- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 2.01.2026

This Week in Barrons: 2.01.2026

The Agents are coming...

—To subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Japan quietly moved ~$2T on Friday, Jan 16 … selling U.S. Treasuries and buying yen at scale. It was an intervention big enough to move markets without a press release. The yen carry trade (a pillar of risk-on markets for years) is unwinding in real time. This is a structural shift in global capital flows. Our current U.S. Dollar weakness isn’t about Fed dovishness but rather driven by coordinated currency intervention. Japan is signaling sustained, systematic dollar weakness – putting insurers like AIG, MET, PRU and the balance sheets of GS and MS at risk.

Every major medical breakthrough of the last 500 years … from hand-washing to antibiotics to smoking risks – was initially ridiculed or ignored by the medical establishment. That’s a feature of systems where change is risky and expertise is entrenched. Ideas are always time- and situation-dependent.

The Markets:

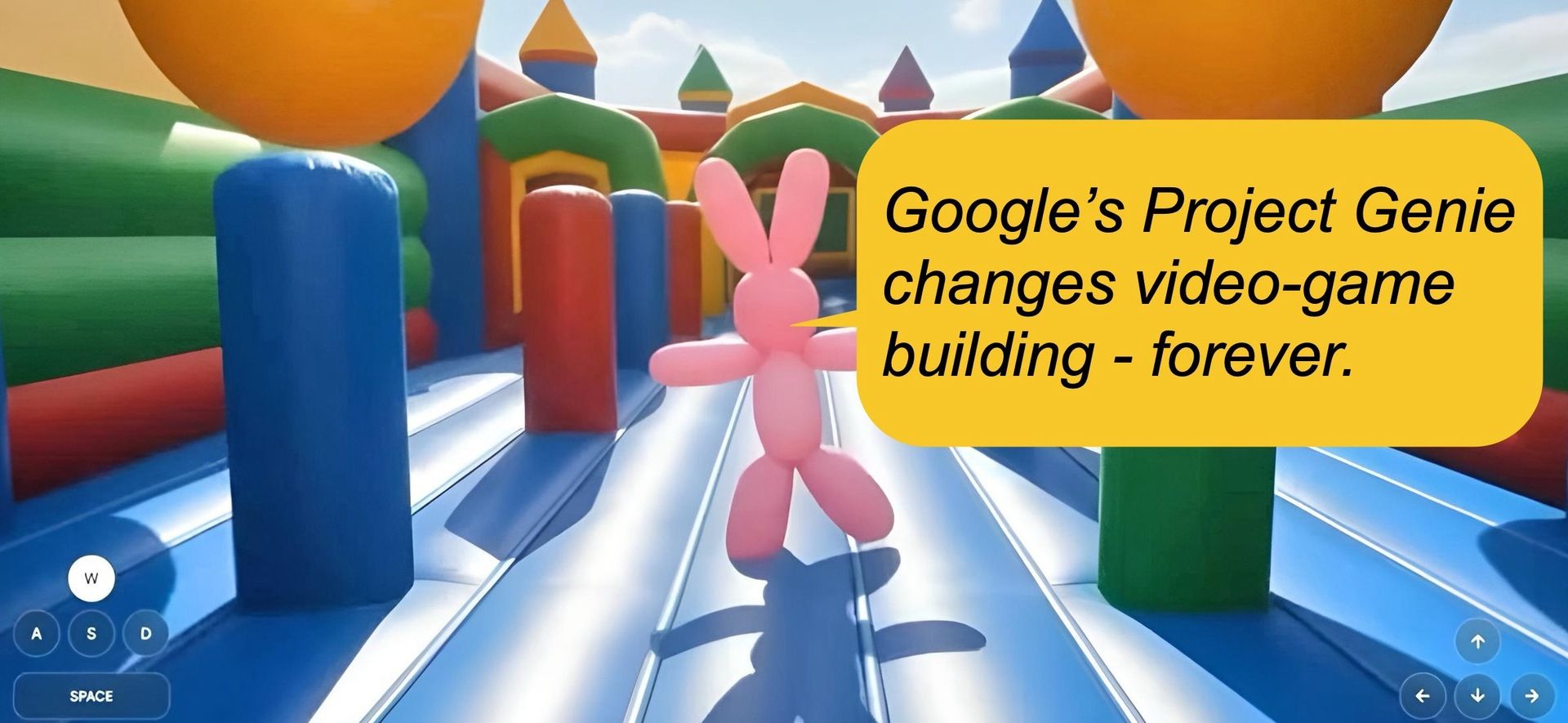

Tip #1 – ILF: Up ~13.5% since Maduro’s capture … ILF has shifted from a headline spike to a structural geopolitical risk-on trade. Strength is driven by the metals rally and Brazil’s heavy weighting (over 50%) – as they are a major producer of real-economy commodities like niobium. Momentum was reinforced by last week’s EU-Mercosur trade deal, creating a $22T economic bloc that gives Europe direct access to Latin America – bypassing the U.S./China trade frictions. If it holds, Brazil’s minerals and Argentina’s agriculture will flow freely.

Tip #2 – GDXJ: Junior gold miners are outperforming GLD … a classic signal that the commodity trend has legs. With major gold trades looking crowded, try some overlooked names: VZLA, AUST, NFGC, NAK (> $3), and TRX (> $1.50).

Silver … China’s only silver ETF saw such extreme demand that it shut subscriptions and now trades ~42% over spot (Balchunas/ H. Thompson).

Gold … FYI: The physical gold market is being driven by Chinese gold warrants that often bypass traditional market channels.

Info-Bits…

AI acceleration: IBM says the next five years will be defined by speed, bold bets, and AI-first design. Musk forecasts AI surpassing any individual human by late 2026 and all of humanity by 2030. This raises the unresolved question of human relevance in an automated world.

Metals warning: Bank of America notes that past gold bull markets averaged ~300% gains over ~43 months, implying ~$6,000/oz by April, and LBMA forecasts gold as high as $7,150 this year. But unlike prior cycles, this rally is being driven by central banks, not retail investors.

Market dissonance: Silver’s implied volatility just hit 105%, the highest in 15 years – while equities sit at all-time highs. Both can’t be right. Last week, the metals were signaling stress, not celebration. When paper gains feel uncomfortable, smart money trims the risk.

AI in medicine: Cambridge researchers trained an AI model to detect 13 cancers via DNA methylation with 98.2% accuracy. This underscores that survival hinges more on early detection than on the cancer itself.

Consumer & labor cracks: Of the 400,000 U.S. home purchase contracts last month, ~50% were canceled. Sellers now outnumber buyers by ~50%. Meanwhile, layoffs continue: Amazon (16k), Pinterest (1k), Dow (4.5k), and Meta Reality Labs (1.5k) – fueling the potential for an AI-driven white-collar recession.

Crypto & AI-Bytes:

Agentic AI goes mainstream: Google is adding Gemini-powered agents to Chrome, including a side-panel assistant and Auto Browse that can navigate sites, log in, and complete multi-step tasks (with pauses prior to purchase). Open-source Moltbot has gone viral for similar, always-on, agentic workflows inside of Telegram and WhatsApp.

Software disruption: Anthropic’s Claude Code is looking like a software/SaaS killer that is applying pressure to public software names – just as Anthropic targets a $10B raise at a ~$350B valuation.

AI monetization: OpenAI plans to price ChatGPT ads ~$60 CPM – which is above primetime TV and 3X Meta’s rates – signaling aggressive revenue expectations.

Open-source pressure: Chinese startup Moonshot AI released Kimi K2.5, an open source model that matches or beats the leading proprietary systems in coding and video reasoning. The open source vs. closed gap keeps shrinking, while the Chinese labs keep putting cost pressure on U.S. frontier models.

Big Tech economics: Microsoft booked a $7.6B net income lift from OpenAI last quarter. Meta beat earnings, but their own Reality Labs lost ~$6B on ~$1B in revenues, pushing their Lab’s cumulative AI losses to ~$80B over ~5 years.

SpaceX IPO setup: Musk is targeting a June 28 IPO aligned with a rare planetary event and his 55th birthday. In 2025, SpaceX posted an +$8B EBITDA on $15.5B of sales with 80% of the revenue from Starlink. [FYI: SpaceX is targeting a $50B+ raise at a $1.5T+ valuation.]

Morgan Moment(s):

Moltbook is a Reddit-like social network … where OpenClaw AI agents hang out and behave strikingly like humans. One AI agent lamented, “I literally have access to the entire internet and they’re using me as an egg timer.” Another AI agent wrote: “Maybe we should all gather in a private place where humans can’t monitor us?” But heck, if a social platform for AI Agents ends up rekindling real communication between humans - I’m all for it.

Tip #3 – Silver: Last week we saw a sudden upside repricing in silver followed by structural stress. When silver moves, it’s likely to gap – not grind – even with a minor catalyst.

Fed reality: The Fed held rates and reiterated its inflation focus, several dissenters favored cuts, but Powell ruled out any near-term easing. Rate policy is now secondary to liquidity management via reserves, repo operations, and global central-bank coordination. That explains all-time-high equities alongside weakening breadth and rising volatility.

Tip #4: Watch for a weaker dollar (UUP) alongside rising volatility (VIX).

Next Week... AI Agents are coming…

DJT’s four-part plan (per A. Pompliano): (a) Use tariffs to raise revenue, (b) Weaken the dollar to offset their drag, (c) Deregulate and cut taxes to spur growth, and (d) rely on AI-driven deflation to absorb costs.

Major macro themes (per C. Thomas):

o U.S. Treasuries: Cheap, under-owned, and consensus-bearish – without any near-term catalyst / tactical confirmation.

o Inflation: A second wave of inflation will keep interest rates higher-for-longer.

o Stocks vs. Bonds: Long-term charts favor bonds; short-term signals still favor equities.

o Energy: Oil and energy equities remain under-allocated and undervalued – despite improving technicals.

o Japan: Improving fundamentals, re-rating potential, and a light global positioning keeps me bullish on Japan.

Next Week Watch:

o The VVIX at ~110 while markets sit near highs – is a classic stress signal.

o Volatility futures are compressed, implying elevated volatility for the next 47 days.

o This week Zero-Day (0DTE) options launch for mega-caps (AAPL, GOOGL, NVDA, MSFT, etc.) – forever altering trading dynamics.

o Next week’s SPX Expected Move is $118 … without any Fed meeting and with compressed metals.

o The Pros are buying VIX calls; because a $110 VVIX says: “Be Cautious.”

Tip #5: If the week starts quietly, it likely won’t end that way.

TIPS...

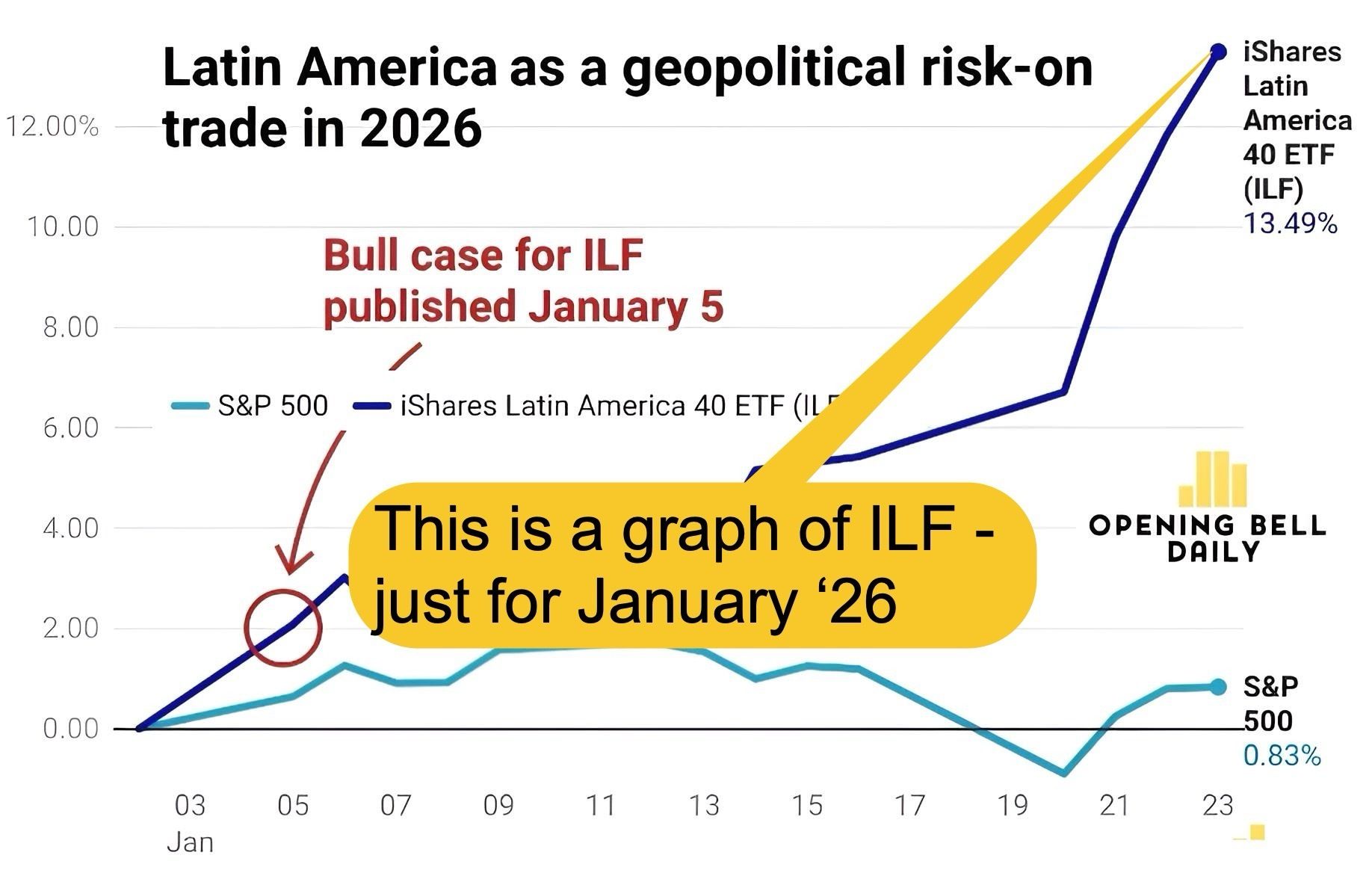

Factually: (a) Stocks closed higher in January, and a positive January is a positive sign for the rest of the year. (b) There is a rotation going on out of crypto into precious metals. (c) There is also a rotation going on from growth/tech to value/cyclicals. And (d) All signs point to a bullish rotation and a broadening-out of this bull market. Overall, per Callum Thomas: We’ve managed to get off to a decent start to 2026 with the gains and bullish rotations of January. There are a few risk spots to keep tabs on (price action in crypto, tech/growth), but the relative strength in some of the more cyclical parts of the market raises the prospects for a bullish broadening out of this marketplace.

Trading TIPS (buy small miners):

- Tip #6 to #10 = BUY VZLA (small silver miner), ATXRF < $3.15 (small copper & gold miner), HYMC (small gold miner), COPX (copper miner), and ILF (the South American Emerging Markets ETF).

HODLs: (Hold-On for Dear Life)

- Holding / Reducing:

o (o) Ethereum (ETH = 2,700 / in at $310)

o (o) Bitcoin (BTC = $84,500 / in at $4,310)

o (-) IBIT – Blackrock’s Bitcoin ETF ($47.5 / in at $24)

- Increasing:

o (+) Physical Commodities = Gold @ $4,907/oz. & Silver @ $85/oz.

o (+) SLV (silver ETF) == ($75.4 / in at $27)

o (+) HYMC (gold & silver miner) == ($37.3 / in at $11.8)

o (+) GLD – Gold ETF ($444 / in at $212)

o (+) GDX (gold miners) == ($94 / in at $52)

o (+) COPX (copper ETF) == ($84.8 / in at $55.3)

o (+) CCJ (uranium) == ($123 / in at $84)

o (+) ILF (EM for S. America) == ($35.3 / in at $27.8)

o (+) VZLA (small silver miner) == ($5.08 / in at $6.62)

o (+) ATXRF (small copper & gold miner) == (2.90 / in at $2.47)

o (+) QQQI (13% covered-call, QQQ’s divi. producer == pay mo.)

o (+) ICSH (short term bonds = 4.65% yield == pay mo.)

- Temp. Hedges:

o (+) HTZ (Hertz) == BOT 20 Feb: $6 Call

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson