- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 7.27.2025

This Week in Barrons: 7.27.2025

People BOT Crap...

Cheap at one-tenth the price… Unitree (a Chinese robotics company) has unveiled its R1 humanoid robot for just $5,900, dramatically undercutting Tesla's Optimus ($20K) and Figure's 02 ($50K) in the race to bring multipurpose humanoids to the masses.

Whenever you find yourself lunging… for a new hire, a prospect and/or a customer == DON’T. Lunging creates conditions that neither side can maintain. Skip the lunge and begin again – by re-evaluating the situation on different terms.

Building a farm system… Today, jobs are scarce. Securing an interview is difficult. Many tech companies are announcing more layoffs and staff reductions. This situation will not correct itself, and can’t be ‘blamed on AI’. Our employment process is broken. When it comes to personnel evaluation, we place all of the person’s value on today, and nothing on tomorrow. That incentivizes universities to maintain their current course curriculums, and has our markets rewarding companies for reducing headcount. The hiring process has become a free-agent bidding war, without the benefits associated with building a farm system to cultivate talent. Introductory hires are viewed as interchangeable parts, and priced accordingly. The corporate challenge is: building a farm system that properly evaluates, integrates, and monetizes all of our smart people.

Settling for Better… What if: you’re really good at your job. You’re focused on every interaction and staying in control. Per Seth Godin, your entire work-community would like to contribute and help you succeed. If scale is your goal, then your control over each interaction must loosen. Leadership creates the conditions for others to raise the standards. Trusting your team isn’t settling for less – it’s Settling for Better.

The Market:

The above chart (per Jim Bianco) compares… retail’s favorite stocks and the top equity holdings of hedge funds. Whenever the ratio is increasing, the retail index is beating the hedge fund gurus. The retail trader has run circles around Wall Street for the last few months. Essentially, retail bought the dip and believed the market would come flying back – while Wall Street stayed on the sidelines and continued playing defense.

ChatGPT announced a Shopify partnership… and the hiring of the former CEO of Instacart. Therefore, it’s no surprise that OpenAI is building a shopping checkout system where users will complete purchases and transactions directly within ChatGPT. This is a shift in OpenAI’s revenue strategy. Currently, OpenAI’s main source of revenue comes from its premium subscriptions, leaving the “free version” as an untapped source of revenue. This move will position ChatGPT as an all-in-one transactional platform (versus just a research area) that will compete head-to-head with GOOGL, AMZN, and WMT.

“Price is the closest thing to the truth… in a market flooded with Internet news and old farts” … Howard Lindzon.

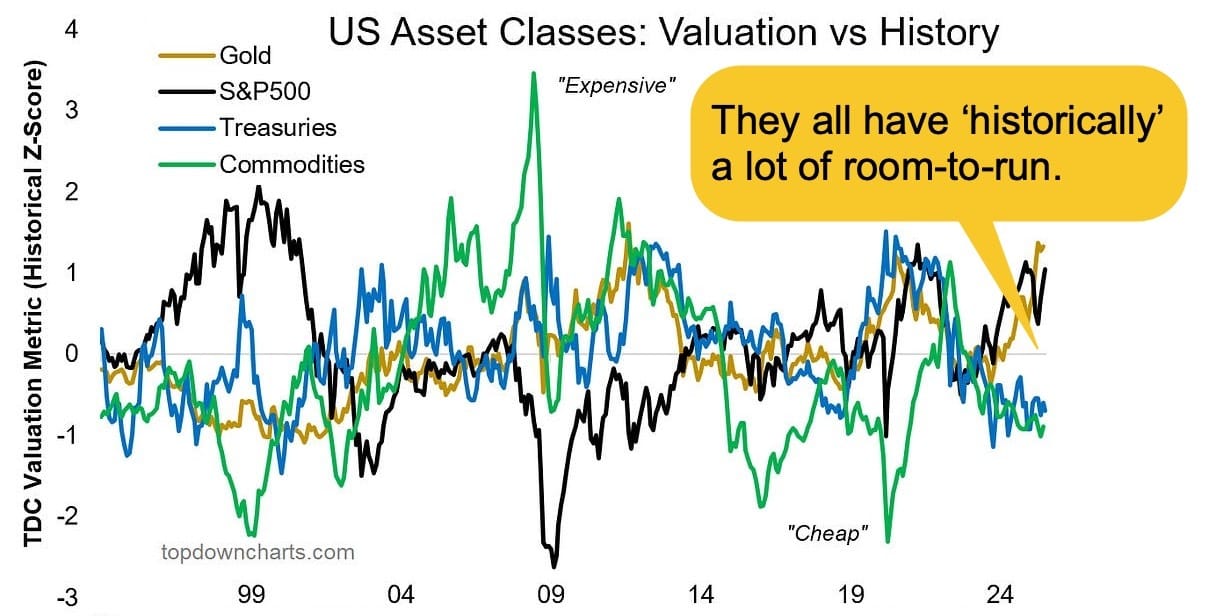

The New Normal is…the U.S. Dollar losing 30% of its purchasing power over the past 5 years, and Gold and Bitcoin outperforming the S&P 500 over the past decade. Essentially our government is guaranteeing that asset owners/holders will always win. But that won’t stop Central Banks from printing more money and destroying their own currency even faster.

Tip #1: The New Normal is where: “Bitcoin, ETH, and Gold only stop going higher – when they stop printing money.”

Things I Use… Attio is simply a ‘Smarter CRM’… Look-n-Learn … R.F. Culbertson

Finally, a powerful CRM—made simple.

Attio is the AI-native CRM built to scale your company from seed stage to category leader. Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Join fast growing teams like Flatfile, Replicate, Modal, and more.

Info-Bits…

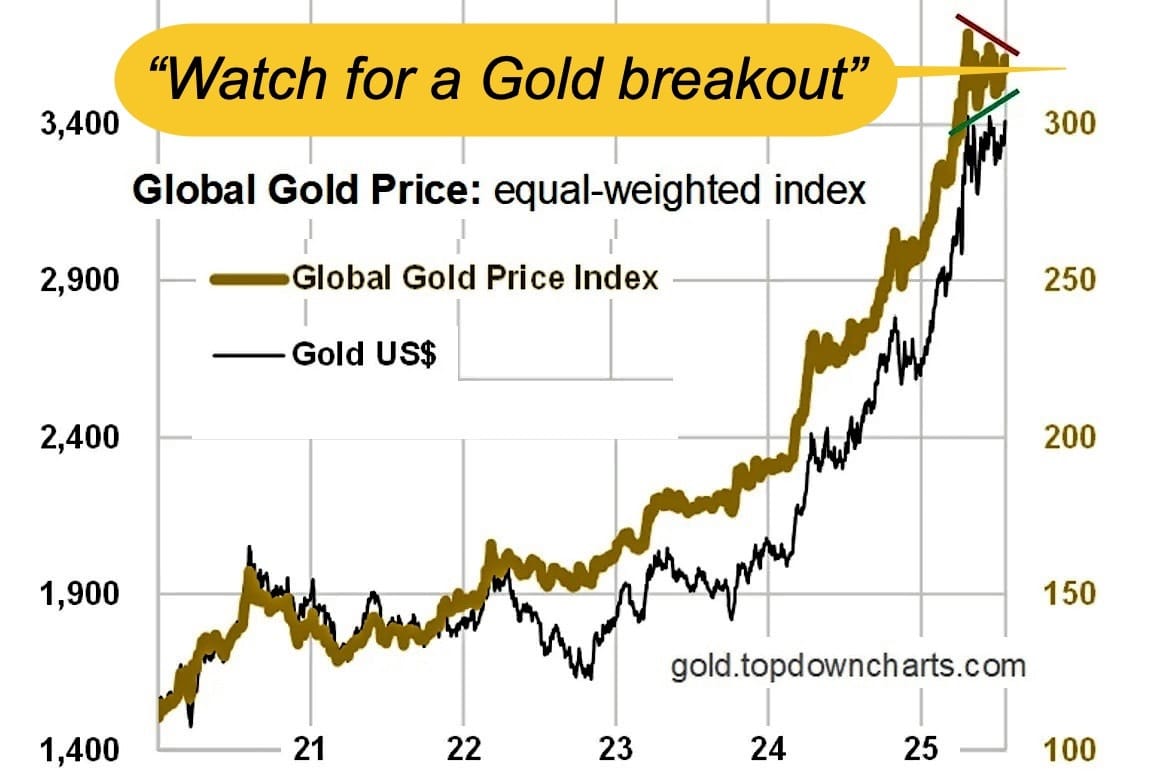

The Global Gold Price Index… is coiling into a short-term symmetrical triangle – that could easily resolve to the upside. Meanwhile the US$ gold price is forming an ascending triangle == a bullish continuation pattern.

The largest trade deal in history with Japan was announced… and included a $550B investment by Japan into the US. In return, tariffs on Japanese goods will be lowered to 15%.

Amazon is acquiring Bee… a startup that makes a $50 AI-powered wearable wristband that constantly records your conversations for daily summaries, insights, and reminders. Despite OpenAI, Meta, and other AI giants pushing into the wearable realm, it still feels like an area wide open for the taking.

Meta has poached the 3 Google AI researchers… behind their mathematics gold-winning model. Meta also unveiled a wristband that lets users control computers with hand gestures.

ChatGPT:

o Is used at work by 28% of U.S. employees – up 20% in 2 years.

o 20% of U.S. ChatGPT use is for learning, 18% for writing, and 7% for coding and math.

o 56% of all U.S. ChatGPT users are between 18-34 years old.

OpenAI will launch its next-gen GPT-5 in August… combining language capabilities with reasoning into one system. With everyone talking about existential shifts and mind-blowing capabilities, August could be the next major raising of the AI bar.

Crypto-Bytes:

Financial advisors are at a crossroads:

o 85% = the 2024 election changed how they talk to clients about crypto.

o +90% = Bitcoin optimistic, but worry about fiduciary risk.

o 84% = would pay (out of pocket) to improve their crypto knowledge.

BitGo confidentially filed for U.S. IPO... as the crypto mkt. surged past $4T.

JPMorgan, Bank of America, and even Citibank… are now piloting crypto-backed lending using Bitcoin and Ethereum as collateral.

Regulators have clarified… staking Ethereum (and other proof-of-stake assets) is NOT a security. That opened the floodgates for institutional investors to pile into ETH – using staking as a treasury management tool.

Bitcoin smashed through $120,000 for the first time… buoyed by Wall Street adoption, corporate balance sheet plays, and post-GENIUS Act optimism.

Things I Read… Again, if you’re trying to keep up with AI - use Rundown AI - it’s fast and it works … Read-n-Learn… R.F Culbertson.

Learn AI in 5 minutes a day

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join 1,000,000+ early adopters reading The Rundown AI — the free newsletter that makes you smarter on AI with just a 5-minute read per day.

TW3 (That Was - The Week - That Was):

Thursday: U.S. futures are looking at a flattish open ahead of another busy day of corporate earnings. On Wednesday, investors seemed relieved that the European Union and the U.S. are moving toward a trade deal that could include a 15% U.S. baseline tariff on EU goods – with possible exemptions. This would come on the heels of a U.S.-Japan deal. Strength is broad based as the Dow Jones Industrial Average nudges closer to breaking its December 4, 2024, record finish.

Friday: Last night, President Donald Trump visited Fed headquarters to inspect the Fed’s HQ renovation. Trump and Fed Chief Jerome Powell disagreed over the project's overall costs in front of cameras and reporters. Trump and some Senators (also on the tour) concluded by calling for lower interest rates. Trump said that firing Powell was unnecessary, and that he believed the FED would do the right thing.

Morgan Moment(s):

Caliway Biopharma has developed an injectable that destroys fat cells directly… delivering fast, targeted fat loss without surgery and/or minimal side effects == edging closer to FDA approval. They slim down fat bulges with visible results after a single treatment and almost zero downtime.

OpenAI’s new agent is here… and it produces content at glacial / yawning speeds. For example, an OpenAI Agent was asked to help plan a trip to attend a wedding in Hawaii. It took the Agent 18 minutes before it recommended a $5,000 / 5-night hotel stay in Maui, some dress shoes, and a very expensive tuxedo. It took over 20 minutes for it to order a dozen cupcakes.

Microsoft’s GitHub unveils AI-powered app builder… using only natural language prompts. To give a sense of how fast the vibe coding trend is moving, the no-code app builder Lovable just crossed $100m in annual recurring revenue in only 8 months. [FYI:That’s faster than any other software company in history.]

Boson AI just released a powerful TTS (text-to-speech) engine… that can clone voices and generate multi-speaker conversations with cutting-edge performance. In one demo, a Korean speaker and an English speaker had a seamless conversation of their voices in near real-time.

Next Week... People BOT Crap…

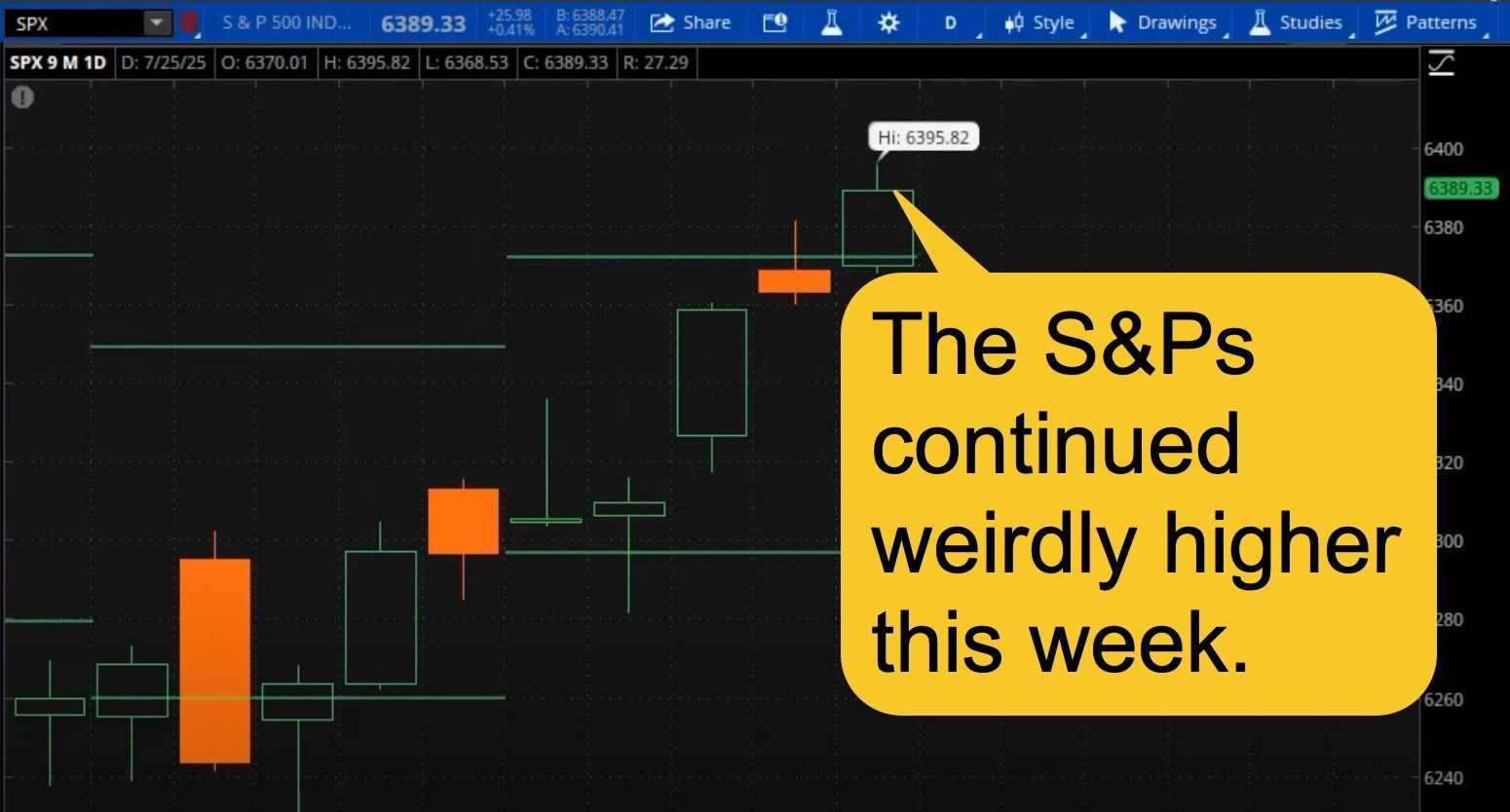

Bkgd: The S&Ps may be drifting higher right now, but don’t let that fool you: volume is dead, tech is stalled, and the leaders seem to be taking the week off. All of the trading volume exists within those mighty: utilities, homebuilders, and healthcare. These were the sectors that nobody gave two-@#$% about two-weeks ago. This isn’t a rotation as much as it is desperation. When crap-stocks lead, it’s a warning – because the next stop is usually down the drain. And if you add in collapsing volume + a quiet VIX + with a sky-rocketing SKEW == you have all of the components for an impending <flush!>

Factually – things are about to get weird:

The SKEW hit 160 Friday… and you can count on one hand how many times it’s been that high. A reading this high tells me that the pros are hedging by buying out-of-the-money PUTs, and financing them by selling out-of-the-money CALLs. The Volatility Futures are telling us that the VIX will be moving from ~15 to 17.5 in August, and to +20 in September.

Crap is driving this rally… (a) Utilities (XLU) are smashing their expected move. (b) Home Builders (XHB) are trading ‘lights out’ with interest rates as high as they are. (c) Healthcare (XLV) is exploding to the upside; all-the-while RFK is doing his best to kill the entire sector.

But the scary part is…. the correlation coefficient between the equal-weighted and the market-cap-weighted S&Ps just snapped back to 92%. To do that, the equal-weighted S&Ps had a significant move higher than their expected move – while the regular S&Ps barely moved-the-needle. That’s a BAD SIGN for technology as: (a) the Technology ETF (XLK) was unchanged, and the semi-conductors (SMH) actually finished lower on the week.

Trading volume is at Holiday / Christmas Eve levels.

Our FED could create bond risk… Currently, there is only a 3% chance of a FED ‘Rate Cut’ next week, but we could have dissenting rate opinions from several FED governors. Watch if this dissention in the ranks, injects any ‘fear’ into the bond market, and causes a significant sell-off.

SPX Expected Move:

o Last Week = $75 … and we moved 15 points outside the EM.

o Next Week = $90 … including a FED announcement and some Mag-7 earnings. Get ready to rumble!

TIPS...

Thoughts:

- Volatility (at a 5-month low) will rise from August to November.

- Stocks, Bitcoin, and Gold are all riding waves of liquidity.

- The Equal-Weighted S&P500 made a new ATH last week.

- Penny stock ‘gambling’ has doubled in recent years.

In General, the rally continues to run its course. Per Callum Thomas: Momentum is strong, sentiment is building, valuations are becoming expensive again, and we could be seeing signs of a bullish rotation and broadening out. But data points to things being a little too quiet lately – just as we head into a traditionally volatile time of year.

More Tips:

1. Global Policy is changing… as central banks are winding-down their rate cut rhetoric.

2. Our FED’s next move… despite the noise, there is no obvious reason for our FED to reduce interest rates.

3. Stocks vs Bonds… it’s a stock-pickers market given valuation extremes. Watch if macros and technicals initiate a high conviction bearish selloff.

4. Credit Spreads… are back to rock-bottom and require constant review.

5. U.S. Treasuries / Commodities… could perform well in a downturn.

HODL’s: (Hold-On for Dear Life)

- (+) IBIT – Blackrock’s Spot Bitcoin ETF ($66.4 / in at $24)

- (+) ETHA – Ethereum ETF ($27.6 / in at $13.5)

- (+) Physical Commodities = Gold @ $3,330/oz. & Silver @ $38.3/oz.

- Bitcoin (BTC = $118,100 / in at $4,310)

- Ethereum (ETH = 3,750 / in at $310)

- (+) GLD – Gold ETF ($307.4 / in at $212)

Options for Income: De-Risking a Portfolio… (using IBIT as an example)

- BUY-n-HOLD the IBIT ETF

- BUY PUTs: 1 Std. Dev. Lower, Expiring in 3-weeks.

- SELL Covered CALLs: 0.75 to 1 Std. Dev. Higher, Expiring in 2-weeks.

‘De-Gen’ Economy:

- SLV: Silver… ($34.6 / in at $31.2)

- PALL: Palladium … ($111.7 / in at $98)

- VIX: Volatility Index … ($15 / in at $16)

- ASPI: ASP Isotopes … ($10.4 / in at $5.88)

- WIMI: WIMI Hologram Cloud … ($3.7 / in at $4.1)

- UDN Dollar Bearish Index 1X … BOT the $18 Sept Calls for 75 cents.

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson