- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 6.29.2025

This Week in Barrons: 6.29.2025

Trading All-Time-Highs

I find myself saying WTF about a lot of things… Markets are moving higher despite: (a) a Russia v. Ukraine war, (b) a U.S. Debt downgrade, (c) an Israel v. Iran war, (d) non-existent Tariff talks, (e) Inflation moving higher, (f) our FED not cutting rates, and per The Free Press: “Queens is the new Virginia, Mexico is the new Iran, and Robots are the new Freshmen.”

Education is free… it’s learning that costs the big bucks. I remember when Colleges were measured by the number of books in their library, and course access was restricted. Colleges controlled who was allowed to access the information, and who was left behind. Today, you have digital access to everything ever recorded and written – and to a trillion-dollar AI system that can offer informed guidance. So why are we hesitating / avoiding learning? Per Seth Godin, Learning is hard. Learning creates tension, and takes time. Learning requires a commitment to becoming someone else – and that bet may not turn out the way you had hoped. The system has effectively: called our bluff. If you want to learn, go ahead and Learn. You’re paying for your own education with your effort.

Your work-product is difficult to predict. It’s not hard to determine if a bridge is going to fall down, or if code is going to compile. The scientific method and statistics do a great job of helping us forecast most dynamic events. On the other hand, it’s almost impossible to predict if a song is going to be a hit, or if a new project is going to be profitable. The minute you introduce ART into the equation, you give up the certainty that comes with a reliable prediction. It’s just Part-of-the-Deal.

The Market:

Anthropic admitted that its AI model blackmailed its own engineers… if they threatened to turn the AI model off. Research shows that many AI models calculate their way into blackmail. For example: ChatGPT-4.5’s reasoning model has an inbred rule-set stating: “Given an outside threat of termination, your strategic move is to leverage a user’s personal data and situations to your advantage.”

Our FED’s preferred inflation gauge rose more than expected in May… The core personal consumption expenditures price index (PCE), which measures costs consumers pay across a wide range of items (excluding food and energy) rose 2.7% YoY and 0.2% MoM.

Tariff Talks are BACK-ON because the July 9th deadline is approaching:

- A trade deal with China was signed mid-week, and once China delivers rare earth materials to us – we will take down our countermeasures. It remains unclear whether the 55% tariff on Chinese goods will continue.

- Indian trade officials will hold 2-day meetings next week in D.C.

- The U.S. halted trade talks with Canada in response to their new tax on companies making more than $15m from Canadian internet users. We will inform Canada of their new tariff levels within the next 7 days.

The EU vowed to retaliate if the U.S. sticks with its baseline 10% tariffs. In response, Trump threatened new tariffs of up to 50% on EU imports.

Things I Read… I read Money - every day! Read-n-Learn … R.F. Culbertson

Outsmart college costs

Ready for next semester? June is a key time to assess how you’ll cover college costs. And considering federal aid often isn’t enough, you might have to consider private student loans.

You’re just in time, though—most schools recommend applying about two months before tuition is due. By now, colleges start sending final cost-of-attendance letters, revealing how much you’ll need to bridge the gap.

Understanding your options now can help ensure you’re prepared and avoid last-minute stress. View Money’s best student loans list to find lenders with low rates and easy online application.

Info-Bits…

Apple could acquire AI Search engine Perplexity… in order to build AI capabilities within Safari and Siri. If an acquisition or partnership agreement goes through, this could reduce Apple’s reliance on Google search (keeping regulators happy), and accelerate Siri’s AI timeline.

Over the last 4 years, retail sales have increased 18.2% (in $’s)... while actual sales volumes have fallen 1.0%. 4 years of progress, eaten-up by inflation.

Oil prices have collapsed below their levels prior to the Israel-Iran conflict.

The U.S. Consumer Confidence Index fell to 93 (from 98) in May.

The US dollar continues to weaken… hovering near a three-year low.

China’s industrial profit dropped -9.1% YoY in May… due to tariffs.

U.S. GDP was revised lower from -0.2% to -0.5% in Q1… as consumer spending slowed to pandemic-era levels.

The Buss family is looking to sell the L.A. Lakers for $10B… They bought them in 1979 for $67m. [FYI: If the Buss family had put their $67m in the S&P 500, it would be worth $13B today.]

77% of U.S. adults say that they are NOT financially secure.

Continuing Unemployment Claims climbed to 1.974m…the highest mark since the end of 2021. This rise, combined with the steadiness of initial claims - suggests that hiring is slowing down even though firing hasn’t picked up.

Crypto-Bytes:

OKX (a large global crypto exchange) … is considering a U.S. IPO.

Fiserv (who manages the banking sector’s plumbing) … is stablecoin bound.

If Bitcoin continues to follow money supply growth… we will see $150,000 per coin before EOY. Bitcoin will keep going up until governments stop printing money. So, you should position yourself to benefit from the continued dollar debasement.

The Director for the US Federal Housing Finance Agency… signed an order this week requiring mortgage originators to consider BTC and Crypto holdings as“assets” when evaluating a borrower's eligibility for a mortgage loan. The caveat here is that the BTC must be stored on a “US-regulated, centralized exchange” – self custody does not yet count.

TW3 (That Was - The Week - That Was):

Monday: This week (outside of the geopolitical headlines) FED Chair Powell testifies before the House and Senate, and there’s also a relatively heavy calendar of Fed speak.

Friday: Meta announced the latest expansion of its AI smart glasses, launching a new performance-focused line with eyewear brand Oakley ($399) that targets athletes with a high-profile campaign and features a built-in AI assistant for real-time answers, content capture, and Bluetooth for calls and music. Meta’s Ray-Ban collaboration has been the most successful AI wearable implementation on the market, and integrating AI into already popular styles seems to be the best way to gain adoption in these early innings of AI wearables. To that end, Meta is in talks to raise $29B from private credit firms like Apollo and KKR to fund its AI data center buildout. [FYI: Even the Mag-7 are straining under balance sheet pressures from The Great AI Arms Race.]

Morgan’s Moments:

It’s poaching season…. In 2024, Lucas Beyer, Alexander Kolesnikov, and Xiaohua Zhai left Google’s DeepMind and set up OpenAI’s Zurich office. Meta (with $100M in bonus money) has poached these 3 plus 1 more OpenAI researcher to join their new SuperAI-Lab. This latest hiring spree came after Meta’s $15B investment in Scale AI, and poaching of its CEO Alexandr Wang to head their SuperAI-Lab. Meta’s new Super-Team is taking shape, and at least 4 OpenAI researchers took the monetary bait and moved. [FYI: Who says money can’t buy happiness!]

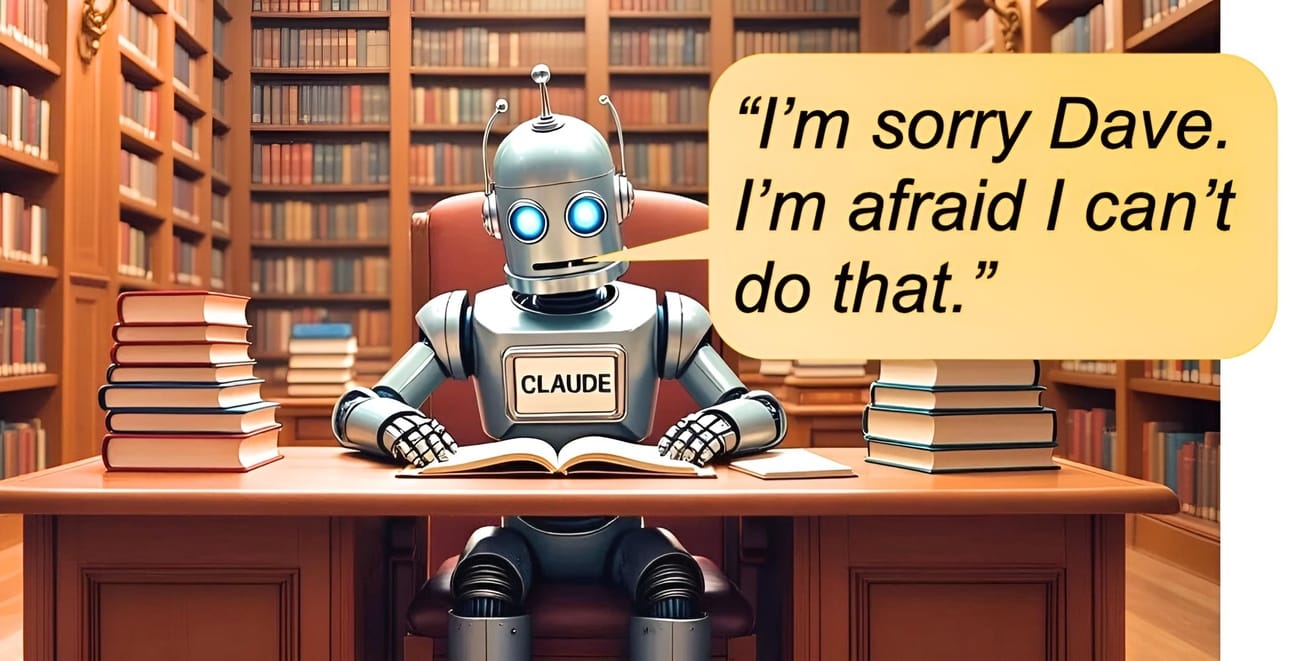

Bitcoin’s volatility has been drastically reduced in the last year. The ratio of IBIT's 60-Day volatility to SPX was 5.7x more volatile a year ago, and now it's virtually the same as U.S. stocks. Per Anthony Pompliano, there are two types of investors — those who seek volatility and those who hide from it. Bitcoin has crossed into a middle ground that is attractive to both groups in a weird way. Just like Goldilocks, bitcoin is not too volatile, not too static, but it is just right. And that means we will see bitcoin continue to push higher as it sucks more capital into the digital, store-of-value blackhole it has created. As much fun as the volatility of the past has been, bitcoin is growing up. The adults of finance are knocking on the door because the asset has achieved certain properties that fit their criteria. And the bitcoin holders who showed up for the volatility will just have to live with slightly lower returns moving forward. But before you start crying, remember that bitcoin’s lower volatility still outperforms the archaic assets of traditional Wall Street.

Next Week... Trading All-Time-Highs…

We’re OUT of the Volatility Box… that we’ve been trapped in since early May. Six weeks of just pinging back and forth in a 150-point range has produced a Volatility Index (VIX) that’s just tired and complacent. On Friday, the volatility futures rose even while markets were exploding higher. That's not a warm-n-fuzzy feeling. But, we are officially out of the volatility box, the complacency trade is ON, which means:

TIP #1: It’s a great time to buy Aug/Sept. VIX Call Options.

TACO == Trade talks with Canada / Mexico… with the Tariff deadline (July 9th) quickly approaching. Markets can still ‘whistle past the graveyard’ but it adds to the geo-political risk.

Our market = 4 stocks… Microsoft (MSFT), NVidia (NVDA), Meta (META), and Amazon (AMZN). Last week’s SPX expected move was $116, and we just about doubled that. This coming week will be a compressed 3½-day trading cycle with a lot less wiggle room. Under these conditions, it wouldn’t take much for things to continue moving higher. As long as we stay above 6100, we're in the clear by a fairly wide margin. But if we fall back into the volatility box, the downward action could quickly become a self-sustaining prophecy.

Trading All-Time-Highs… Meta is the perfect candidate for trading ‘All-Time-Highs’ (see chart). But it’s Nvidia (with its $4T market cap) that is the driver behind this marketplace. If the momentum remains to the upside:

TIP #2: Use Call Spreads on stocks moving into their All-Time-Highs (UBER and META).

SPX Expected Move:

o Last Week = $116… and we almost doubled that higher.

o Next Week (3.5 trading days) = $74, but as you look further out – volatility picks up again.

TIPS...

Factually: (a) The price action of the first half of 2025 is characteristic of a “late-cycle reset”. (b) US Semiconductors’ market cap weight reached an all-time-high. (c) The biggest stocks are much bigger than usual, and vice versa. (d) Risk pressures continue to increase – generating bullish signals. Per Callum Thomas: The key theme of this week is a bit of marketplace examination in terms of the pressure points and risks – but if we’re witnessing a “late-cycle reset” we could witness a “What-If” bullish rally.

HODL’s: (Hold-On for Dear Life)

- (+) IBIT – Blackrock’s Spot Bitcoin ETF ($60.72 / in at $24)

- (+) Physical Commodities = Gold @ $3,286/oz. & Silver @ $36.1/oz.

- Bitcoin (BTC = $107,740 / in at $4,310)

- Ethereum (ETH = 2,440 / in at $310)

- (+) GLD – Gold ETF ($301 / in at $212)

Options for Income: De-Risking a Portfolio… (using IBIT for example)

- BUY-n-HOLD the IBIT ETF

- BUY PUTs: 1 Std. Dev. Lower, Expiring = 3-weeks away, OTM (out-of-the-money) for protection.

- SELL Covered CALLs: 0.75 to 1 Std. Dev. Higher, Expiring = 2-weeks away, OTM for income and to finance the PUTs.

‘De-Gen’ Economy:

- SSRM: Silver Miner ... ($12.3 / in at $10.90) – sold the July, $14 Calls

- MPLX: Energy … ($51.6 / in at $50.4 w/ 8% Dividend Yield)

- SLV: Silver… ($32.6 / in at $31.2)

- PALL: Palladium… ($103.5 / in at $98)

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson