $3,500 dollar gold and $75 silver. This year gold blew through that prediction by $1,000 dollars and silver hit my 18-year-old target on Friday. For silver, supply has not kept pace with demand and has gotten to a point where it’s almost comical. This is highlighted in the Shanghai exchange, where silver transacts at $85/oz. – right now. Manufacturers want the metal – now, and they don't want worthless COMEX futures contracts that will never be swapped into physical silver. Of course, you have those screaming that silver's price is going to become "unobtainium", but those individuals are unfamiliar with how true price discovery works. For those of you that trusted my opinion, you've enjoyed a spectacular run. Imagine buying a box of 500, one-ounce silver eagles at $10/oz. in 2008 = $5,000. 25-years later, at $75/oz. your single box = $37,500. Good for you-all! Factually, banks and COMEX have lost control. No one wants those London COMEX paper contracts, but rather they want physical Shanghai delivery. And besides, COMEX doesn’t have enough physical silver to even cover the paper contracts that are out there currently. What we need to keep an eye on are 2 things: (a) whether China with their Shanghai Exchange does to copper, platinum, and palladium what it did to silver, and (b) which banks have continued to ‘naked short’ silver during this run-up and are at the risk of going under because of it.

Things I Read… Roku helps me find customers and readers … take it on a free ride here … R.F. Culbertson

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Info-Bits…

"Slow is smooth, and smooth is fast." … Sonny Hayes: F1

The economy is booming … The US beat expectations in the third quarter with 4.3% GDP, the strongest growth in two years. Consumer spending rose 3.5% in Q3, up from 2.5% in Q2.

Gold is set to notch its best year since Jimmy Carter was president … and copper prices are surging alongside gold and silver to end the year.

Crypto & AI-Bytes:

"Our shot is battling in the turns. We need to build our car for combat." … Sonny Hayes: F1

Nvidia made its biggest purchase ... by acquiring the assets from the chip company Groq for about $20B. It was founded by creators of Google’s TPU, which competes with Nvidia for AI workloads.

Things I Read… Roku helps me reach out where people are streaming ‘n shopping … R.F Culbertson.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Morgan Moment(s):

Morgan got the flu last week.

Next Week... Rock, Paper, Scissors…

RF got the flu last week.

TIPS...

Overall, Per Callum Thomas: For the year, US equities have lagged significantly behind vs rest-of-world. Global stocks have actually put in very strong performance (particularly Europe and Emerging Markets). So, it’s a reminder to take stock of your biases and question the consensus.

Money (in whatever quantity) remains a hygienic motivator (useless after a month). However, reasons like gaining respect, making-a-difference, sending-a-message, making the world a better place … are all motivators that have stood the test of time. A simple entrepreneurial rule: “Do what you love, and love what you do.”

Sonny Hayes in F1 said: "If the last thing I do is doing what I love, I will take that life – a thousand times."

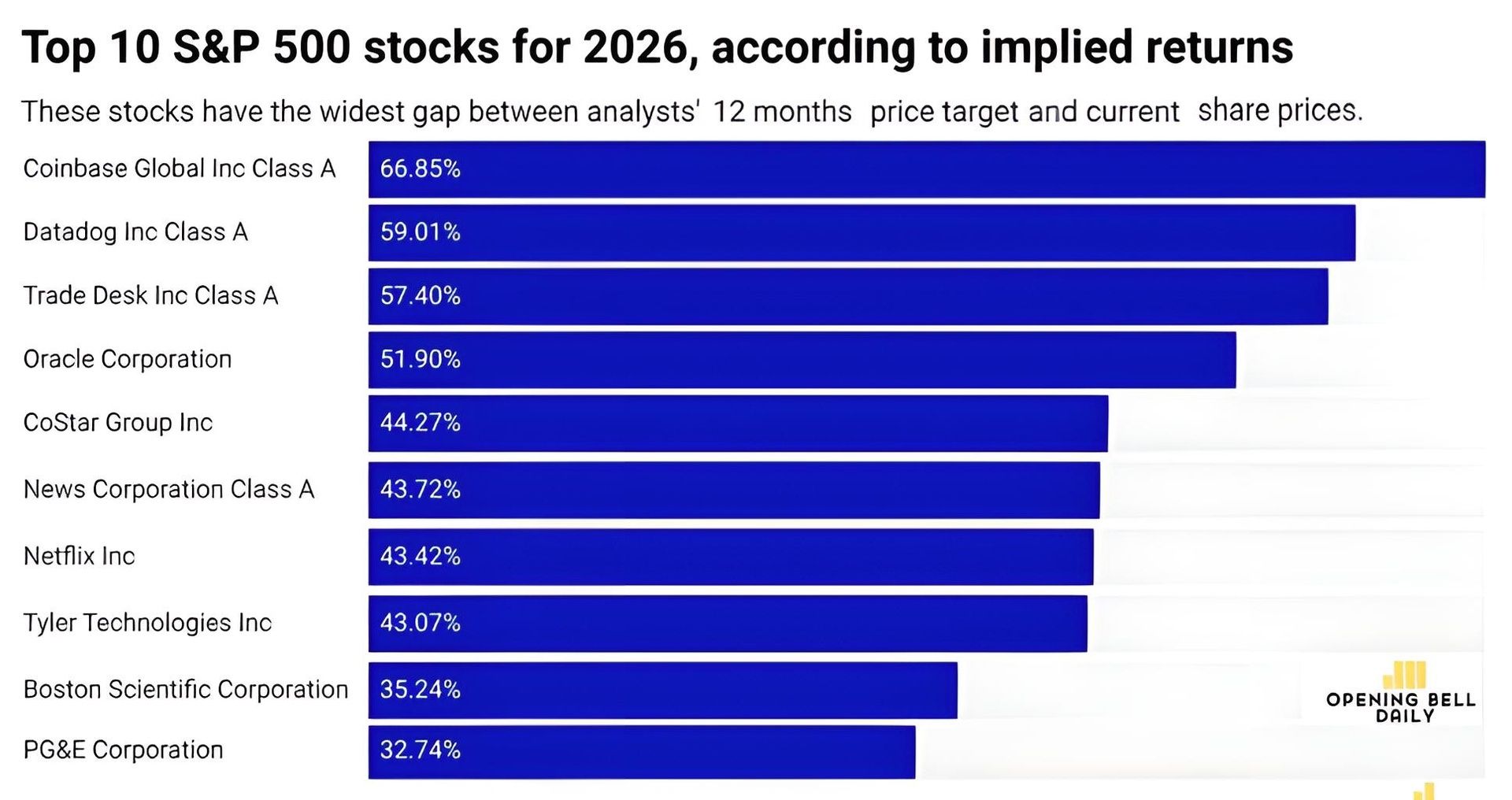

TIPS on Trades:

- Tip #1: HYMC: keep buying this Gold / Silver stock with Call Spreads

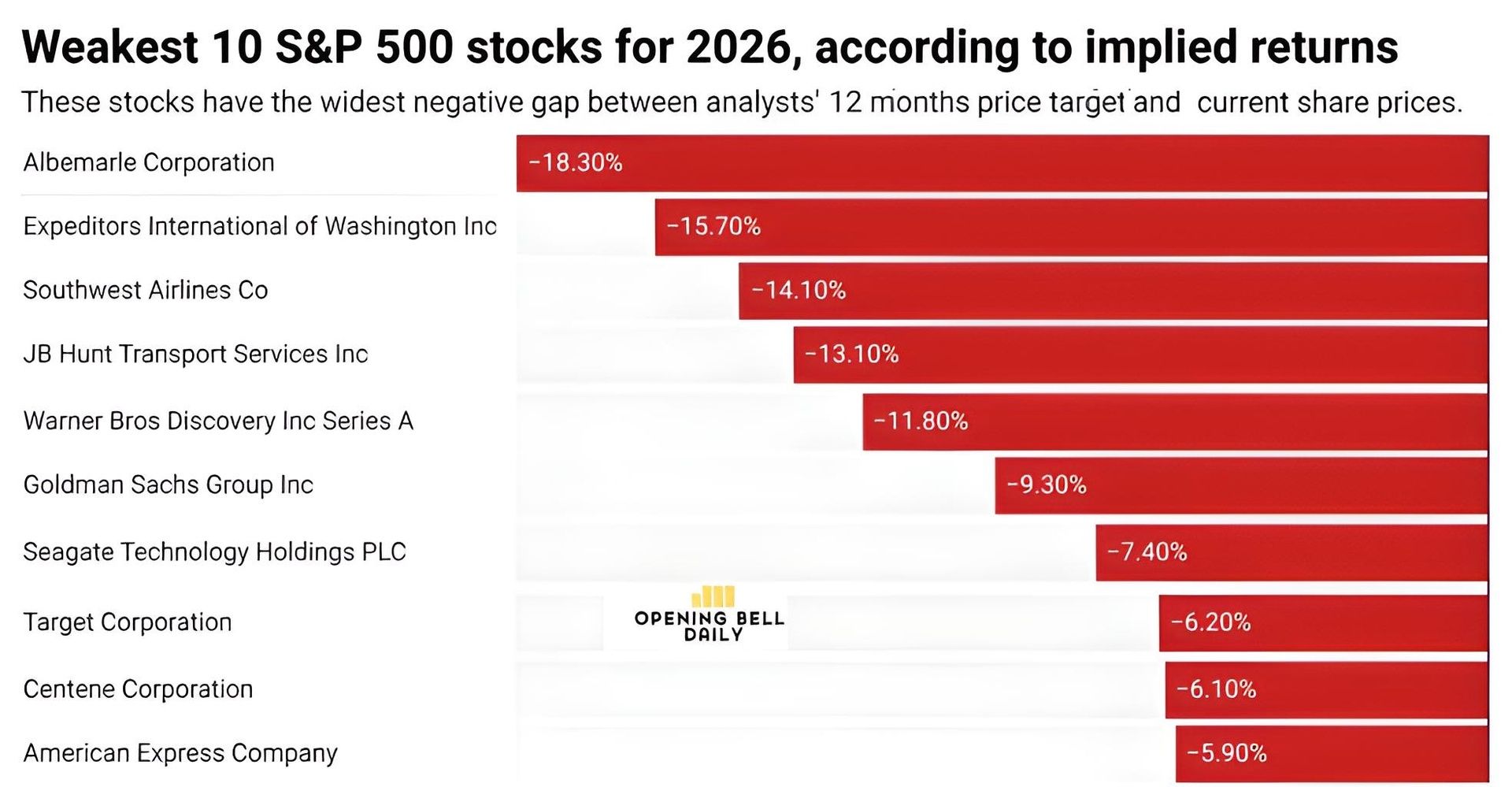

- Tip #2: ALB: due to its 12.5% short interest / BOT 16 Jan. +$155 / -$160 Call Spread

- Tip #3: NEXT: due to its 10.8% short interest / BOT 20 Feb. $6 Calls @ $0.37

- Tip #4: SLV: Silver has breached their expected move 5 weeks in a row with ~1m contracts being traded daily. Keep buying Calls / Call Spreads.

HODLs: (Hold-On for Dear Life) – Learn to like Precious Metals …

- Reducing:

o (-) Ethereum (ETH = 2,737 / in at $310)

o (-) Bitcoin (BTC = $87,800 / in at $4,310)

- Increasing:

o (o) IBIT – Blackrock’s Bitcoin ETF ($49.6 / in at $24)

o (+) Physical Commodities = Gold @ $4,562/oz. & Silver @ $79/oz.

o (+) SLV (silver ETF) == ($71.1 / in at $27)

o (+) GLD – Gold ETF ($416 / in at $212)

o (+) HYMC (gold & silver miner) == ($25.1 / in at $11.8)

o (+) GDX (gold miners) == ($91.29 / in at $52)

o (+) COPX (copper ETF) == ($75.7 / in at $55.3)

o (+) CCJ (uranium) == ($92.8 / in at $84)

o (+) SIL (large silver miners ETF) == ($90 / in at $82)

o (+) SILJ (junior silver miners ETF) == ($30 / in at $26.5)

o (+) ICSH (short term bonds = 4.65% yield == paid monthly)

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson