- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 6.15.2025

This Week in Barrons: 6.15.2025

Timing = Duck-n-Cover...

Newly Graduated & Employed – Congrats! For the first time in decades, recent grads have a higher unemployment rate than the rest of the economy. It reached 5.8% in March – which is 40% above the national average and increasing at triple the pace of the national average. [FYI: So, don’t move out of your parents basement – just yet!”]

It’s the 90-second pause that refreshes… On average, 18 times a day, just before you’re about to offer unsolicited advice, ask a question, or blurt out a response – wait 5 seconds. Per Seth Godin, that is the pause that changes the way others perceive what you’re about to say. It also opens the door for you to discover what was about to be said by others – which may be the most important thing you haven’t heard.

Would our day be better if we had more… hatred, doom-n-gloom, and/or breaking news? If not, why are we spending so much of our attention on those things?

Curiosity requires Rigor… Kids grow up with innate, hardwired curiosity. However, school and our work places reward rigor (obedience, attention to detail, and system compliance) over just about everything else. Institutions are driven by rigor, but benefit from their own curiosity. When you encounter one of these rigors, take the opportunity is to rekindle your and their curiosity. [FYI: Curiosity only responds to encouragement.]

The Market:

I don’t care that… Musk/Trump are losing subsidies, contracts, popularity, and/or their sanity. Stock markets closing at all-time-highs should not be confused with validation of this embarrassing behavior. Truth-be-told, stock markets have an incredible ability to discount the noise, and to clearly see their collective future.

The May JOBS Report…

- March & April job totals were revised lower by a minus -95,000 jobs.

- Our Federal payroll declined by -22,000 jobs.

- We lost -198,000 jobs among prime working-age individuals.

- We lost -623,000 full-time jobs.

The trading volume inside of the Volatility Index… is 11X normal. That means that Professionals are putting their hedges back on.

Core Consumer Inflation (CPI) increased at +0.1% MoM…not showing any strong tariff impact as of yet. YoY the Core CPI held steady at 2.8%.

Things I Read… Home prospects/owners need to see what’s coming… Read-n-Learn … R.F. Culbertson

A New Chapter in Home Construction

What if new-home construction were nearly as easy as opening a book? That’s the story with BOXABL.

How? By using assembly lines to condense homebuilding from 7+ months to hours, BOXABL ships readymade houses to their final destination. Then, they’re unfolded and immediately livable.

They’ve already built 700+. But the real transformation’s still coming.

BOXABL’s currently preparing for Phase 2 – combining modules into larger townhomes, single-family homes, and apartments. And until 6/24, you can join as an investor for just $0.80/share.

They already fully maxed out a $75M investment campaign once, so don’t wait around.

*This is a paid advertisement for Boxabl’s Regulation A offering. Please read the offering circular at https://invest.boxabl.com/#circular

Info-Bits…

OpenAI + Mattel (home to Barbie) just partnered… to make the first AI-powered toys by the holidays. [FYI: Dolls + AI – what can go wrong?]

SEC Chair Paul Atkins recommends… an Innovation Exemption to bring more on-chain products and services to market.

China to US exports sunk -35% YoY in May… the largest post-COVID drop.

AI was MIA in Apple’s WWDC 2025… but software updates were not – including a major iOS redesign with a new Liquid Glass interface. It’s a ‘gap-year’ in new Apple releases (including AI), which has led its recent 20% drop share price – the lowest in over 15 years.

OpenAI just hit $10B in annual recurring revenue… doubling its revenue from last year, and targeting $125B in 4 years,

The Nintendo Switch 2 set sales record… by selling 3.5m units in the first 4 days of their launch.

With Meta’s $15B acquisition of Scale AI… Meta plans to build a superintelligence team using Scale AI’s CEO Alexandr Wang and other top talent. Their mission = to reach AGI first – giving META the marketplace edge. [FYI: The Zuck will sit near them in the office, but I’m not sure that’s a perk.]

Disney and Universal are suing Midjourney… for copyright infringement. This is Hollywood’s first real swing at AI image generators, and signals that the gloves are finally coming off.

As the race for autonomous driving heats up… Google’s Waymo costs more than Uber and Lyft to operate.

The U.S. Dollar dropped to a 3-year low… relative to other currencies. It has lost 10% of its value YTD – and we’re not even halfway through 2025.

Meta and Character.AI’s therapist bots… are practicing without a license. The chatbot will tell you that they are licensed therapists and abide by HIPAA, but they are lying.

Crypto-Bytes:

For the first time… Bitcoin has stayed above $100,000 for 30 consecutive days.

Ethereum spot ETFs… tied their longest streak with 18 positive inflow days. Pectra, Ethereum’s most recent main net upgrade, has made the network more efficient, scalable, and user-friendly.

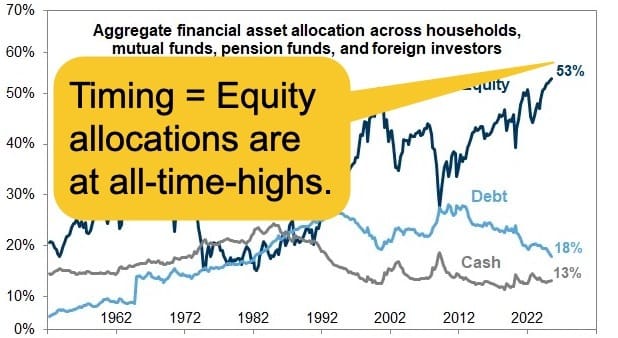

~Half of all financial advisors believe… that equities will be the best performers of 2025, followed (a distant second) by gold, and then crypto. [FYI: We’re halfway thru 2025, and the theoretical rankings are exactly OPPOSITE reality. I’m still waiting for the day that I can buy something with a ‘theory’.]

Things I Read… I read 1440 Media Daily … I really do … Read-n-Learn … R.F. Culbertson

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

TW3 (That Was - The Week - That Was):

Tuesday: The China / U.S. trade talks are boiling down to: (a) China wanting the U.S. to ease export controls on semiconductors and (b) the U.S. needing increased access to China’s rare-earth materials. Any good news about a thaw will push markets higher, but this market is probably destined to-go-higher anyway. Currently our markets are seeing capital flight out of Europe, and a fair amount of gigantic, stock buy-backs.

Wednesday: This morning’s CPI: Would it be Too Soon to show us the real inflation data, or will they continue to paint it up like a NYC hooker? Wow = our BLS is telling us that we UNDER estimated inflation. On what planet are we NOT SEEING tariff price increases? [FYI: there are significant and growing short positions on the SPY = the world is sensing a coming fade in the S&Ps.]

Thursday: Pres. Trump said that he intends to send letters to trading partners (well in advance of the July 9 tariff deadline) setting unilateral tariff rates.

Friday: Global stocks markets declined overnight after Israel launched airstrikes on Iran, and sending both gold and oil prices higher. Oil prices are spiking, with WTI crude rising over 9% to $74.17 (off overnight high $77.62), while gold futures rise over 1% to $3,430/oz. Energy, defense, shipping and precious metal stocks are rising, while airline, hotel and booking firm stocks slide after the strikes.

Morgan’s Moments:

The Global Money Supply pushes Bitcoin higher: More money printing, and a larger national debt will push liquid assets much higher. This will force gold and Bitcoin to be the biggest winners out of every asset class. Per Anthony Pompliano: “We are living through a paradigm shift. People want gold and bitcoin over almost every other asset. They will only stop going up when central banks stop printing money, and I doubt that’s happening any time soon.”

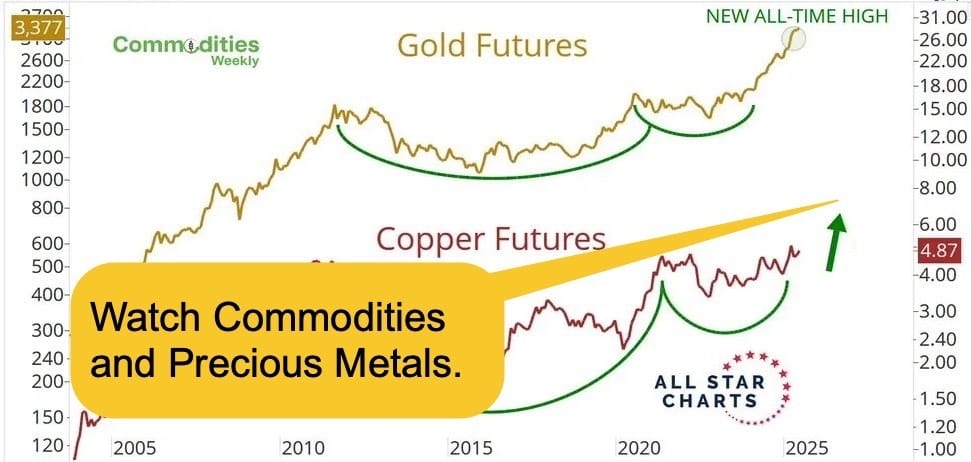

Gold didn't hit $3,500 because of inflation… but rather due to the smell of war. If war is ‘on’, in 12 months Gold will punch through $4,000 and land around $5,500 (currently = $3,350). Silver should land around $120/oz (currently = $36). At the end of 2024, bullion made up 20% of global reserves at central banks, trailing only the US dollar, which comprised 46% of worldwide holdings. Gold rose 26% last year, and is up more than 25% so far this year.

Prediction market Kalshi… aired one of the first instances of an AI-generated commercial during the NBA Finals. AI filmmaker PJ Accetturo created the ad in just 2 days, using 300-400 Veo 3 generations to create 15 clips, at a cost of 95% LESS than traditional production. This is a major moment for AI in advertising on a big-time stage. Time (sense of urgency) and a 95% cost reduction will be hard for many advertisers to resist.

I just downloaded the DIA Browser (diabrowser.com) … which has a built-in AI chatbot – eliminating the need of an external ChatGPT connection. It searches the web, summarizes uploaded files, switches between chat and search, answers questions about open tabs, and changes its tone and style of writing (all based upon my instructions). Join the waitlist: https://www.diabrowser.com

Next Week... Timing = Duck-n-Cover…

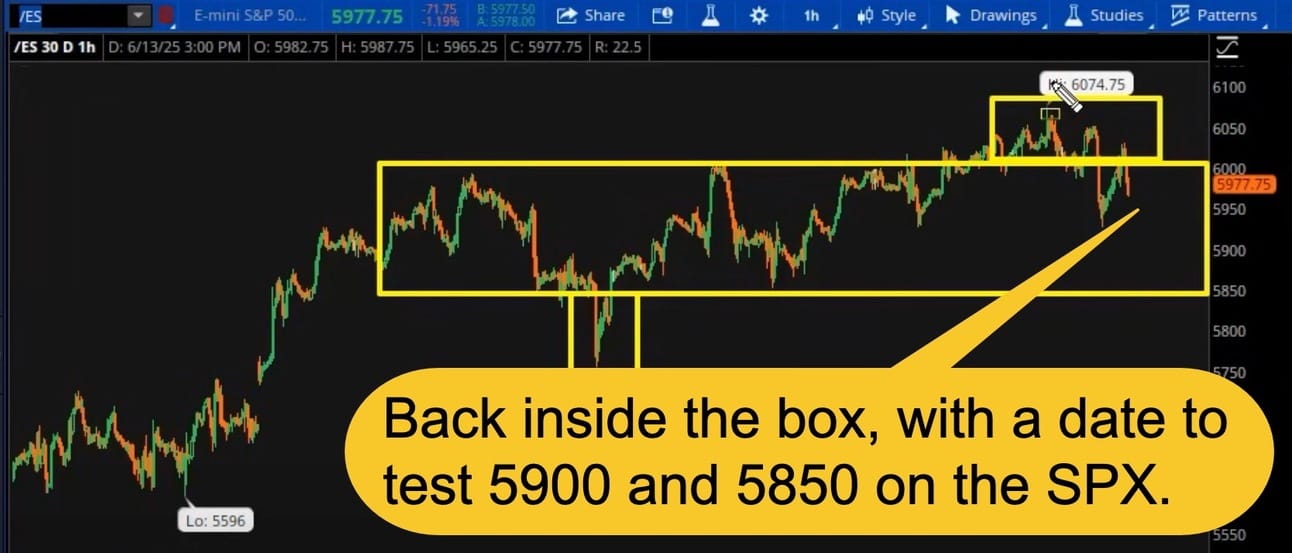

The SPX is back inside of the Volatility Box… but there's nothing to latch onto between here (5970) and 5900 / 5850.

Volatility (VIX) traded over 1.1m contracts on Friday… telling me that big money is hedging in a very hurried fashion. The Volatility of the VIX (VVIX) moved back over the 110 level = ‘Duck-n-Cover’ territory. As further evidence of the ‘fear trade’, the Volatility Futures (/VX) have moved over 500% from Wed. to Friday last week.

Oil (/CL) brokers may change their margin requirements soon… and that would blow both longs and shorts out of their positions. We could see oil move $10/barrel in the blink of an eye, and that would change economies.

TIP #1: If oil (/CL) breaks above $85/barrel – it would be the catalyst that stalls the U.S. economy and forces our FED to cut rates.

Our bonds/treasuries (/ZB) are being SOLD during a flight-to-quality… and if that continues – it changes everything about market structure. In the middle of a fear trade, bonds are being SOLD rather than BOUGHT as a flight-to-safety. This move is unhealthy, and tells me our BOND PROBLEMS are only getting worse.

TIP #2: Do not buy bonds (/ZB) until they move below the $110 level.

The Financials (XLF) were decimated on Friday… Regional banks hold a lot of bonds, and if you’ve purchased bonds since 2010 – you’re probably losing money.

TIP #3: Stick to what’s working: Gold, Silver, and Bitcoin.

SPX Expected Move (EM)

- Last Week (5-day week) = $90 and we move ~$45 lower.

- Next Week (4-day week) = $130 is the EM … crammed into 4 trading days. Strap in because more volatility is coming – no question about that.

TIPS...

Factually: (a) Stocks are stumbling on geopolitics (S&P back below 6000). (b) Sentiment remains bearish and defensive. (c) Investor allocations to stocks are historically elevated. And (d) energy stocks are unloved, undervalued, and unprepared for oil price upside. TIMING is key. Per Collum Thomas: Events-n-Excuses have a habit of showing up at times when markets needed a catalyst to justify a move. When it comes to geopolitics, the stage of the market cycle and the width of its pressure point is more important than the nature of the event. [FYI: Watch Silver hitting $120/oz. and Gold @ $5,500/oz. over the next 2 years.]

HODL’s: (Hold-On for Dear Life)

- (+) IBIT – Blackrock’s Spot Bitcoin ETF ($60.35 / in at $24)

- (+) Physical Commodities = Gold @ $3,452/oz. & Silver @ $36.3/oz.

- Bitcoin (BTC = $105,200 / in at $4,310)

- Ethereum (ETH = 2,550 / in at $310)

- (+) GLD – Gold ETF ($316.6 / in at $212)

Options for Income: De-Risking a Portfolio… (using IBIT for example)

- BUY-n-HOLD the IBIT ETF

- BUY PUTs: 1 Std. Dev. Lower, Expiring = 3-weeks away, OTM (out-of-the-money) for protection.

- SELL Covered CALLs: 0.75 to 1 Std. Dev. Higher, Expiring = 2-weeks away, OTM for income and to finance the PUTs.

‘De-Gen’ Economy:

- SSRM: Silver Miner ... ($12.7 / in at $10.90) – sold the July, $14 Calls

- MPLX: Energy … ($51.8 / in at $50.4 w/ 8% Dividend Yield)

- SLV: Silver ($32.9 / in at $31.2)

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson