- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 6.20.2025

This Week in Barrons: 6.20.2025

Volatility's a Comin'...

Investing, finance, and markets have never been further from fundamentals. Per Howard Lindzon: Today, the average person spends 6 minutes researching a stock. That 6 minutes will continue to decrease due to: (a) AI research moving toward cheaper-better-faster, and (b) we are in the: ‘Give people what they want era’ and what they want is: ‘More bets’. Look no further than Polymarket and Kalshi that have each raised $100’s of millions – allowing people to make prop bets on just about anything. And there’s no stopping AI, robots, and the degenerate economy from exploding the speculative / ‘edutainment’ culture. The religion of ‘HODL’ and ‘Just Do It’ will be hard to break as Bitcoin continues to trend higher. I don’t know how all of this safely unwinds. With increased media censorship, the truth will be tougher to uncover, and your abilities and experiences will continue to be the deciding factor.

Why is it that every personality trait is viewed as a ‘problem to be solved’? Every habit, eccentricity, feeling that’s too strong, and anything too human – must be labeled and explained. Therapy-speak is ruining how we talk about romance and relationships, narrowing how we think about pain ‘n suffering, and now we are limiting the vocabulary that describes who we are. Per Freya India: Therapists need to explain everything: psychologically, scientifically, and/or evolutionarily. They search for causes, categories, and what to correct. We’ve traded our mystery, romance, and most of ourselves – for theories, frameworks, motivations, and mechanisms. I liked the old way better.

What’s the Degree of Difficulty… It’s tempting to seek out the easy gigs, and the straight-forward projects. But that’s the majority’s focus - so your ability to add unique value declines. Per Seth Godin: Focus on the projects that take insight, guts, risk tolerance, and involve significant human connection and effort. Instead of asking: “What can I do to make my job easier?” Learn to ask: “How can I use this to do something really hard?”

The Market:

Last week’s markets seemed a bit ‘off’ to me. Sure, we’re only a few points away from new all-time-highs, but the VIX (volatility index) is nowhere near all-time-lows. The U.S. bond market continues to go meaningfully lower suggesting interest rates are still going higher. Also, everything does not seem well in Washington, D.C. The US Dollar is crashing, and our present government’s lack of understanding surrounding their tariff consequences is: NOT forgivable – BUT survivable. However, their forever lack of understanding surrounding their looming debt crisis is: NEITHER forgivable – NOR survivable.

Scott Bessent, the Treasury Secretary said: “The US will never default. We will raise the debt ceiling, and the Treasury will not use any gimmicks.” That said, the debt ceiling is not his to raise, and he’s already using the QE / liquidity gimmick. Some related facts:

o Trump filed for bankruptcy six times from 1990 to 2009 (Taj Mahal, 2 other Atlantic City casino properties, the Plaza Hotel, the Trump Hotel and Trump Entertainment).

o Trump’s deficit playbook is clear: He sticks his bondholders with billions of dollars of worthless paper and never repays a penny.

Advice: Make sure you’re seated near the exit door – because that door gets smaller as any credit crisis gets closer.

Google signed a $2.4B licensing agreement with WindSurf… blocking the agentic coding start-up’s sale to OpenAI for $3B. Google hired the WindSurf leadership and researchers, and will be granted a non-exclusive license to WindSurf's technology. OpenAI’s deal fell through because they didn’t want to give Microsoft immediate access to WindSurf's technology. Google’s agreement also represents a reverse-acquisition maneuver where Big tech companies hire a start-up's top talent and gain access to its technology without actually acquiring the entire company. This bolsters their position in the AI race, and doesn’t draw attention from industry regulators.

Things I Read… Superhuman AI is an easy way to keep-up with AI… Look-n-Learn … R.F. Culbertson

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

Info-Bits…

In China, a fleet of robots (each a meter tall with glowing LED faces)… can navigate subway stations, elevators, and train carriages autonomously. This flips the script on city logistics. In the race for robotic dominance - this is a serious flex.

40% of American fourth graders have less than basic reading skills… and only 26% of 12th graders are proficient in math.

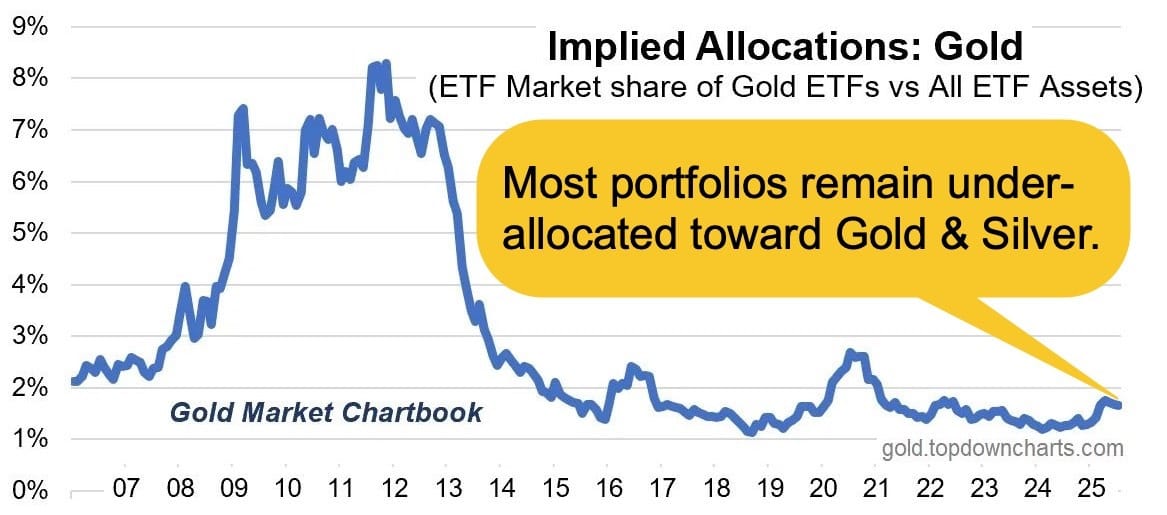

With gold stalling out, commodity rotation is in full-swing… into silver, platinum, and palladium.

Peter L Brandt says: “Silver is the mother of all Cup ‘n Handle patterns, but it’s had a lot of rug-pulls along the way. That’s why it’s known as the Widow Maker”.

Nvidia is restarting Chinese sales of its H20 Artificial Intelligence chip.

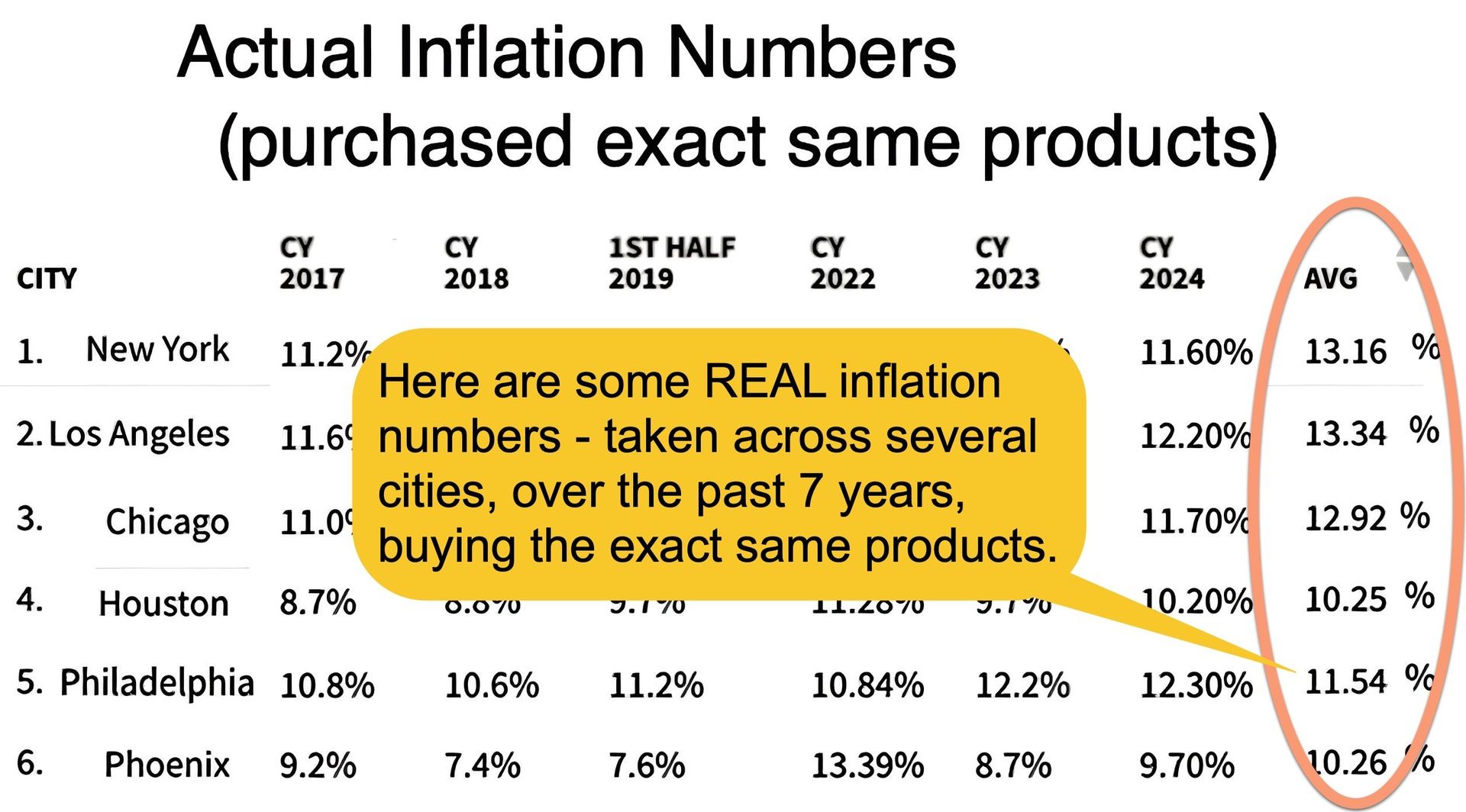

Inflation rose in June to a 2.7% annual rate. [FYI: Honestly? Really? Please refer to the above chart.]

Nvidia controls 8% of the entire S&P 500.

Thinking Machines Lab, founded by X-OpenAI CTO Mira Murati… just raised a $2B seed round at a $12B valuation despite having no public product and a pitch that hinges on open source tools for researchers and custom model builders.

Waymo, the Alphabet-owned robotaxi service… has hit the 100-million-mile autonomous driving milestone. A figure that is 10X what it was 2 months ago.

Anthropic is looking to raise money at a +$100B valuation… more than a 50% increase over its previous round – all while generating $4B/yr. in revenue.

Crypto-Bytes:

When measured in Bitcoin… the S&Ps are down -85% since 2020.

When Peter Brandt says: “It’s altcoin season!” … it probably is. Long story short: when one of the greatest living traders says something is happening – it’s probably a good idea to pay attention.

What caused bitcoin to break above $110k… (a) Bitcoin ETF inflows were near record levels, (b) Bitcoin options were expiring, and (c) Bitcoin short sellers had become too complacent and got liquidated on the way up.

The PUMP public token sale sold-out… within the first 12 minutes.

Federal prosecutors and the Commodity Futures Trading Commission… have dropped their investigation into the crypto betting site: Polymarket.

Crypto Week in Congress produced:

o The GENIUS Act (ready for Trump’s signature): Creates the first federal framework for stablecoins, and Requires a 1:1 dollar backing and monthly reserve disclosure. Stablecoins == the main buyer of our T-bills.

o The CLARITY Act (PASSED on to the Senate): Defines which digital assets are securities vs. commodities, and Curbs SEC oversight in favor of the more crypto-friendly Commodity Futures Trading Commission.

o The Anti-CBDC Surveillance State Act (PASSED on to the Senate): Prohibits our FED from issuing a retail digital currency, and Protects our financial privacy from government overreach.

Tip #1: Buy Bitcoin and ETH while you can – not when you’ll have to.

Things I Read… Again, if you’re trying to keep up with AI - use Superhuman AI - it’s fast and it works … Read-n-Learn… R.F Culbertson.

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

TW3 (That Was - The Week - That Was):

Monday: Before the market opened, Bitcoin soared to $120,000, Trump announced more tariffs, and the new Superman movie secured a $122m box office weekend. This week brings the release of June’s CPI data on Tuesday, and the last FED speakers before their July 30 blackout period. The last four months have shown a steady decline in inflation despite the threat of tariffs. Markets expect June’s headline CPI to rise by +2.6% YoY, while core CPI is expected be up +2.9% YoY.

Thursday: In FED news, voting member Waller believes that they should cut interest rates 25 bps at their July meeting. In trade news, the EU's trade chief has held intensive negotiations with US Commerce Secretary Lutnick in Washington. U.S. Treasury Secretary Scott Bessent told the Japanese Prime Minister that their countries can reach a "good agreement" on tariffs. In earnings news, Netflix reported good results / guidance, and Chevron will proceed with its $53B acquisition of Hess after it prevailed in the courts against larger rival Exxon.

Morgan Moment(s):

OpenAI just rolled out their ChatGPT Agent… that allows their AI Agent to control a virtual computer that is designed to tackle complex workflows and agentic tasks. Their Agents combine all of OpenAI’s strongest features with their traditional: cheaper-faster-better scorecard.

Elon Musk’s xAI also introduced AI companions… featuring animated 3D avatars powered by its Grok model that interact in real-time through voice conversations. Releasing Grok-avatars that are capable of having explicit conversations feels a bit risky given last week’s Grok / Hitler issues, but certainly aligns with Musk’s unfiltered vision.

BYD is rolling out its Level 4 (L4) autonomous parking system… with the caveat that they (the Chinese EV company) will take full legal and financial responsibility for anything that goes wrong. BYD’s L4 tech is ahead of the competition, while still offering over-the-air updates to all models, and uniquely taking full responsibility for any issues.

Per Anthony Pompliano: 2025 is the year that bitcoin and crypto grew up. Governments and banks are realizing that they need to play in the sector in a major way. There will always be more work to be done, but this is what mass adoption feels like. Financial organizations are creating bitcoin / crypto packages for their customer portfolios, and last week’s legislation created the environment for that to happen.

Next Week... Volatility’s a Comin’…

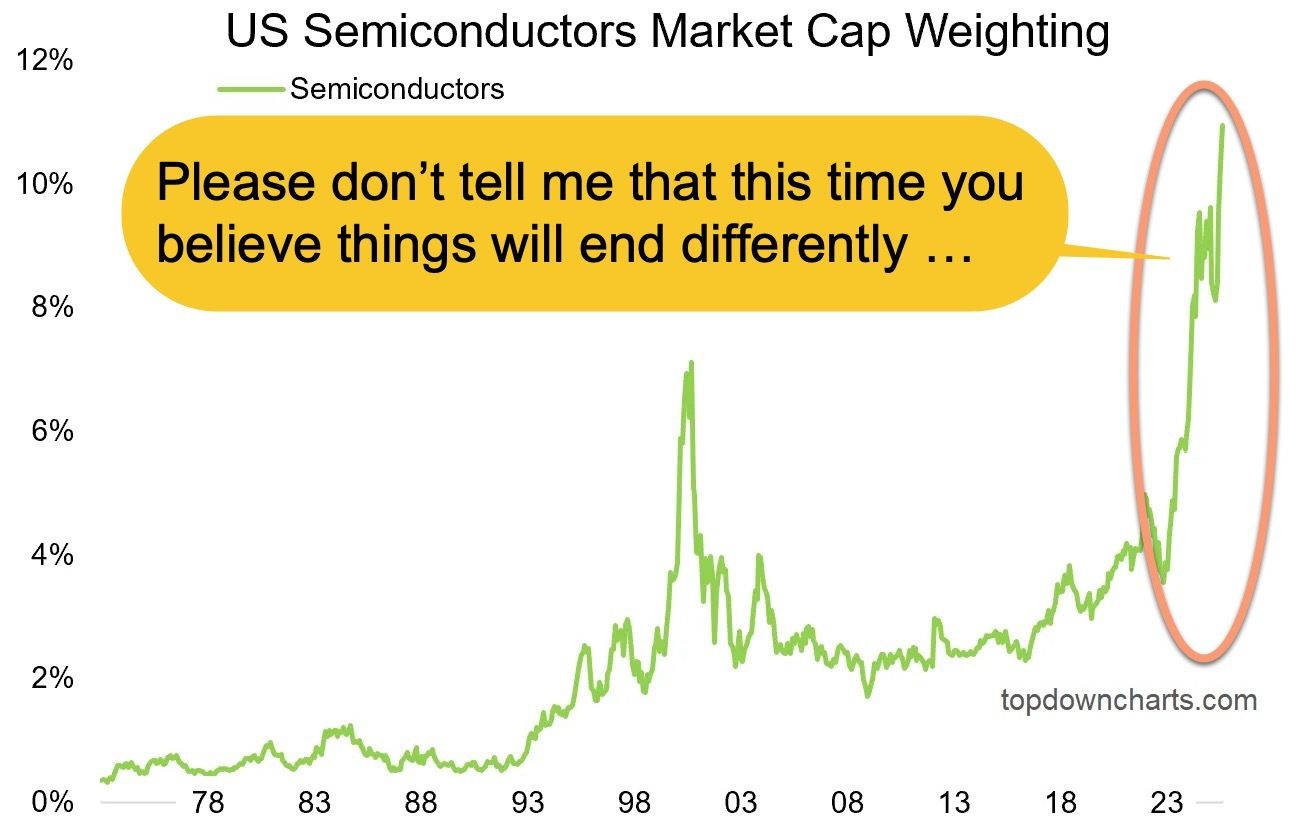

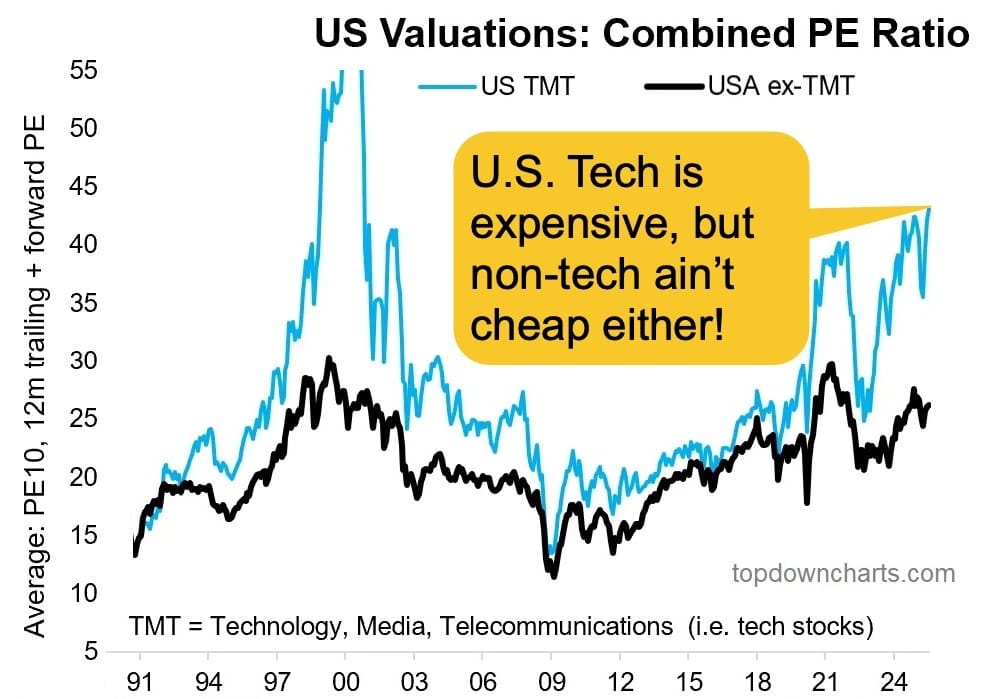

Bkgd: (a) Semiconductors (along with their market cap weight) made further ATHs. (b) History tells us that the semis are normal & healthy, but need to be monitored. (c) Market cap Put/Call ratios and stretched valuations = stocks that are late in the cycle. And (d) Market booms start with good reason, and end when things get unreasonable. Overall, it’s a good opportunity to take a minute and look at the markets – as they relate to the risk and cycles outlook. Learning from history means learning to identify risks, opportunities, and what may come next.

SPX vs RSP = Correlation breakdown: The SPX is the market cap weighted index associated with the S&Ps. The RSP is the non-market cap weighted S&P index. The SPX is weighted heavily by the Mag-7, and the RSP is weighted equally among all 500 stocks.

o Only 4 times in the past 3 years, have these indexes diverged this much.

o In every case, a downward correction in the Mag-7 and a sharp increase in volatility occurred.

Tip #2: BUY the September VIX Calls / Call Spread ($22 / $32). Increased volatility is coming, and right now options are cheap.

Bond risk is still on the table… It won’t take much to move our bonds (/ZB) from their current $111 area down below the Duck-n-Cover region of under $110.

Non-Mag-7 Earnings are under-performing:

o Cyclicals’ earnings are rolling over, and this is often a bearish sign. Watch this trade because it’s being crowded out by tech.

o Defensives’ earnings weight has reached the low end of the range – a signal often seen toward the peak of the market cycle. [FYI: Defensives plod along, get crowded out by tech, and then claw their way back by just plodding when everyone else suffers in recession or downturn.]

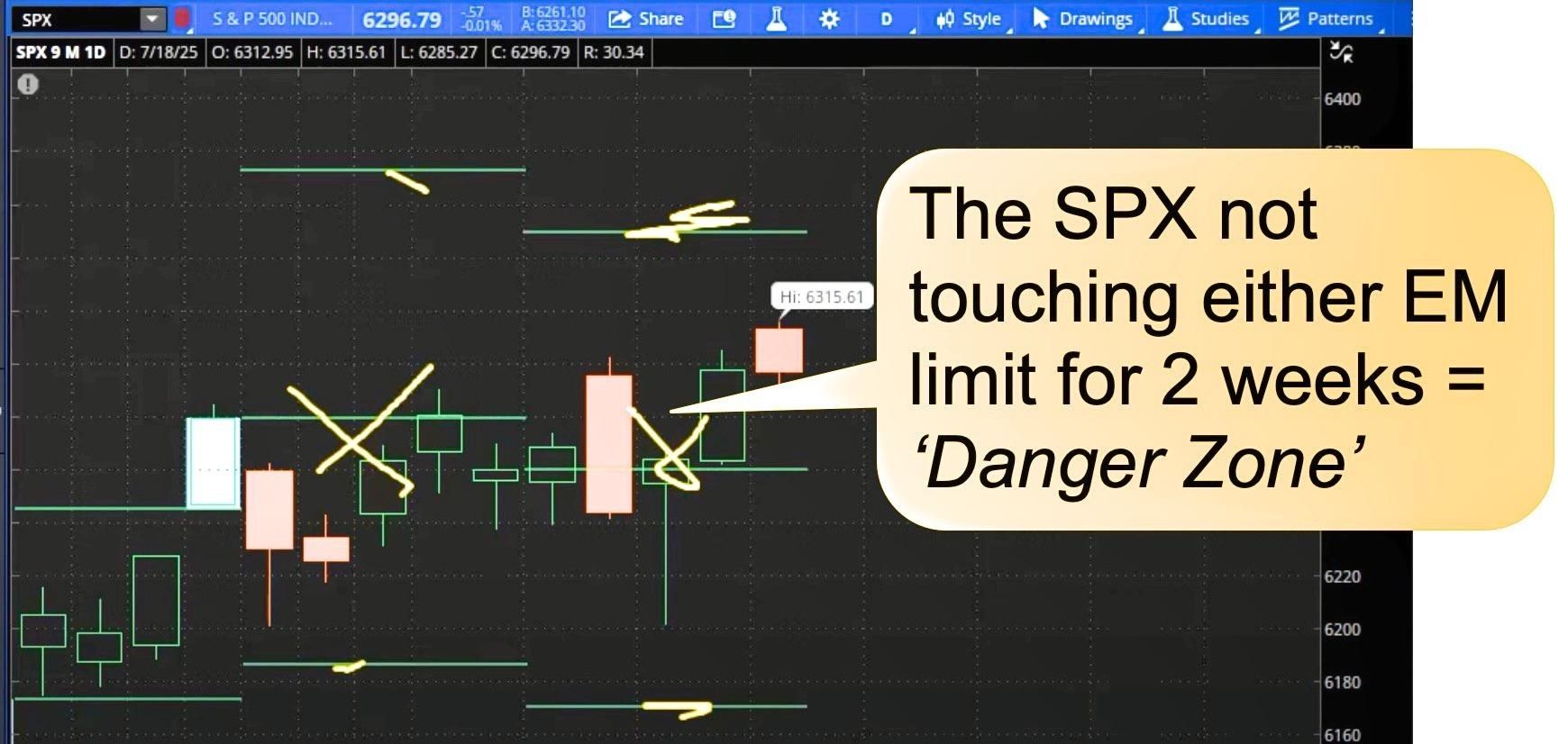

SPX Expected Move:

o Last Week = $90 … and we moved all of ~35 points.

o Next Week = $75 … and I’m looking for Bonds to slowly decay.

TIPS...

HODL’s: (Hold-On for Dear Life)

- (+) IBIT – Blackrock’s Spot Bitcoin ETF ($66.8 / in at $24)

- (+) ETHA – Ethereum ETF ($27.3 / in at $13.5)

- (+) Physical Commodities = Gold @ $3,350/oz. & Silver @ $38.5/oz.

- Bitcoin (BTC = $117,600 / in at $4,310)

- Ethereum (ETH = 3,500 / in at $310)

- (+) GLD – Gold ETF ($308.7 / in at $212)

Options for Income: De-Risking a Portfolio… (using IBIT as an example)

- BUY-n-HOLD the IBIT ETF

- BUY PUTs: 1 Std. Dev. Lower, Expiring in 3-weeks.

- SELL Covered CALLs: 0.75 to 1 Std. Dev. Higher, Expiring in 2-weeks.

‘De-Gen’ Economy:

- SLV: Silver… ($34.7 / in at $31.2)

- PALL: Palladium … ($114.7 / in at $98)

- GDX: Gold Miner ETF … ($51.4 / in at $49.8)

- VIX: Volatility Index … ($16.6 / in at $16)

- ASPI: ASP Isotopes … ($10.4 / in at $5.88)

- WIMI: WIMI Hologram Cloud … ($3.7 / in at $3.6)

- UDN Dollar Bearish Index 1X … BOT the $18 Sept Calls for 75 cents.

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson