- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 4.20.2025

This Week in Barrons: 4.20.2025

This Market is 'Fully Baked'...

TRUMP vs POWELL … per Darius Dale (CEO @ 42 Macro):

Chairperson Powell understands what occurred in the bond market last week, and did what he had to do to preserve our ability to service and grow $36T+ of debt – with foreigners owning 30% of it. It would be Bond market suicide if our FED demonstrated a lack of independence and a disregard for inflation during the current crisis of confidence in US assets that Trump’s Tariffs have created. Also, it would be a dereliction of duty for our FED not to defend the US dollar from destabilizing capital outflows.

For the first time in decades, it is no longer attractive for foreign investors to invest in our bond market. Trump’s Tariffs have created a crisis of confidence in U.S. assets due to his sophomoric rollout of a flawed tariff policy – sending the US dollar into free fall. The US has a net international investment deficit of $24T = over two-thirds of our GDP. We also have fiscal and current account deficits totaling -11% of GDP. Combined, these demonstrate unprecedented degrees of U.S. fiscal irresponsibility. When we respected others, the world was OK about financing our high-on-the-hog life styles. Our exorbitant economic privileges have been eroded by: emotional outbursts, policy blunders (e.g., Trump’s Fisher-Price Tariff Formula), and by our current disregard for the rule-of-law.

Jay Powell knows all of this, and is doing what he must to preserve our absurdly low cost of capital. He is doing what every Central Banker would do to stem capital outflows during a crisis of confidence: implement hawkish policy. The fact that bonds rallied during Powell’s hawkish speech last week is confirmation of this view.

The Market:

CURRENCY MARKETS: Per H. Thompson, China's CIPS cleared more cross-border payments than our SWIFT system last week for the first time. So, as our Republicans head to El Salvador, Bernie goes to Coachella, Trump tries to out-smart Harvard, and RFK Jr. explains how to solve autism -- the U.S. Dollar continues to lose ground in the global currency war. This Easter week will be remembered as when the currency tide finally turned against the U.S. Dollar.

[TIP #1: BUY more Gold and Bitcoin.]

BITCOIN: Using Bitcoin to work around petro-dollar constraints is no longer theoretical. China and Russia have both started settling energy transactions in Bitcoin and other digital assets. Bolivia has announced plans to import electricity using crypto. And French energy utility EDF is exploring whether it can mine Bitcoin with surplus electricity currently exported to Germany. Bitcoin is evolving from a speculative asset into a functional monetary tool – particularly in economies looking to bypass the dollar and reduce exposure to U.S. based financial systems.

GOLD: Sovereigns and large foreign asset managers are deliberately rotating out of U.S. Dollar assets. De-dollarization has gold at record highs and the U.S. Dollar index (DXY) at its weakest level in 2 years. This reflects a gradual but consistent hedging by countries in response to what they see as an erosion in America’s long-standing ‘safe haven’ status.

TARIFFS: Trump will be forced to pivot on tariffs. How he believes destroying $12T+ in wealth justifies earning $500B in tariffs is beyond me. Since his “buy stocks” comment, he owns all market outcomes. Factually, it will take months to correctly work through 80+ bilateral trade deals. A Trump Tariff Recession (aka: the largest tax increase since Smoot Hawley), will cost Republicans the mid-terms as he is punishing American small businesses the most, and they voted Republican. Trump’s Tariffs will cause increased inflation and lower corporate earnings growth.

Things I Read… Mode Mobile allows you to make money with your iPhone. Look-n-Learn … R.F. Culbertson

Today’s Fastest Growing Company Might Surprise You

🚨 No, it's not the publicly traded tech giant you might expect… Meet $MODE, the disruptor turning phones into potential income generators.

Mode saw 32,481% revenue growth, ranking them the #1 software company on Deloitte’s 2023 fastest-growing companies list.

📲 They’re pioneering "Privatized Universal Basic Income" powered by technology — not government, and their EarnPhone has already helped consumers earn over $325M!

Invest in their pre-IPO offering before their share price changes on May 1st.

*An intent to IPO is no guarantee that an actual IPO will occur. Please read the offering circular and related risks at invest.modemobile.com.

*The Deloitte rankings are based on submitted applications and public company database research.

Info-Bits…

China bought ~50 tons of gold in February … because of Trump’s Tariffs and increasingly dis-respect / hostility. Chinese retail investors are chasing gold because of its out-sized returns when compared to the overall market.

LVMH, the juggernaut in the world of luxury fashion … reported that its Q1 sales FELL 2% more than expected. The luxury business is often the canary in the diamond mine. [FYI: If the wealthy are tightening their Birkin strings, that means everyone on the food-chain is feeling the Trump Tariff Pinch.]

OpenAI is developing its own X-like social media network … that is focused around ChatGPT's image generation capabilities.

Fyre Festival 2 has been postponed indefinitely. [Who didn’t see that coming?]

The Trump Team launched probes into pharma and chip sectors … in a bid to impose more tariffs. Currently, pharmaceuticals and semiconductors are exempt from reciprocal tariffs.

Meta Platforms is asking companies like Microsoft and Amazon … to help fund its Llama AI development. [FYI: The enormous costs of AI are straining even the coffers of one of the richest companies in tech.]

US regulators have approved Capital One’s $35B acquisition of … Discover Financial. That’s the last major hurdle for a deal that will create America's largest credit-card issuer (~ $250B). They will account for ~22% of the US credit card market.

Pill Baby Pill … Eli Lilly announced that their experimental pill for weight loss is just as effective as rival Novo Nordisk’s Ozempic injections. The anti-obesity drug market will grow to $100B by 2030. Anti-obesity medications are now prescribed to 6% of all Americans.

Courts have ruled that Google is illegally dominating … key segments of the online advertising market. The tech giant's practices in managing publisher ad servers and ad exchanges is stifling competition. The decision may pave the way toward divestitures that would restore market fairness.

Retail sales rose 1.4% in March (MoM) … the highest gain in over 2 years. Spending on automobiles and parts climbed a 5.3%, suggesting that some Americans (fueled by the impending 25% auto tariffs) splurged on cars.

Crypto-Bytes:

Vitalik Buterin wants Ethereum to have a ‘good social philosophy’ … that guides developers and avoids disasters like FTX or pump.fun. [FYI: ETH users would like cheaper transaction fees and a blockchain that’s faster than dial-up.]

Kraken announced a phased exchange rollout … that allows users to trade equities alongside crypto on one platform.

Bitcoin is having a record worst 1-Year performance post Halving … [FYI: BTC's +32.74% one-year gain post-2024 halving is its lowest-ever 12-month return after a halving event.]

Things I Read… I start the daily with the Daily Upside … try it … Look-n-Learn… R.F. Culbertson.

What Top Execs Read Before the Market Opens

The Daily Upside was built by investment pros to give execs the intel they need—no fluff, just sharp insights on trends, deals, and strategy. Join 1M+ professionals and subscribe for free.

TW3 (That Was - The Week - That Was):

Tuesday: I think we retest previous lows in the not too distant future. JPMorgan’s CEO Jamie Dimon just filed to sell 133,639 shares of JPM ($31.2m). I’m thinking that there are not a whole lot of people ‘more connected’ than Jamie Dimon. Combine that with Citigroup’ ‘DOWNGRADING of all U.S. stocks to Neutral’, and telling investors to look overseas due to uncertainty surrounding: Trump’s Tariffs, the U.S. Dollar, and the declining demand for American stocks. The play here is in liquidity. The U.S. has a Quantitative Tightening (QT) stance – while other nations are freely printing money (QE).

Wednesday: Spot gold rose above $3,300/ounce for the first time in history. [FYI: My $3,500 target for gold is getting closer.].

Thursday: Trump called for FED Chair J. Powell to step down when he said: “The ECB is expected to cut interest rates for the 7th time, and yet, ‘Too Late’ Jerome Powell of the Fed (who is always TOO LATE AND WRONG) issued another report which was a typical, complete ‘mess!’. Powell’s termination cannot come fast enough!”

Morgan Moment(s):

Ray Dalio (Founder of Bridgewater Capital) is fearful that … Trump’s Tariffs will result in more than just an economic slowdown. Trade disruptions, mounting national debt, and a massive shift in global economic / political power will upend an 80-year status quo. “The U.S. could be on the verge of something graver than the 2008 financial crisis.”

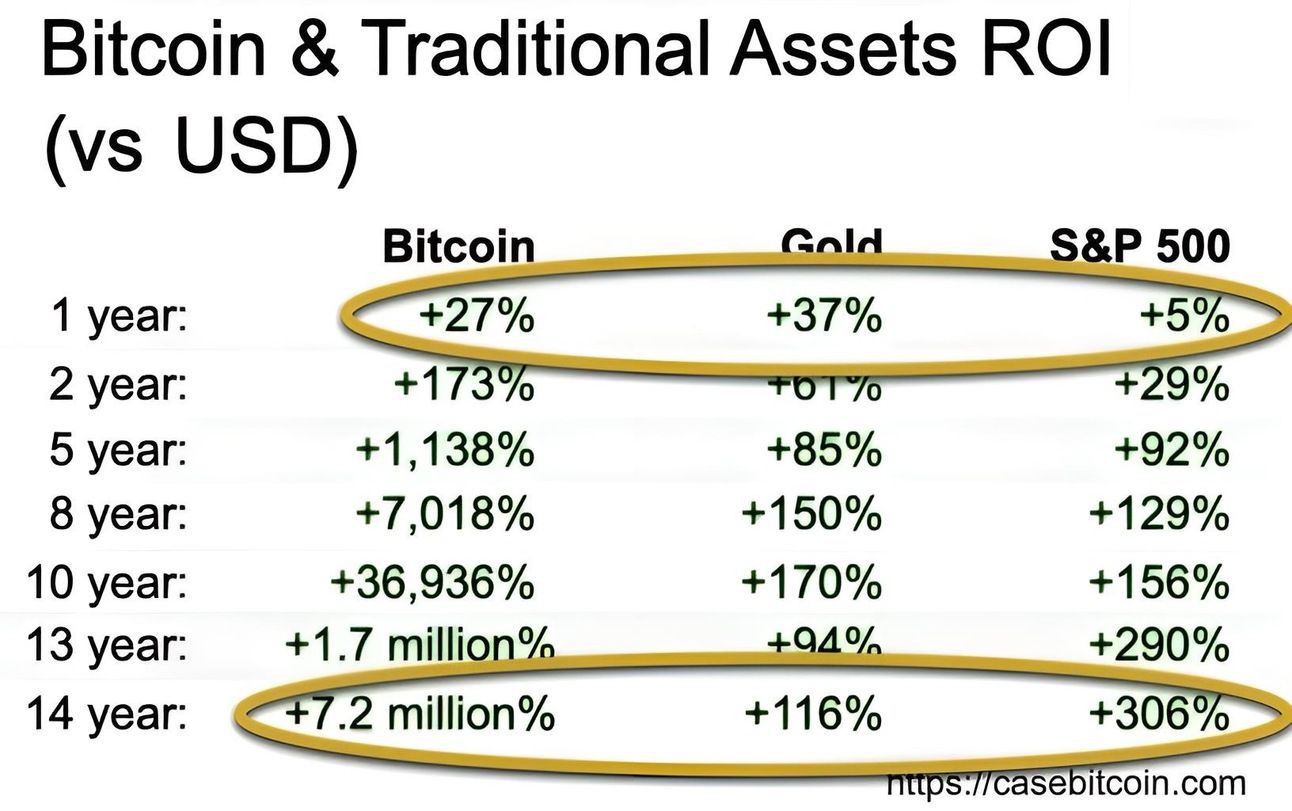

Per ‘The Pomp’: “The rich need a place to store their wealth. The 80’s saw that place as being U.S. bonds, the 90’s = U.S. stocks, the 00’s = U.S. and London Real Estate, the 2010’s = U.S. tech stocks, and since 2020 = Bitcoin has massively outperformed. But now we have Trade Wars that are: bad for bonds, bad for stocks, bad for real estate, good for Gold, and ultimately great for Bitcoin.” Bitcoin provides the correct solution to governments that continue to debase their own currencies. [FYI: There are only 2 sound-money assets out there – both are investible and doing well.]

Next Week... This Market is ‘Fully Baked’…

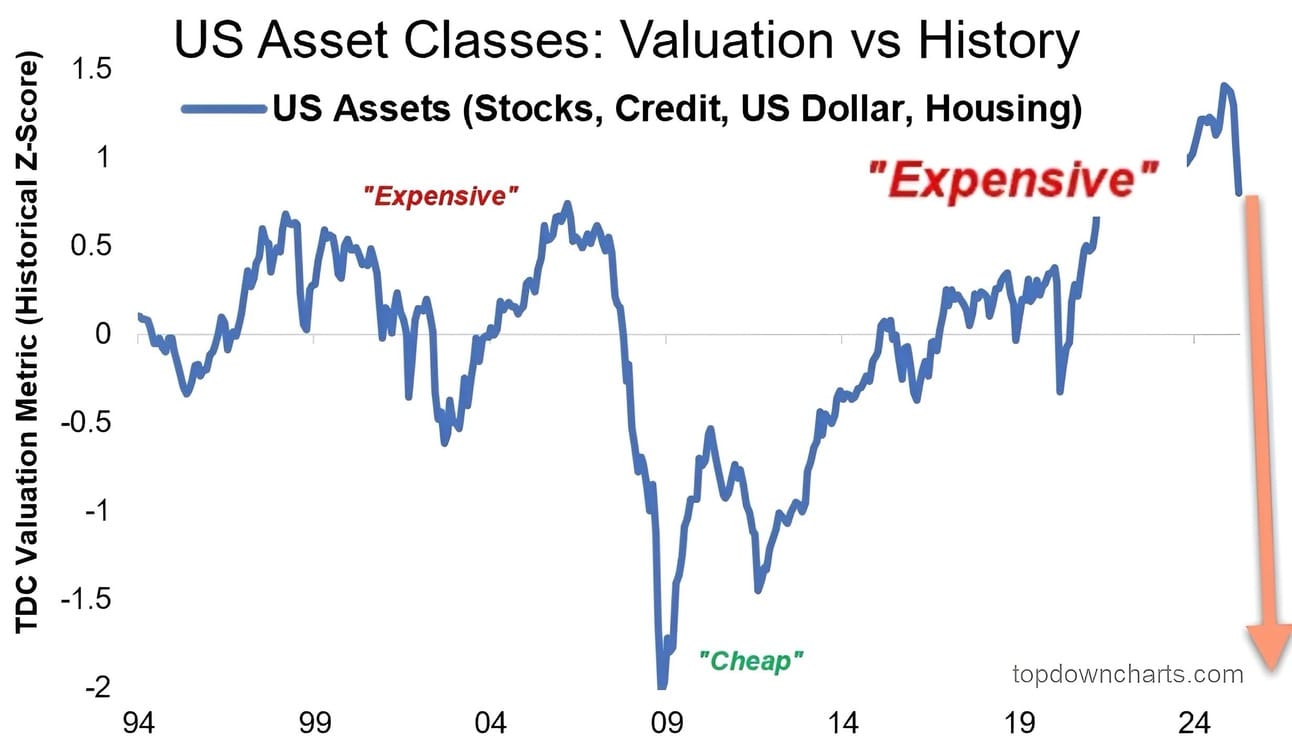

Investor Timing … Investors had a good-time-for-a-long-time buying when this indicator reached low levels, and had a bad time when buying at high levels. We have moved from one of the best buying opportunities in history (2009), to one of the worst (2025). In this case ‘Don’t bet against America’ is more of a statement about the long-term.

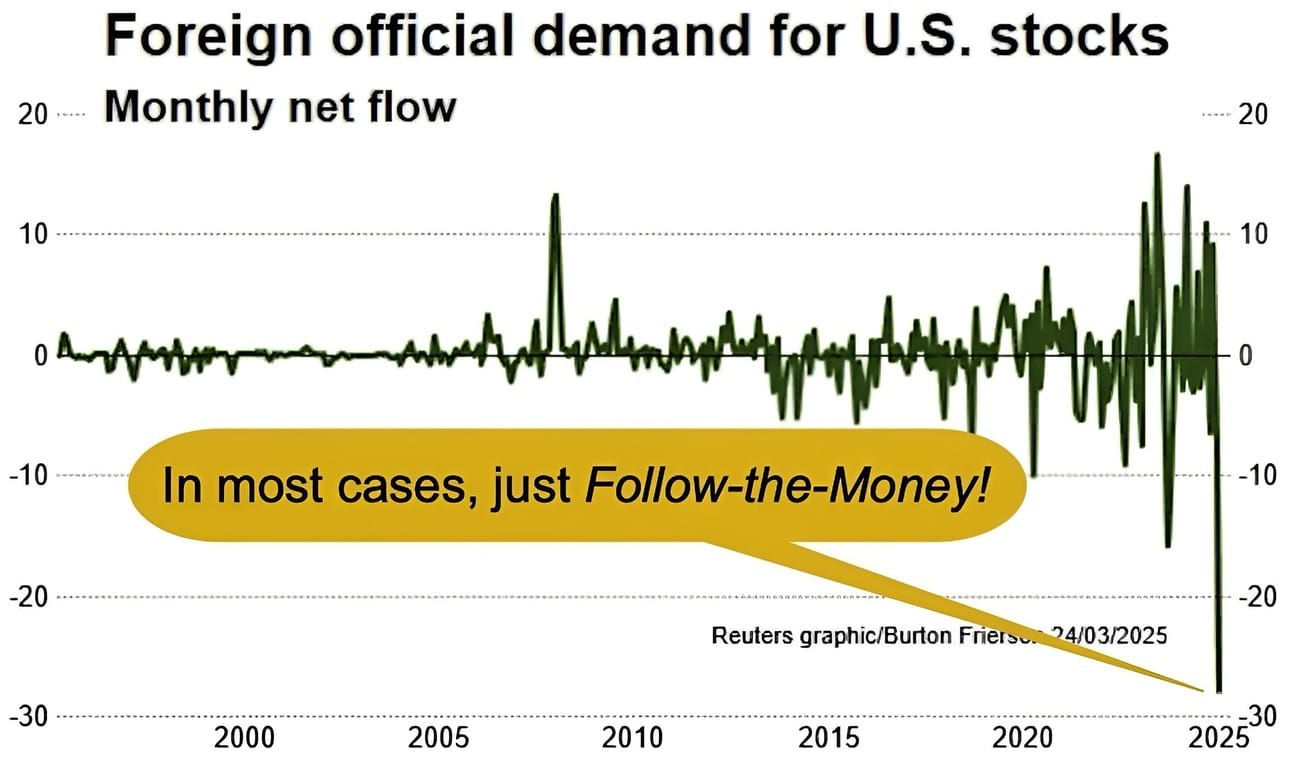

When you ‘Follow the Money’ … it shows us that foreign investors are voting with their feet. Per Callum Thomas, they’re concerned about the U.S. Dollar, high valuations, policy uncertainty, and recession risks. They’re rotating out of U.S. stocks and back into their home markets or gold. It doesn’t make sense for U.S. assets to trade at such a premium when Trump’s Tariff risk is this high, and our recession risk is over 50%. [FYI: When you’re priced-for-perfection and then find yourself in an increasingly imperfect world – it’s time to pause and re-think.]

Volatility is DOWN, but far from OUT … as the VIX (Volatility Index) only fell from the stratosphere (~60) into the 30’s. After watching the train wrecks associated with NVDA and Mag-7, please be extremely cautious because:

o Trading Volumes are gone, and

o Liquidity Issues are here to stay.

Tip #2: Bullish == China… The Chinese economy is at an inflection point after a multi-year downturn. I’m expecting stimulus, cyclical improvement, and priced-for-imperfection Chinese stocks to perform much better than most expect.

Tip #3: Bullish == Gold, Bitcoin, and Defensives… will outperform given: valuations, political posturing, and fundamentals. But the real money to be made in a BEAR MARKET is betting with the momentum – to the downside.

Tip #4: Bearish == Energy (XLE) and Financials (JPM) … This market will not allow any substantial gains without Tech being involved.

The S&P (SPX = $5283) Expected Move (EM):

- Last Week’s EM = +/- $237 … and we moved ~$250 from low to high.

- Next Week’s (4-Day) EM = +/- $139 – keeping our VIX in the 30’s. Liquidity and Volume will drive the week.

Bitcoin (IBIT = ~$48.3) Expected Move (EM):

- Next Week’s EM = +/- $3.4 … an ~7% EM for the trading week.

TIPS...

HODL’s: (Hold-On for Dear Life)

- (+) PUBLIC.com Bond Portfolio (6.9% yield) / TLT (10-year T-Bills)

- (+) IBIT – Blackrock’s Spot Bitcoin ETF ($48.2 / in at $24)

- (+) Physical Commodities = Gold @ $3341/oz. & Silver @ $32.5/oz.

- Bitcoin (BTC = $85,400 / in at $4,310)

- Ethereum (ETH = 1,610 / in at $310)

- (+) GLD – Gold ETF ($306 / in at $212)

Options for Income: De-Risking a Portfolio… (using IBIT for example)

- BUY-n-HOLD the IBIT ETF

- BUY PUTs: 1 Std. Dev. Lower, Expiring = 3-weeks away, OTM (out-of-the-money) for protection.

- SELL Covered CALLs: 0.75 to 1 Std. Dev. Higher, Expiring = 2-weeks away, OTM for income and to finance the PUTs.

‘De-Gen’ Economy:

- Singapore (SE = $120.9 / in at $107)

Watching:

- PAAS: Silver miner moving higher.

- XLE & JPM: BUYing PUT Options: In/Out Put Spreads.

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson