- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 6.13.2025

This Week in Barrons: 6.13.2025

Volatility is Dangerous...

“Does this make my Blog look big?”… With all the drama of a 2000’s-era Razr, our new phones will begin to start snapping closed - again. They will continue to be thinner, lighter, and have bigger screens, and like every device these days – will be crammed with AI features. They’ll even have an AI assistant that can critique our outfits. (“Does this make my Blog look big?”)

There isn’t much of a correlation… between how fast you swim, and how much energy you put into it. Per Seth Godin, drowning people burn plenty of calories but they don’t go anywhere. When we’re confronting a new problem, more effort might not be the answer. It could be that we benefit more from staying calm, and focusing on our technique / problem-solving skills.

Who’s your customer? If you’re smart, this is the choice that you will make first on your entrepreneurial journey. Your customers decide whether or not to spread the word, to be loyal, and to push you to raise or lower your standards. Your customers are your growth engine, and are also the architect of how you spend your day.

- Who are your employees? They determine your cost structure, your deal flow, and the space you have to work with.

- Who are your investors? They decide the scale of your resources, timeframe, and your decision-making rubrics.

It’s easy to just do what others are doing. However, while it’s still your project and you get to choose how to run it – might I suggest that you choose your customers first, and then your future.

The Market:

“To Be or Not to Be – Poached.” Meta recently poached Ruoming Pang, Apple’s head of foundation AI models, alongside other new OpenAI additions to its new Superintelligence unit. Pang’s departure followed internal tensions that arose after Apple leadership openly explored replacing their in-house AI models with options from OpenAI or Anthropic. This matters because Apple Intelligence and an AI-Infused Siri have been nothing short of a disaster. Meta’s poaching may be the headline, but the real story is Apple’s AI brain drain that will continue to slow their AI implementation.

The AI Browser Race is heating up… with Dia, The Browser Company, and Brave among the early movers. Perplexity just tossed its AI-powered web browser Comet into the competition. It uses its own AI search engine, and its Comet Assistant is accessible to automate routine tasks. Shortly, OpenAI will release its new browser that is designed to keep a user in a ChatGPT-esque interface rather than clicking to other websites. And because they’re integrating their own AI Agent – they will be able to offer users something Google Chrome can’t – ‘The Finishing Move’ == SALES. [FYI: In terms of ‘poaching’, OpenAI’s released browser will come ~1 year after they ‘poached’ the 2 Google VPs who helped develop the Google Chrome browser.]

The Cost of Financial Freedom… Americans now believe that it takes an average net worth of $840,000 to be financially comfortable - a drop from the $1m Americans agreed upon in 2022. The ‘wealthy’ requirement has also fallen to $2.3m. Surveys continue to find that ~50% of the respondents tie being wealthy directly to happiness, ~33% tie wealth to physical and mental health, and 25% tie being wealthy to maintaining strong relationships. [FYI:The Lennon-McCartney Wealth Theory == “Money Can’t Buy Me Love”.]

Things I Read… The Air Insider allows you to invest like an Insider - using picks from the pros… Look-n-Learn … R.F. Culbertson

Expert investment picks that have returned 200%+

AIR Insiders get picks from expert investors and industry leaders sent straight to their inbox every week. Picks like:

Jason Calacanis recommending Uber at $25/share (200%+ return)

Anthony Scaramucci recommending Bitcoin at $29,863 (200%+ return)

Sim Desai recommending OpenAI at an $86 billion market cap (200%+ return)

Looking to invest in real estate, private credit, pre-IPO ventures or crypto? Just sign up for our 2-week free trial so you can experience all the benefits of being an AIR Insider.

Info-Bits…

Meta has hired Apple’s head of AI models… to help lead its superintelligence efforts with a ‘package’ worth tens of millions of dollars per year == as The Zuck continues his talent raid.

Amazon’s four-day Prime Day sales event… is expected to boost online spending to $23.9B = 2 Black Friday’s == a 28.4% increase YoY.

Waymo began robotaxi testing in Philadelphia and NYC.

China’s BYD will begin assembling EVs at its new Brazilian factory… It aims to cut import costs – as rising tariffs impact its largest overseas markets.

Intel has initiated another major round of layoffs.

Samsung’s Q2 operating profit fell -56% YoY… as the chip crisis deepens.

China’s producer prices fell 3.6% in June… the biggest drop in nearly two years as deflation deepens.

Nvidia joined the $4T mkt. cap club… as the club’s only member.

Amazon may invest +$B’s more in Anthropic… to tighten their AI partnership and to fend off competition from Mata, Microsoft, and OpenAI.

Crypto-Bytes:

The above orange trendline is Bitcoin’s dominant interior trendline … and it’s where BTC is currently banging its head to breakout higher. Watch this line because for over a year it’s pulled Bitcoin around like gravity.

Block CEO and Twitter co-founder Jack Dorsey… spent last weekend building a new messaging app called Bitchat – a peer-to-peer chat service that operates entirely over Bluetooth mesh networks.

Bitcoin hit a new all-time high… when it crossed $118,000 for the first time. That beats the previous record of $111,970 set on May 22 = Bitcoin Pizza Day.

Grok is coming to Tesla vehicles “next week, at the latest” … Elon has been teasing this Tesla/Grok integration for months, claiming that Grok would become an AI assistant that would enable drivers to “chat” with their cars and ask Grok to perform certain tasks.

Next Week our Government will vote on… the Genius Act – a long-awaited regulatory framework for stablecoins. If passed, it will head directly to Pres-Trump’s desk to become the first major crypto regulation ever approved by Congress. The bill will legitimize the stablecoin market, and encourage more financial institutions to move closer to crypto. Also, next week we vote on:

The Clarity Act… which will clarify which agencies oversee different parts of the digital asset market.

And the Anti-CBDC Surveillance Act… that bans any U.S. Central Bank Digital Currency (CBDC)

Things I Read… “Tangle is a non-partisan political newsletter that unpacks one important news story everyday – examining it from all sides.” Read-n-Learn… R.F Culbertson.

Real News for Real People — Not Partisans

Feeling like you want to get off the rollercoaster of polarizing politics? Read Tangle — an independent and nonpartisan political newsletter recently profiled on This American Life for helping to bridge the gap between politically divided families. Each day, the newsletter unpacks one important news story, examining it from all sides of the political spectrum.

TW3 (That Was - The Week - That Was):

Monday: After last week’s all-time-highs, stock futures are slightly lower. Pres. Trump said that: "Tariff letters and/or deals will be delivered from midday Monday.” He also threatened that: "Any Country aligning themselves with the Anti-American policies of Bric’s, will be charged an ADDITIONAL 10% Tariff. There will be no exceptions to this policy."

Wednesday: Trump declared that a 50% tariff on copper was in the works, and threatened 200% duties on pharmaceuticals. The president also reaffirmed that the pause he placed on "reciprocal" tariffs in April will end August 1 with “no extensions”. The EU commission then came out and said that it is aiming to reach a trade deal with the U.S. before Aug. 1, potentially even in the coming days.

Thursday: Bitcoin briefly hit a new all-time high of $112,152. Bitcoin's price has been rising over the past few days as the U.S.’s new tariff date has eased volatility. In earnings news, Delta Airlines (DAL) reported an earnings beat, and raised guidance.

Friday: The futures are sort of ugly, but on the other hand gold, silver, and bitcoin are all up – bigly. Most of this is due to Trump’s tariff talks. The tariff wars have escalated, starting with Brazil and most recently with Canada’s 35% amount.

Morgan Moment(s):

The stock and bond markets are forecasting different scenarios… for the US economy. Bonds are playing Lucy with the football while stocks are Charlie Brown. Stocks are projecting optimism: higher equity prices, earnings growth, and broad enthusiasm. Bonds are pricing in: FED rate cuts, weakening growth, and an economy that stalls out. Goldman Sachs and Bank of America have both raised their S&P year-end price targets. However, it’s the bond market that continues to be the “adult in the room” that doesn’t succumb to retail or meme-driven forces and are historically better forecasters of the economy. The people, the FED, and the Bond Market all expect higher inflation in the coming months.

A Johns Hopkins robot just nailed a key gall-bladder surgery… with no human hands on deck. The robot performed 8 gall-bladder surgeries like a seasoned pro, self-correcting and adapting in real time. This marks a new era for surgical robots, and just imagine how it could handle medical emergencies.

A Chinese robot dog named Black Panther II … set a new record by sprinting 100m in 13 seconds. While Usain Bolt still holds the 100m record, China’s Black Panther outpaces almost all humans. It’s AI-driven gait adaption, biometric design, and real-time machine learning - are ‘proof-of-work’ that much smarter and faster robots are on the way.

Next Week... Volatility is Dangerous…

Volatility (VIX) = huh? I believe that "TACO time is officially over.” (TACO = Trump Always Chickens Out.) Once July 9th became August 1st, everyone assumed we’d have even more delays – but Brazil showed us that we’re wrong. Brazil is our second-largest trading partner, and U.S. markets are acting like nothing's happening with the VIX sitting at 16. We have a Trump presidency and tariff deadlines looming, and we're still pricing volatility like we're in some sleepy summer market.

Tip #1: VIX – BUY the August +$22 / +32 Call-Option spreads – while everyone else is playing musical chairs with big tech.

Our market internals are ugly. Per Garrett Baldwin: The advance/decline line looks like trash, and correlations are breaking down. The bond market continues to throw its weight around just enough to screw up everyone’s risk models. Add to that – earnings start next week and they’d better be stellar. The S&P 500 has been riding above its upper Bollinger Band for eight straight sessions. The last time we saw this kind of extended stretch was July 2024. A swift 10% correction was next – reminding everyone that: “It’s not a question of whether this ends – just who will be the bag-holders when it ends?”

Traders are leveraged to the max… as margin debt has reached levels never seen before. Everyone's trying to beat inflation, chase retirement dreams, and cure FOMO by borrowing money to buy stocks. This isn't optimism, but rather desperation wrapped in leverage. The pattern is always the same: explosive melt-ups fueled by debt, followed by violent unwinds when volatility spikes or liquidity tightens.

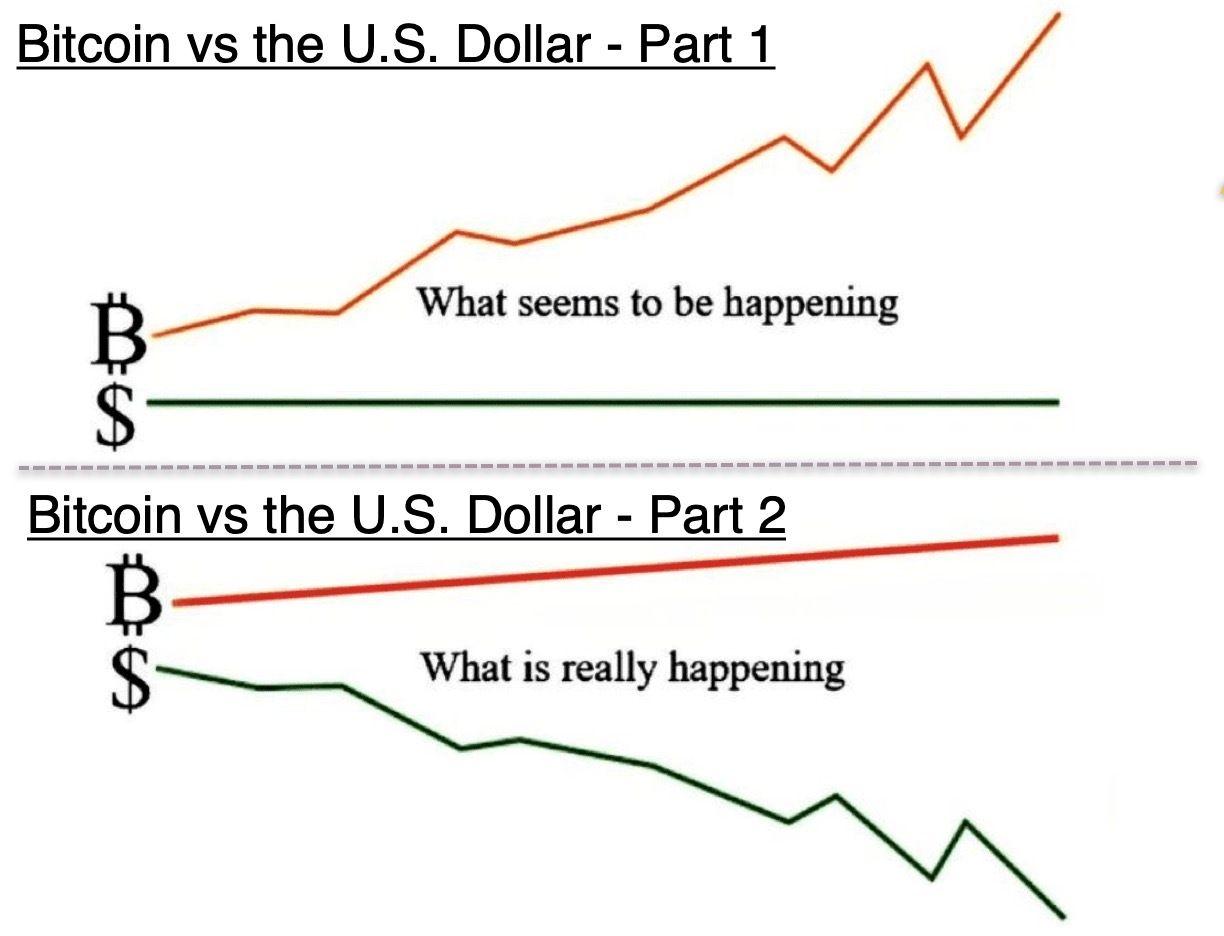

The U.S. Dollar’s moment of truth… as it has reached the bottom of a multi-decade ascending channel. This is a zone that historically has triggered sharp reversals.

Tip #2: EEM – BUY the August +$49 / -$47 Put Spread for $0.76

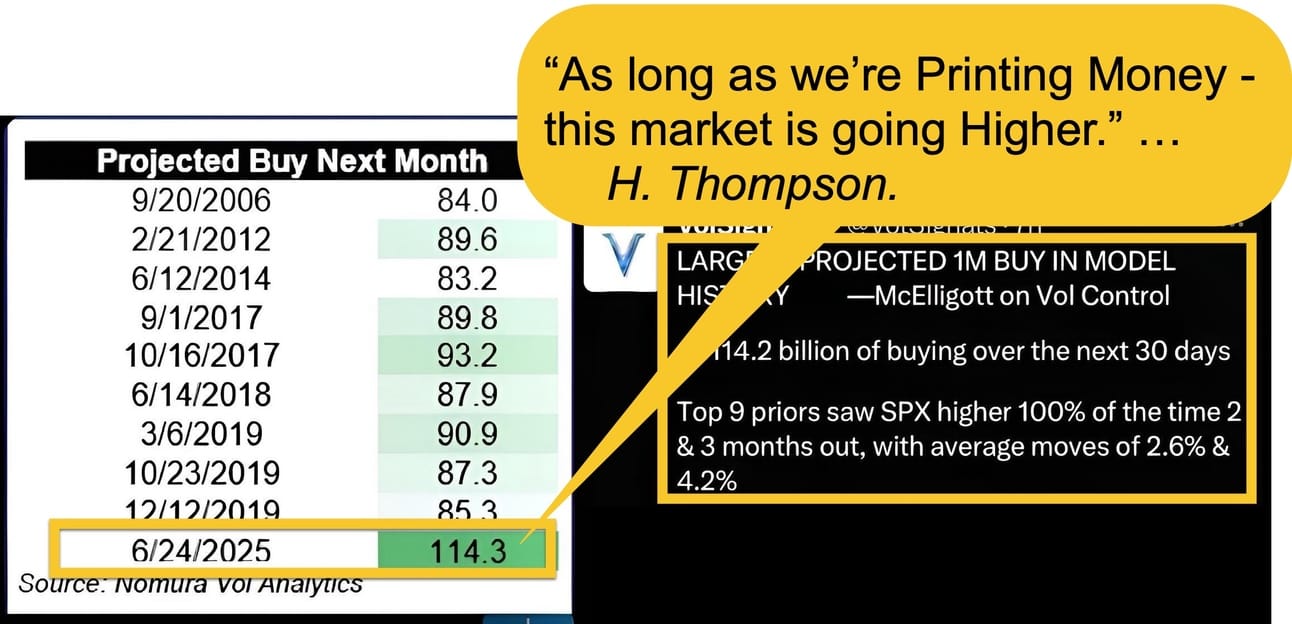

Bitcoin hit $118,000… but this isn’t a crypto story as much as it is a U.S. Dollar story. As confidence in fiat currency erodes and money supply hits record after record, assets like Bitcoin are reasserting themselves as liquidity barometers. This breakout amid falling VIX, rising debt, and soaring margin usage isn't about technology or speculation. It's a scream for help from the financial system itself. If this rally holds, it won't be about adoption or innovation, but rather about lack-of-trust.

We're living through:

o Technical extremes

o Record leverage masquerading as confidence

o Currency instability at critical inflection points, and

o Alternative assets screaming warnings about fiat decay.

The kicker is that next week’s SPX expected move is only $86. We moved $50 on Friday (in a single session), and the options market is pricing the entire week at $86. That's not just wrong – it’s dangerous.

TIPS...

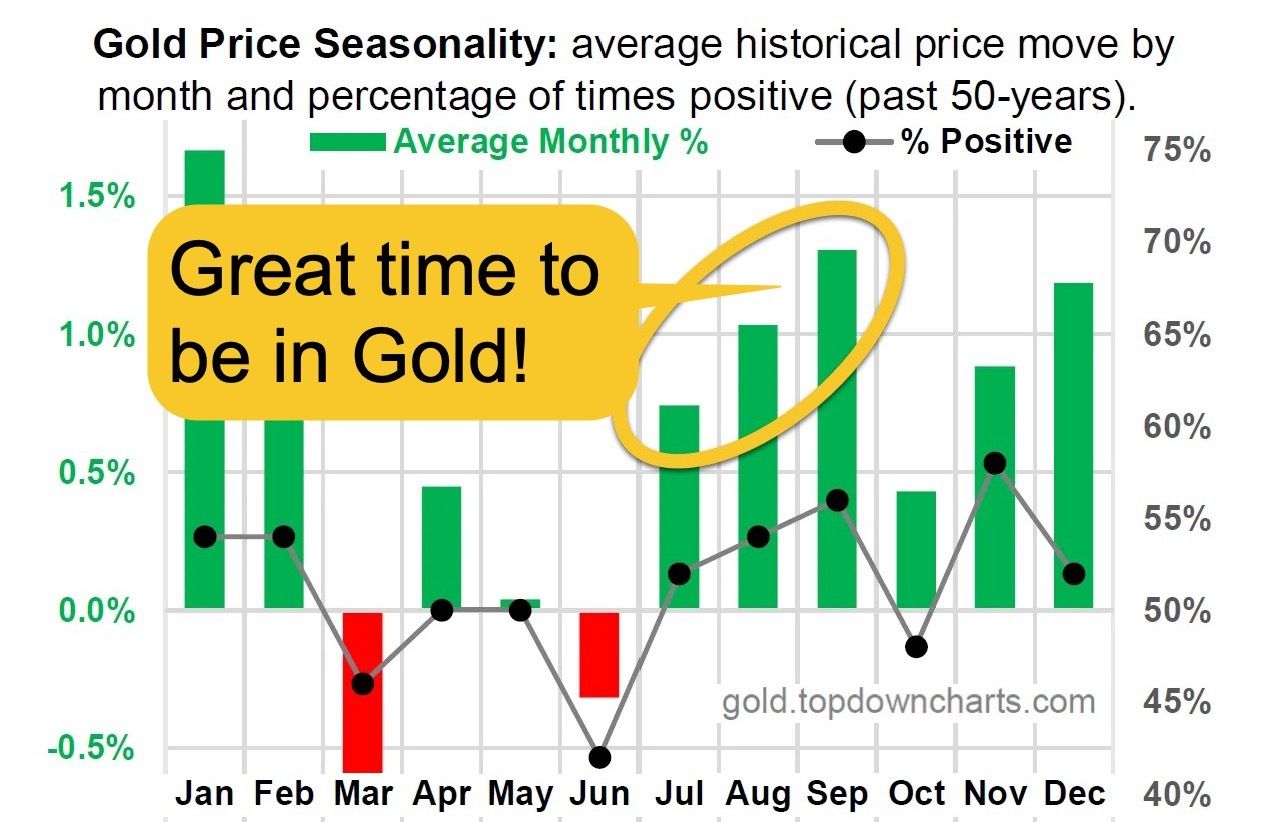

TIP #3: Buy more Bitcoin (IBIT) and Gold – then sit back and enjoy the show.

Factually: (a) We appear to be going through a “late-cycle reset”. (b) Institutional sentiment is healing, and risk appetite is resurging. (c) Retail investors are running very high equity allocations. (d) Our FED cutting rates may NOT be a good thing. (e) The IPO market is opening-up again. Overall per Callum Thomas: There is mounting evidence for the ‘Late-Cycle Reset’ hypothesis. Just like the late-90’s we’re seeing: (a) A frothy market with increasing pressures, (b) That was given ‘new life’ via a healthy correction (shaking out sentiment but doing little fundamental or enduring damage), and (c) Then will melt-up into a later and larger blow-off top.

HODL’s: (Hold-On for Dear Life)

- (+) IBIT – Blackrock’s Spot Bitcoin ETF ($67.2 / in at $24)

- (+) Physical Commodities = Gold @ $3,370/oz. & Silver @ $39/oz.

- Bitcoin (BTC = $118,800 / in at $4,310)

- Ethereum (ETH = 2,980 / in at $310)

- (+) GLD – Gold ETF ($309 / in at $212)

Options for Income: De-Risking a Portfolio… (using IBIT for example)

- BUY-n-HOLD the IBIT ETF

- BUY PUTs: 1 Std. Dev. Lower, Expiring = 3-weeks away, OTM (out-of-the-money) for protection.

- SELL Covered CALLs: 0.75 to 1 Std. Dev. Higher, Expiring = 2-weeks away, OTM for income and to finance the PUTs.

‘De-Gen’ Economy:

- SSRM: Silver Miner ... ($12.66 / in at $10.90) – sold the July $14 Calls

- SLV: Silver… ($35 / in at $31.2)

- PALL: Palladium … ($111 / in at $98)

- GDX: Gold Miner ETF … ($52.4 / in at $49.8)

- VIX: Volatility Index … ($16.4 / in at $16)

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson