- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 12.7.2025

This Week in Barrons: 12.7.2025

FED's Bringing Volatility Back...

To subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

You can NO LONGER mathematically compound your way to wealth: With 7% returns, 3% inflation (likely understated), and 35% taxes over 20 years, the best case is ~1.5X capital. This arithmetic explains the under-30 “YOLO” mentality.

JPM relocated gold trading from NYC to Singapore: This was a wholesale shift to Asia, not an expansion into it. It’s a strong signal of structural change coming to precious metals and commodities.

Japan is signaling a Dec. 19 rate hike: It would push rates to 30-year highs and further unwind the global yen carry trade.

“We gave students laptops and toke away their brains.” Long-term data shows a clear pattern – increased classroom technology causes reduced student outcomes.

CEO pay is accelerating: In 2024, the average S&P 500 CEO pay hit $18.9m (+7% YoY).

Macro-economic regime shift in one week:

o Our FED halted QT,

o Our SEC invoked the Innovation Exemption rule,

o BofA and Vanguard went pro-crypto, and

o We Lost Jobs: The Chicago ISM reports showed collapsing orders, backlogs at their lowest levels since 2009, and a jobs index at 2009 lows. Zero firms reported any job additions. Per H. Thompson, “The job losses are mostly from small businesses, and could build into a bottom-up recession. It would be a stealth recession as most economic indicators are skewed towards measuring only big business activities.”

The Markets:

Problem-solving has no universal path: Simple, obvious solutions scale best in mass markets (per S. Godin). Political movements fail when they oversimplify complexity, and social platforms fail when they force generic solutions onto nuanced problems. Choose your quadrant deliberately.

Black Friday sales hit a record $11.8B … roughly tracking real inflation.

Q2 GDP revised to 3.8%; Q3 tracking 3.9%. Higher inflation + fewer human jobs = higher measured productivity. [FYI: “What do we do with the extra employees?”]

Prediction markets price ~87% odds of a December Fed rate cut. Historically, when the Fed cuts with the S&P within 2% of ATHs and no recession – the index is higher 12 months later.

HSBC: OpenAI’s likely cash-flows will be negative until after 2030. Their estimated capital needs exceed $200B and require an additional $1.4T in computing commitments.

Largest U.S. nuclear push in 50 years ($80B with Westinghouse):

o Build eight AP1000 reactors across the United States.

o Accelerate permitting and strategic financing.

o Revive domestic supply chains that have been dormant since the 1980s.

o Deploy Westinghouse’s AP300 Small Modular Reactors (SMRs).

Things I Read… Money helps me understand areas like Insurance … Try-it-Here … R.F. Culbertson

Does your car insurance cover what really matters?

Not all car insurance is created equal. Minimum liability coverage may keep you legal on the road, but it often won’t be enough to cover the full cost of an accident. Without proper limits, you could be left paying thousands out of pocket. The right policy ensures you and your finances are protected. Check out Money’s car insurance tool to get the coverage you actually need.

Info-Bits…

Netflix to acquire Warner Bros. Discovery for $82.7B: This is a generational Hollywood merger that formally completes Netflix’s shift from disruptor to establishment power. It also sets up a defining antitrust test over vertically integrated content + distribution.

Dell to raise prices 15–20% starting mid-December: Costco and hundreds of others will follow as companies begin to push tariffs directly back into consumer prices.

Black Friday sales were predominantly wealthy citizens purchasing discounted products. BNPL surged (per A. Pompliano):

o Nearly half of e-commerce spending came from the top 10% of earners.

o There was record BNPL (Buy-Now / Pay-Later) usage.

o 41% of ages 16-24 used BNPL.

o 38% of $100k+ income households used BNPL.

o 25% of BNPL users finance their groceries.

The Federal deficit is at an all-time high despite record tariff revenue: No politician is committed to cutting spending or balancing a budget.

Meta to cut budgets ~30%: After experiencing ~$70B in Metaverse losses since 2021, capital is being reallocated away from legacy bets and toward AI.

Crypto & AI-Bytes:

OpenAI issued a “Code Red”: OpenAI’s daily active users have fallen sharply after Google’s Gemini 3 launch. ChatGPT is pivoting to speed, reliability, accuracy, and personality.

DeepSeek-V3.2 rivals ChatGPT-5; “Speciale” matches Gemini-3 Pro … and can be used as an AI assistant backbone. ~80% of U.S. AI startups rely on the cheaper Chinese open-source AI models.

Baidu is spinning off its AI chip division.

Rufus AI is materially lifting conversion: Amazon’s Amazon is experiencing a 75% daily purchase rate in Rufus-assisted sessions vs. 35% purchase rate in non-Rufus-assisted sessions.

AWS unveiled Trainium3 + Nova frontier models: Trainium3 claims 50% lower training and inference costs vs Nvidia. AWS also launched tools for customer-customized gen-AI models.

Google launched no-code AI agents: Gemini can now automate workflows across workspaces and third-party apps via natural-language task descriptions.

AI Myth-Busters:

o LLMs don’t truly learn from experience; real breakthroughs will eventually come when models can observe, experiment, and learn from failure.

o Current AI monetization is occurring via making the human-in-the-loop more productive. [FYI – “Let’s increase your engineering team’s productivity 10-fold.”]

o America’s lead in AI intellectual capital is eroding: Chinese AI papers now outnumber U.S. output, top global universities are equally competitive, and Chinese control of rare-earth materials is a strategic advantage.

Things I Read… Money helps me take advantage of bull markets … give ‘em a try … R.F Culbertson.

Want to take advantage of the current bull run?

If you want to take advantage of the current bull market but are hesitant about investing, online stock brokers could help take the intimidation out of the process. These platforms offer a simpler, user-friendly way to buy and sell stocks, options and ETFs from the comfort of your home. Check out Money’s list of the Best Online Stock Brokers and start putting your money to work!

Morgan Moment(s):

Trump is set to announce his FED chair pick … and betting markets favor Kevin Hassett. If confirmed, this would mark the first true FED regime shift since Volcker.

The last 37 years = The “Fed Put”:

o Bernanke expanded his crisis support budget from ~$900B to ~$10T.

o Yellen pinned rates low and inflated asset prices, all-the-while keeping real wages low.

o Powell’s approach is one of constant crisis management and money printing fueling Mag-7 excess.

Hassett’s doctrine: “No more bailouts.”

o Failed banks and hedge funds will be allowed to fail.

o Don’t expect any last-minute liquidity rescues.

o Inflation will no longer be ignored.

Market implications of a No-Sugar FED:

o Mega-cap growth companies will weaken without cheap money.

o Real asset and positive cash-flow businesses will outperform.

o High-yield energy companies will look compelling vs. low-yield Treasuries.

The 20-year cycle turns:

o Fundamentals will replace leverage,

o Dividends will beat speculation, and

o Energy, utilities, and real estate will outperform once again.

Your Portfolio Takeaway: If you’re positioned for the old liquidity regime, rotation is no longer an option. Smart money is already moving.

Next Week... FED’s Bringin’ Volatility Back…

Here's what I’m worried about:

o Tech valuations seem impervious despite fundamental questions about AI monetization. Nobody’s paying for AI despite trillions in additional market cap being added to corporate valuations.

o Microsoft is suddenly acting like a dead weight on the Mag-7.

o Retail traders seem to be obsessed with the same 3 names – while rotation warfare intensifies.

o Markets are showing late-stage bubble behavior without a crash… yet.

o Markets will gradually ignore a lot of fundamental problems – until suddenly they won't.

The FED risk that no one’s pricing in … While everyone's focused on the obvious 25 basis point cut, I see a volatility catalyst brewing, and that will be Powell's forward guidance. I think Jerome Powell is going to stir things up by being hawkish with his outlook - and that could be amplified by a continued selloff in crypto.

The SPX Expected Move (EM):

o Last Week’s SPX EM = $100 (5-day week) … and we were flat’ish.

o Next Week’s EM = $104 … and that looks low. Going back 10 years, there is a 90% probability of our market touching the upper and/or lower edge(s) of their EM on a weekly basis. Last week we did NOT do it; therefore, be a little more careful this coming week.

Tip #1: GLD == BOT the Jan 16, 2026, +$400 / -$415 Call Spread … due to an institutional build-up that always precedes multi-week runs. In this case, one institution purchased 58,000 Calls on a GLD call spread (+$400 / -$410) for December 19th. Another bought a block of 113,000 Calls at the +$400 / -$415 strikes for Jan 16, 2026. .

Tip #2: HTZ == If it gets over resistance at $6/share … BUY the Jan 16, 2026, $9 Call Options … Following a 27,000 Call Option single purchase on Friday, and Hertz carrying a huge, short interest of +40% of the float – use the $6 resistance level as the catalyst to move to $9 by mid-January.

Tip #3: Chinese stocks are moving higher:

o KWEB = a broad Chinese internet stock ETF. BUY the Mar 20, 2026, +$39 / -$44 Call Spread … due to one institution buying 71,000 of those same calls on Friday and another trader scooping up ~8,000 calls at the $43 strike – both expiring Mar 20, 2026.

o ASHR = a large-cap group of Chinese stocks traded in Shanghai. ASHR saw ~9,000, +$35 / -$39 call spreads BOT for Mar 20, 2026.

o EEM = a broad emerging market ETF – where China makes-up ~30% of the portfolio. A single trade had 30,000 EEM March 20, 2026, $58 Call options being purchased.

Tip #4: GDX = Downside puts being purchased on the gold miners ETF.

Tip #5: GME = GameStop is looking at a potential short squeeze opportunity.

Tip #6: AG, ASTS, QBITS, & UAMY == look good for more upside.

TIPS...

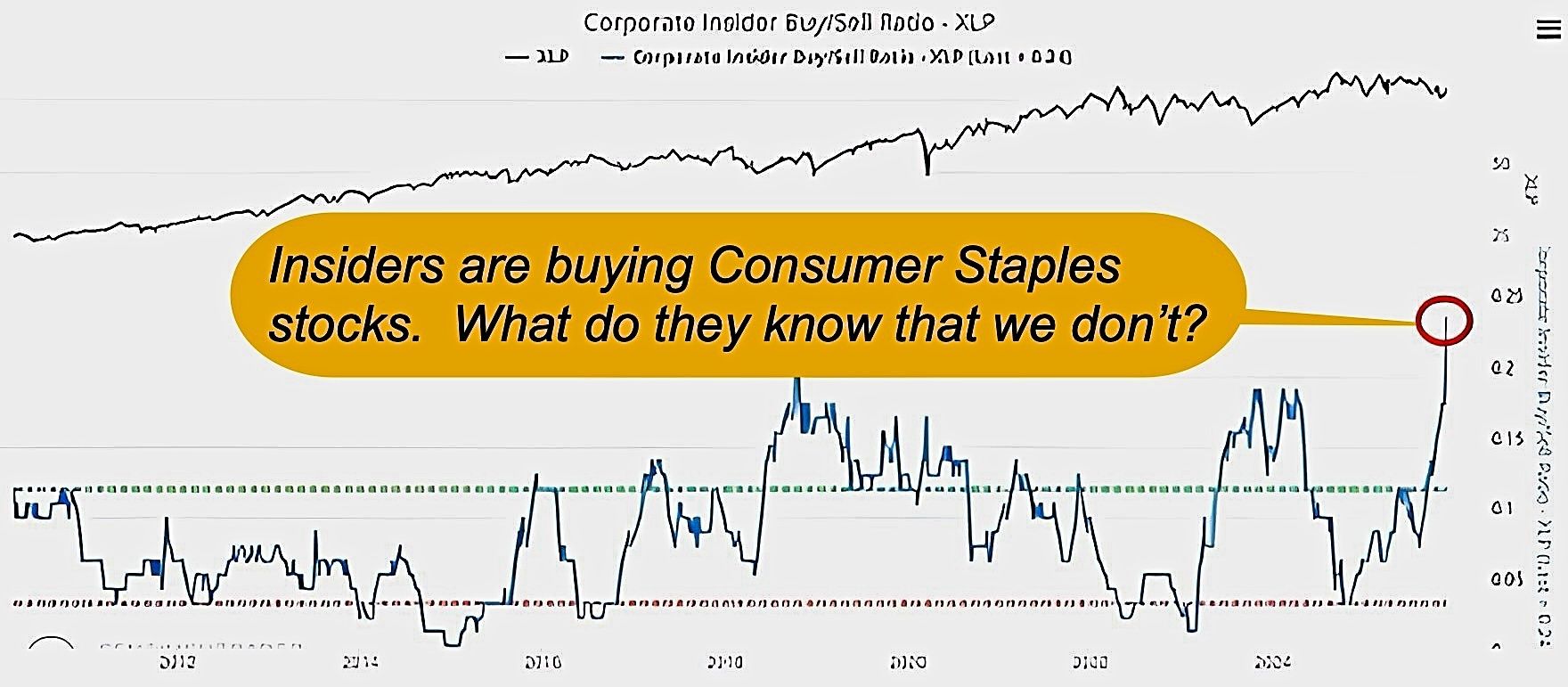

Factually: (a) Years ending in 6 (e.g. 2026) tend to see weaker price action. (b) Insiders are buying up (relatively cheap) consumer staples stocks. (c) REITs are seeing significant relative value (vs expensive stocks). And (d) the ETF marketplace appears to be a bit frothy. Overall, per Callum Thomas: The key takeaway from this week is that while there are some pockets of excess and risk-flags, there are many opportunities out there for those willing to look in other directions and openly explore: cheap vs history vs Mag-7.

HODLs: (Hold-On for Dear Life)

- Reducing:

o (-) Ethereum (ETH = 3,020 / in at $310)

o (-) Bitcoin (BTC = $89,400 / in at $4,310)

- Increasing:

o (+) IBIT – Blackrock’s Bitcoin ETF ($50.7 / in at $24)

o (+) Physical Commodities = Gold @ $4,227/oz. & Silver @ $58.8/oz.

o (+) SLV (silver ETF) == ($52.9 / in at $27)

o (+) GLD – Gold ETF ($386.4 / in at $212)

o (+) CCJ (uranium) == ($91.6 / in at $84)

o (+) ICSH (short term bonds = 4.65% yield == paid monthly)

o (+) GDX (gold miners) == ($81 / in at $52)

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson