- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 6.22.2025

This Week in Barrons: 6.22.2025

Panic-by-Paralysis

Remember to get Better… because we don’t get a chance to do yesterday – over again. The best reason to think about the past is because it gives us the opportunity to improve the future. After all, we don’t get a chance to do tomorrow over again – either.

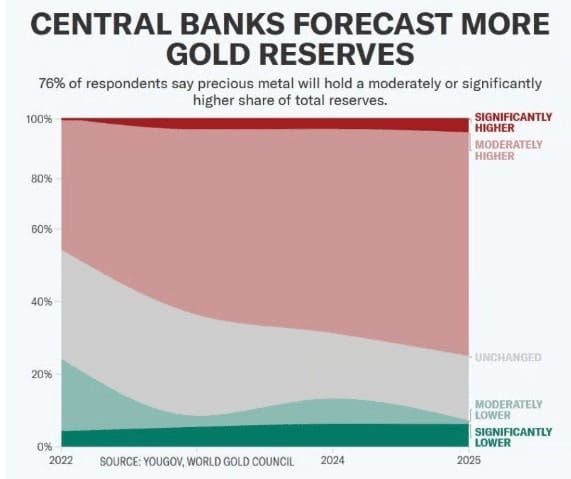

Buy the stuff you can’t Print… Gold is now +20% of global reserves. This isn't just a portfolio adjustment, but rather central banks admitting the quiet part out loud. What does it tell you when the people who PRINT the money start hoarding shiny rocks instead? It tells you that they know something about their own product that they're not sharing with the class. Even Central Bankers know to: ‘Buy the stuff you can’t Print’.

Dumb & Dumber – Deja Vu … A new study from MIT found that students using ChatGPT for essay writing showed significantly weaker brain activity and memory retention – compared to those writing unaided or using traditional search engines for research. Early dependence on AI can have a costly impact on developing minds.

“Kindness isn’t a weakness. It is a very potent strength…” said actor/comedian Steve Carell at Northwestern University’s commencement services.

The Market:

The S&Ps produced their first consecutive losing week since Liberation Day… after reports of new impediments on China’s ability to access semiconductor equipment, and Japan cancelling their tariff meeting after we asked them to spend more on defense.

There are 5,400 stocks to trade… and now over 4,100 ETFs. We have almost as many ways to trade stocks as we have actual stocks. This isn’t investing, it’s money looking to play short moves without engaging in the real economy. In a financialization world, everybody's a trader and nobody's an owner. Remember, when this unwinds - the door to get-out is smaller than the one to get-in.

The Debasement Paradox… The U.S. Dollar has dropped 8% year-to-date. That's not a correction, that's a vote of no confidence. Per Garrett Baldwin: When the U.S. begins to engage in QE, that will actually drive the dollar HIGHER. QE has a history of sucking global assets back into America as investors chase liquidity. But it’s like being the cleanest dirty shirt in the laundry – eventually you still stink.

The Metal nobody’s watching… While everyone’s obsessing over gold and Bitcoin, palladium’s quietly staging a breakout like it’s 2001 and catalytic converters are the new iPhone. Industrial metals don’t like, they just tell you what’s actually happening in the real economy while financial assets play make-believe. Palladium’s breakout is giving us a preview of information on supply chains, auto production, and global trade - that the S&P won’t admit for another 6 months.

TIP #1: Pay close attention to PALL – because a move back to the $120 range is my expectation.

Things I Read… I read the Daily Upside - every day! Read-n-Learn … R.F. Culbertson

Smarter Investing Starts with Smarter News

Cut through the hype and get the market insights that matter. The Daily Upside delivers clear, actionable financial analysis trusted by over 1 million investors—free, every morning. Whether you’re buying your first ETF or managing a diversified portfolio, this is the edge your inbox has been missing.

Info-Bits…

If a digital avatar and a real human were… talking, reacting, and selling the same products in real time – which would you buy from? Audiences are choosing to buy from the digital avatar 62% more often, and the avatar is 80% cheaper. [FYI: Is a real human interaction worth any commercial advantage in markets where efficiency is key?]

According to Bloomberg: “Central banks have been buying nearly four times more gold than what has been publicly disclosed. A new gold rush is unfolding in real time.”

Goldman Sachs analysts are finding: “China continues to secretly buy ~10x more gold than it reports.”

The days of: “No ads! No games! No gimmicks!” are over... That was the WhatsApp slogan for years. Meta (WhatsApp’s owner) announced they will start showing ads in the coming months, turning on another revenue spigot.

Social media overtakes TV… as Americans’ top news source for the first time.

The number of viewers +65 watching YouTube on TV… grew +50% YoY last month. In May, the audience for TV streaming surpassed the combined audiences for broadcast + cable for the first time… ever.

Tech-employee Retention Rate… After 2 years, Anthropic retains 80% of its tech-staff, Google retains 78%, and OpenAI’s retains 67%. Meta is spending $2m/yr/person to attract AI talent, but losing them to both OpenAI and Anthropic.

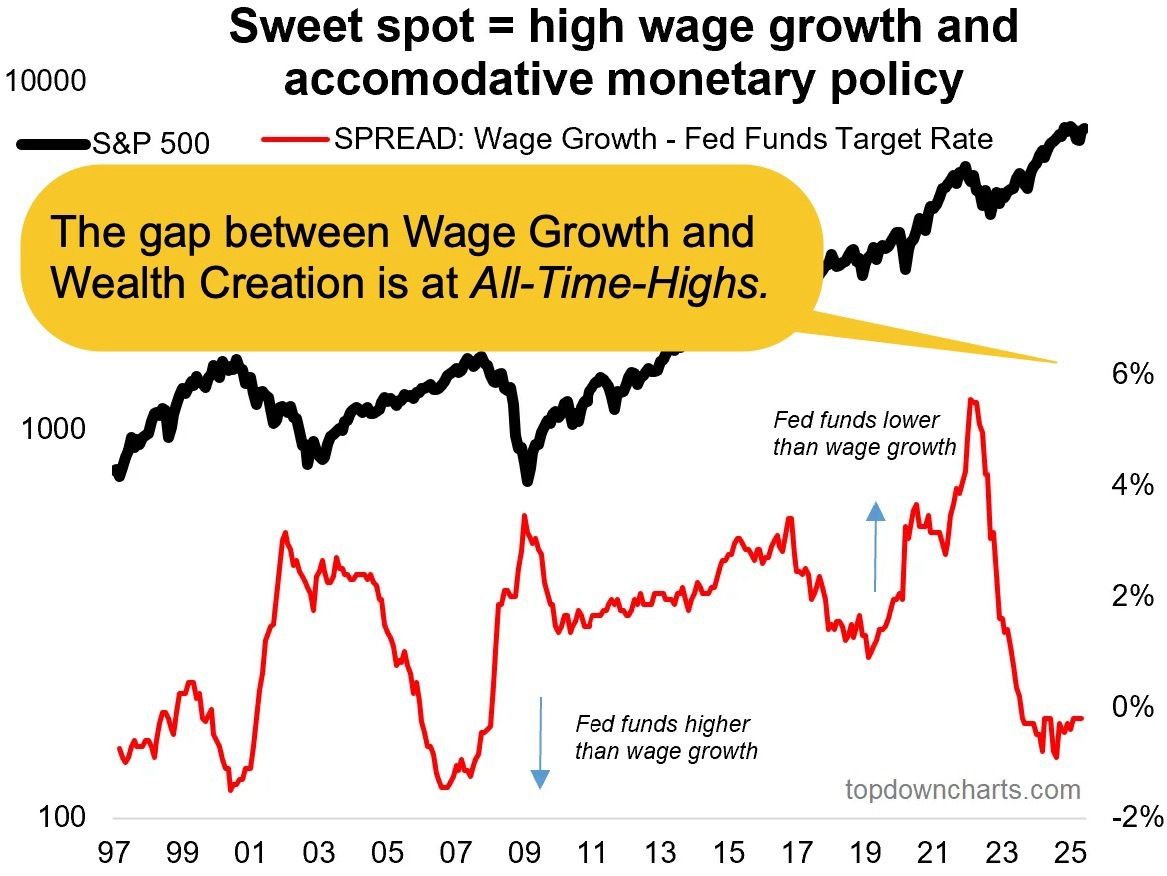

Powell’s reluctance to cut rates is classic final-year behavior… as Alan Greenspan and Janet Yellen both stopped raising rates in their final year.

Housing Starts were down -9.8% MoM… and the previous month was reduced by -2.7%.

Crypto-Bytes:

This is the furthest crypto legislation has ever gone in Congress. If the CLARITY Act and the GENIUS Act pass, they will finally set the foundation for a secure, open, and innovation-forward U.S. crypto economy.

Cardano’s founder is selling his Cardano altcoins… from the treasury, and buying more Bitcoin. He believes that his own altcoin will not be as good of a ‘store-of-value’ as bitcoin. [FYI: How many Micro-Strategies do we need?]

Trump Media and Technology Group filed with the SEC… to list a Truth Social Bitcoin and Ethereum ETF. 75% of the ETF’s capital will be allocated to Bitcoin, and the remaining 25% to Ether.

JPMorgan tossed a JPMD trademark into the U.S. Patent Office yesterday… and it covers every piece of JPM crypto plumbing: trading, custody, and payment processing. It appears that JPM intends to get serious about tokenizing assets – faster than Jamie Dimon can mutter: “I still don’t like Bitcoin.”

Crypto Buy Low and Sell High…. One on-chain analysis shows: (a) the most attractive coins are: ADA, LINK, and ETH, and (b) the Steady Eddie is Bitcoin. BTC is not expensive yet, but I would expect a sideways to slow-grind higher being more common than moonshots from this point toward EOY.

Currency Substitution == Stablecoins… In 10 years, there will be fewer sovereign currencies and many of the weaker nations will be dollarized. Stablecoins eliminate the power of borders in currency choice, and allow our natural network effects to take hold. Bitcoin will always win, but U.S. Dollars in stablecoin form could win as well.

TW3 (That Was - The Week - That Was):

Tuesday: Senate Republicans proposed a tax plan that would reduce taxes for households and businesses, cut Medicaid benefits, and add to the U.S. budget deficit. The bill would also end tax credits for wind and solar earlier than anticipated. Suddenly the White House has escalated things with Iran, saying if they don't totally surrender – we will obliterate them. So now everyone's worried that in a day or two, the US is going to step in – and then it's outright War.

Morgan’s Moments:

Remembering our Commodities:

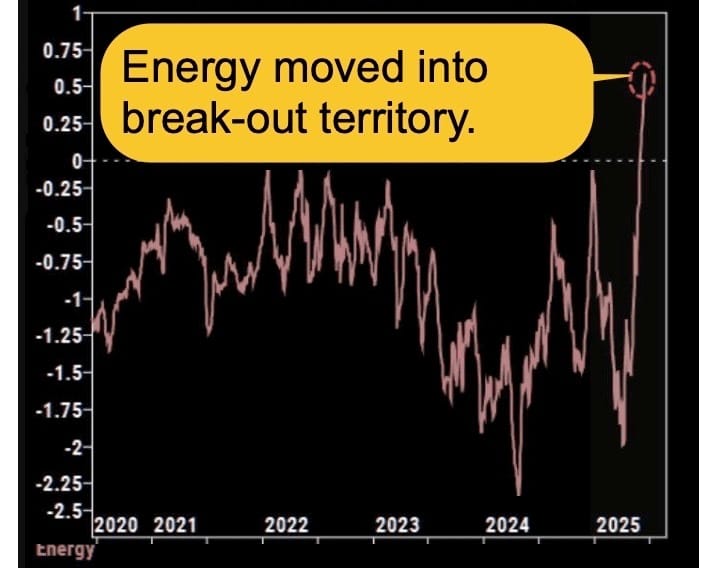

- Crude Oil/Energy: Buy crude oil (technicals, sentiment, positioning, supply/demand), and energy stocks (cheap valuations, light positioning, upside in energy prices).

- Oil vs Gold: Short-term I’m bullish on oil vs gold, and energy stocks vs gold miners on value, sentiment, positioning, and technicals.

- Gold: Gold continues to see strong tailwinds. Gold miners look promising, and likely serve well as a defensive position.

Powell expects tariffs to bring Stagflation… The FED is expecting higher inflation and slower economic growth == Stagflation. “We haven’t been through a situation like this, and I think we have to be humble about our ability to forecast it. This summer will bring more data on how tariffs are impacting the economy.”

Next Week... Panic-by-Paralysis…

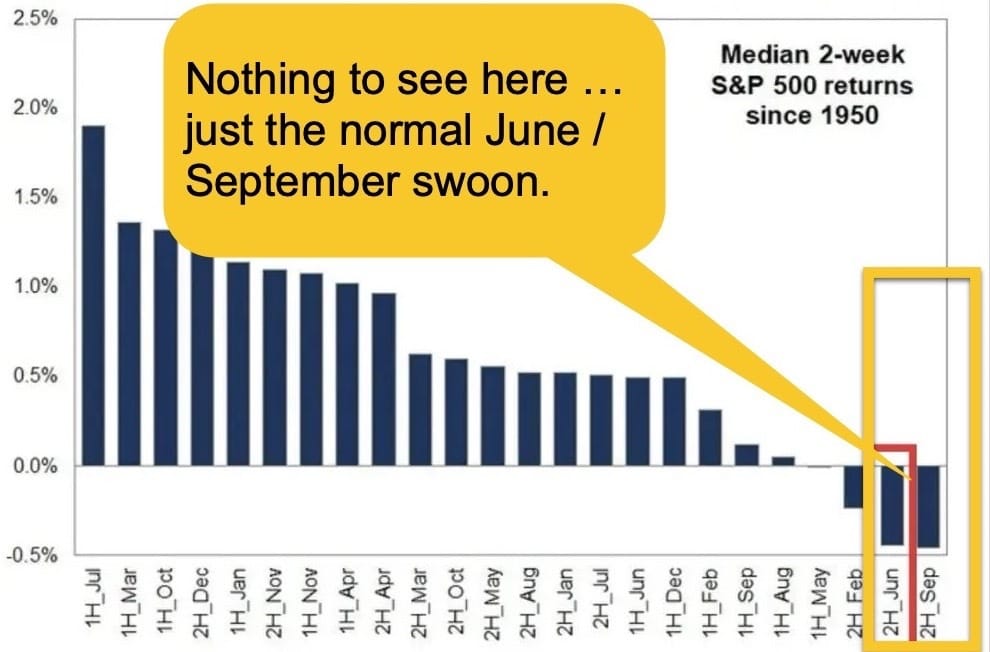

We've been trapped in this same trading range… for 7 weeks. We're currently compressed into a 100-point range. The longer you're in a box like this, the more risk accumulates. When we come out of this range, it will be a violent trade.

Keep your hedges on… as the VVIX remains near 110 = the Duck ‘n Cover level. Professional traders are gobbling up VIX options, because the smart money has seen this movie before.

The Mag-7’s are under pressure… as Amazon, Google, Meta, and Microsoft are all showing consistent selling pressure that could trigger a cascade. While everyone's obsessing over geopolitical noise, the Mag-7’s are getting hammered.

Geopolitical Risk + upcoming Tariffs + the Big, Beautiful Bill… are creating a perfect storm. The Panic-by-Paralysis that's gripped the marketplace may be coming to an end.

SPX Expected Move (EM)…

- Last Week: $129 EM … but we moved very little in a 4-day week.

- Next Week: $117 EM … but with the U.S. on a bombing mission – all bets are off.

TIPS...

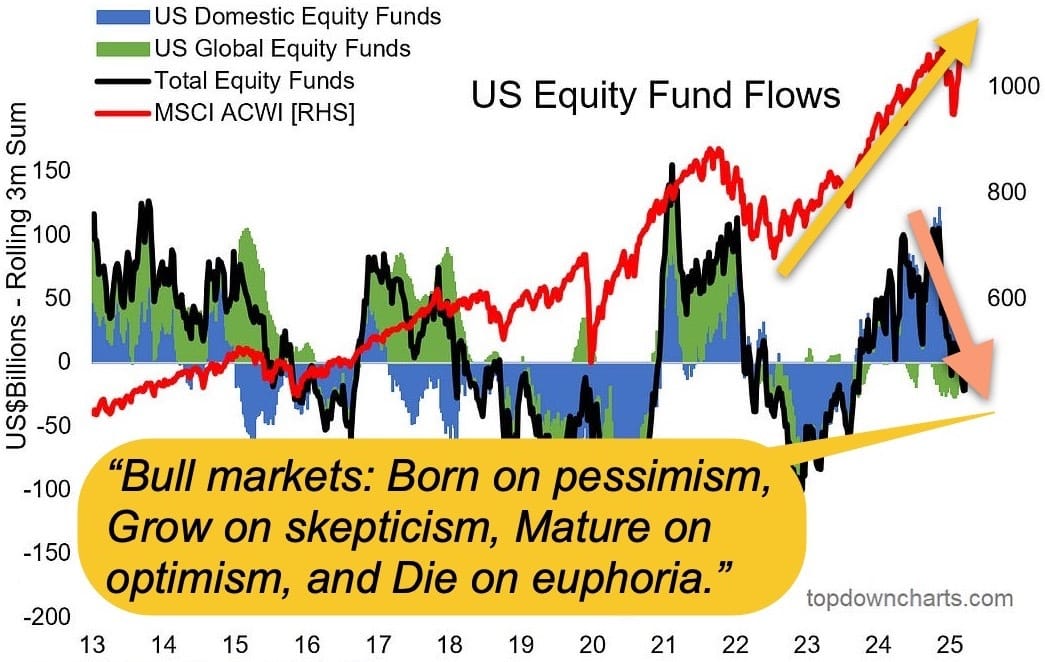

Factually: (a) The market is facing a “Wall of Worry” as noise levels are increasing. (b) Currency flows coupled with negative seasonality are showing a transitional phase in the market. (c) Again, it’s a perfect storm for increased Geopolitical Risk + Tariffs + the Big, Beautiful Bill to come back into focus. Per Callum Thomas: the major theme for the short-term is one of worry, pessimism, and we hit a sour-spot. The long-term optimist in me will say that walls of worry are made to be hurdled, but we cannot ignore the legitimate concerns.

HODL’s: (Hold-On for Dear Life)

- (+) IBIT – Blackrock’s Spot Bitcoin ETF ($58.67 / in at $24)

- (+) Physical Commodities = Gold @ $3,384/oz. & Silver @ $35.9/oz.

- Bitcoin (BTC = $102,826 / in at $4,310)

- Ethereum (ETH = 2,280 / in at $310)

- (+) GLD – Gold ETF ($309.8 / in at $212)

Options for Income: De-Risking a Portfolio… (using IBIT for example)

- BUY-n-HOLD the IBIT ETF

- BUY PUTs: 1 Std. Dev. Lower, Expiring = 3-weeks away, OTM (out-of-the-money) for protection.

- SELL Covered CALLs: 0.75 to 1 Std. Dev. Higher, Expiring = 2-weeks away, OTM for income and to finance the PUTs.

‘De-Gen’ Economy:

- SSRM: Silver Miner ... ($12.7 / in at $10.90) – sold the July, $14 Calls

- MPLX: Energy … ($51.3 / in at $50.4 w/ 8% Dividend Yield)

- SLV: Silver… ($32.7 / in at $31.2)

- KTOS: Defense… ($43.25 / in at $41 – sold the July, $45 Calls)

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson