- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 7.6.2025

This Week in Barrons: 7.6.2025

Markets behaving badly...

Ric Edelman is in the Financial Advisors Hall of Fame. Ric’s most recent suggestion is that investors put 10% to 40% of their asset portfolio into crypto. His thoughts dwarf the normal 1-3% allocation, for 3 reasons:

o We need to completely re-think our financial models because elements like the traditional 60/40 stock-bond allocation model have not produced competitive results in decades.

o Owning crypto is no longer a speculative position; failing to do so – is. A passive market-weighted index comprised of all asset classes would have 3% in crypto, so an investor who lacks crypto is now effectively shorting it.

o There’s no logic to omitting an asset class that’s outperformed all others for 15 consecutive years, and is widely projected to continue doing so for the next decade. Historic performance shows that portfolios including bitcoin have generated higher returns, lower risks, and superior Modern Portfolio Theory metrics.

Per Roy Rubin: “Intentless Commerce” explained:

o With Google Search numbers collapsing, shoppers are not browsing, but rather seeking solutions = a single prompt / answer.

o AI models respond instantly – finding specific products based upon your behavior, context, and data. The days of delivering you multiple homepages for you to evaluate are over. From here forward, it’s simply: “Here’s exactly what you need.”

o Intentless Commerce is when the AI model handles all of a consumer’s intentions behind-the-scenes – prior to revealing the solution. The AI model collapses: discovery, evaluation, and purchase into a single moment. The buying decision is being made BEFORE a prospect reviews your product/service or is even aware of your brand.

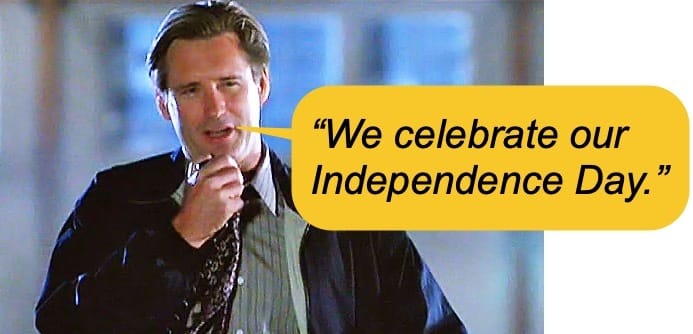

o Factually: Google crawls 18 pages for every website it presents. OpenAI evaluates 1,500 pages to deliver 1 result, and Anthropic reviews 60,000 pages to deliver 1 response.

o This is NOT Search 2.0. Sellers are no longer optimizing for clicks, but rather competing to be what the AI model needs to see. If your product/service is NOT structured, trusted, and ready for AI-driven discovery - you won’t show up.

o AI Models are your new EXPERT purchasing agents. They’re solving the: what, where, and when about buying everything, anytime – anywhere.

The Market:

Do you see what I’m seeing? So much complacency, with so few regulatory hurdles. So many bulls, with so little volatility and fear. If I was a bull, I would be searching for that elusive Wall-of-Worry. Here are my red flags, but I’m always early to any party:

- Crypto premiums are on the rise – compared to cash markets.

- Option volumes are increasing – sparked by ridiculous amounts of PUT selling.

- Banks and financial stocks are skyrocketing with little regulatory oversight.

- Institutional managers who sold in April (at the bottom) – are now scrambling to buy (at the top).

Remember: “Buy the Noise – Sell the Calm”, and you can hear a pin drop right now.

Another S&P all-time high... but I'm seeing something else entirely. Someone just bought 50,000 $44 Put contracts ($400,000) on BAC that expire July 11th. These expire BEFORE Bank of America reports earnings on July 16th; therefore, this is NOT an earnings play. Other massive bearish purchases were made on Wells Fargo ($73 Puts) and Morgan Stanley ($130 Puts) – all targeting prior lows, and all expiring July 11th. FYI: July 9th is when the Reciprocal Tariffs kick back on. I remember April 7th, when tariff news crushed the banks and sent gold soaring. Despite markets sitting at all-time-highs, the SKEW remains above 130. The downside risks associated with: FED policy, tariffs, inflation, and geopolitical tensions have not gone away, but rather are just waiting for a catalyst. Do not believe the all-time-high applause – because the smart money is preparing for something entirely different.

Looking ahead until December 31, 2025… statistically here are the expected one standard deviation moves:

- SPY has a 68% probability of landing between $548 - $702,

- QQQ 68% prob. of landing between $479 - $643,

- IWM 68% prob. of landing between $182 - $257,

- TLT 68% prob. of landing between $78 - $98, and

- VIX 68% prob. of landing above $10.00.

Things I Read… I read the Morning Brew - every day! Read-n-Learn … R.F. Culbertson

Quick, hard-hitting business news.

Morning Brew was built on a simple idea: business news doesn’t have to be boring.

Today, it’s the fastest-growing newsletter in the country with over 4.2 million readers—thanks to a format that makes staying informed both easy and enjoyable.

Each morning, Morning Brew delivers the day’s biggest stories—from Wall Street to Silicon Valley and beyond—in bite-sized reads packed with facts, not fluff, and just enough wit to keep things interesting.

Try the newsletter for free and see why busy professionals are ditching jargon-heavy, traditional business media for a smarter, faster way to stay in the loop.

Info-Bits…

Trump and Canadian PM Mark Carney have agreed… to restart Canadian tariff negotiations and aim for a deal by July 21.

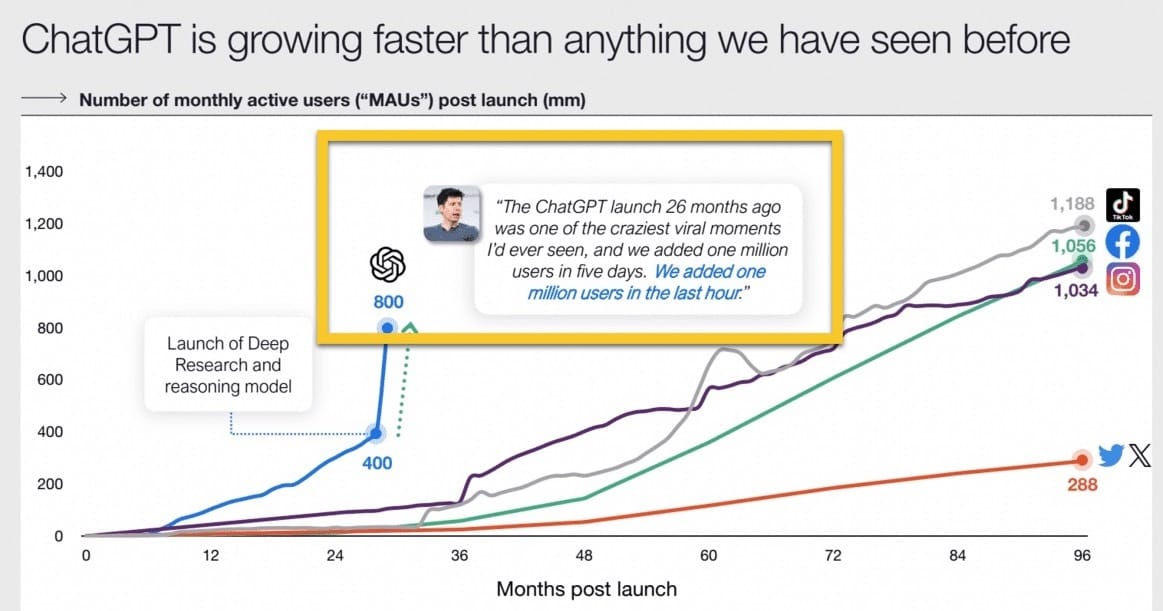

“Missionaries will beat Mercenaries” … said Sam Altman as he slammed Meta’s AI talent poaching spree. Meta’s $300M in bonuses over 4 years – with $100M in the 1styear are the particulars surrounding +10 offers that the Zuck made to AI researchers.

Trump’s trade deals are 3 days away from the deadline… without any sweeping reforms.

Apple is weighing a major AI pivot… potentially replacing its in-house Siri models with tech from Anthropic or OpenAI. Maybe its internal efforts have fallen behind enough, that it's finally willing to look outside to stay in the race.

Meta is formalizing its AI strategy… by consolidating all teams under a new Superintelligence Labs group. They’ve tapped Scale AI founder Alexandr Wang to lead the charge, and is stacking its bench with new hires from DeepMind, Anthropic, and OpenAi.

Microsoft unveils an AI tool… that diagnoses patients 4x more accurately than human doctors.

Goldman Sachs updated its rate forecast… to 3 rate cuts in 2025 – starting in September.

Figma filed for an IPO… after Q1’s numbers beat estimates: $228m in revenues and $45m in net income.

Microsoft is cutting another 9,000 jobs… as it doubles down on AI and trims roles across sales and gaming.

A 20% tariff/trade deal was reached with Vietnam.

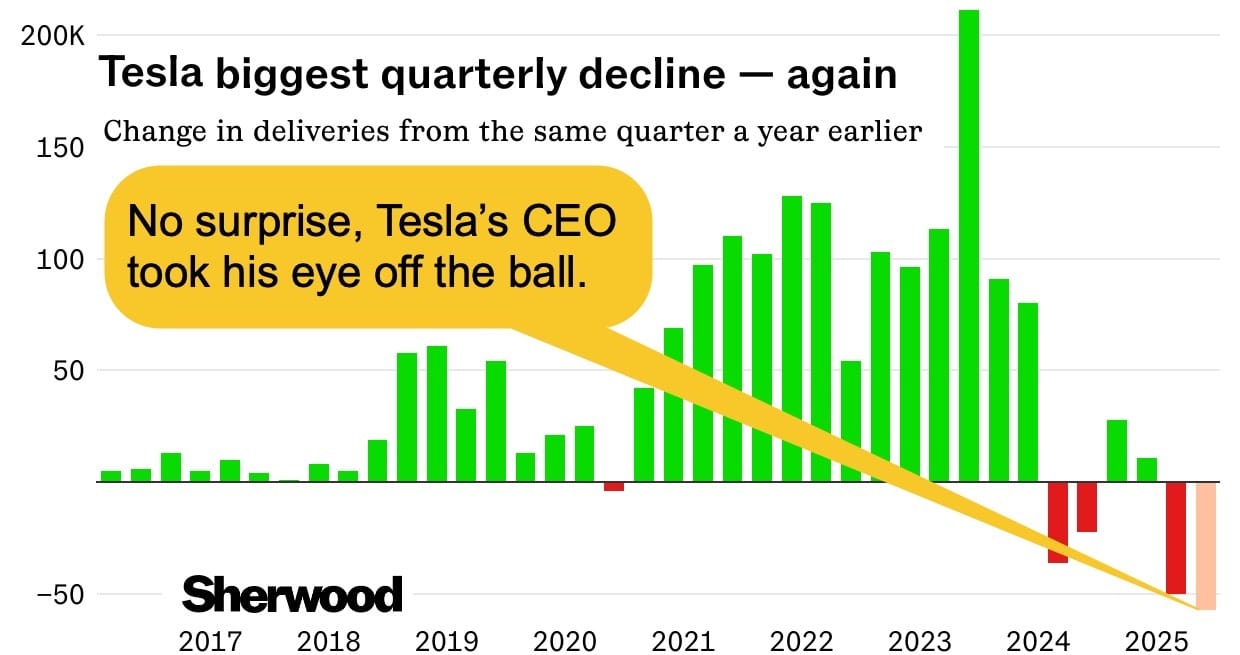

Tesla sales fell -13% YoY in Q2… and 2025’s total revenue decline will be close to -8%.

The June Jobs number came in at +147k… a lot higher than the estimates. The Unemployment Rate fell to 4.1% - instead of rising to 4.4%.

Amazon just deployed its one-millionth warehouse robot… and cemented its status as the world’s largest operator and maker of mobile robotics.

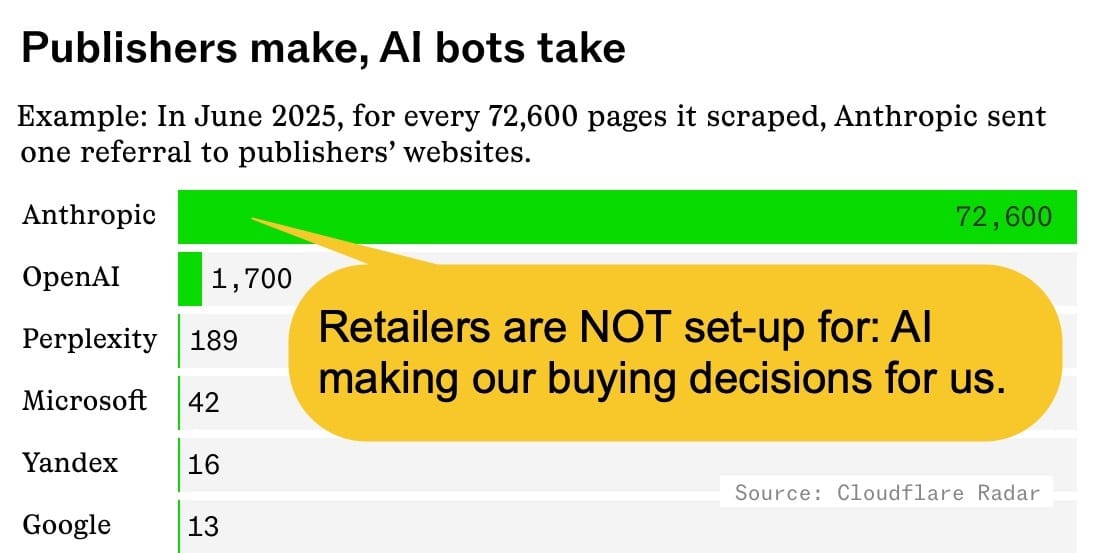

Per MJP: Mexicans in Mexico City are protesting Americans… migrating there, buying property, and causing gentrification. The irony is: We do not want Mexico’s illegal immigrants because they have no money, and Mexico does not want our legal immigrants because they have too much money.

Crypto-Bytes:

Tom Lee (Wall Street strategist) has been appointed Chair-person of bitcoin miner… BitMine Immersion Technologies. BitMine announced a $250m private placement to implement a buying strategy around ETH, which it aims to make its primary treasury reserve asset. Lee’s appointment comes amid a groundswell of interest from traditional financial institutions around stablecoins, many of which run on the Ethereum network.

Robinhood makes tokenized U.S. securities… available in 30 European countries. It’s built on Arbitrum, and the tokens offer 24/5 access, dividends, and zero commission spreads. Robinhood will own the shares backing the tokens. Perpetual futures will also be rolled out by the end of the summer, and staking for ETH and SOL will be available soon in the U.S.

Gold has quietly pulled off the rare feat of… beating Bitcoin’s first half returns by a double-digit margin. Bitcoin had gained +13% and Gold is up +26% YTD – giving Gold its best half-year performance since 2007. Since Bitcoin's inception (2009), gold has only outperformed Bitcoin in 3 calendar years, and each of those came from Bitcoin selloffs, not gold rallies. With a 13% edge, could 2025 become the fourth year where gold beats Bitcoin?

I worry about Nintendo. I believe that if Nintendo stays on their current path, they will end up suffering the same fate that has lately befallen Apple: overreliance on plodding iterations at a great risk of customer fatigue – while ignoring the innovation of nimble competitors.

TW3 (That Was - The Week - That Was):

Tuesday July 1: For June, the S&P 500 gained 5%, the Nasdaq rose 6.5%, and the Dow climbed 4%. For the quarter, the S&Ps gained 10.5%, the Nasdaq climbed 17.8%, and the Dow moved + 5% == marking the best quarter for markets since December 2023. The U.S. Dollar is continuing to fall, as the greenback crashes -13% YTD, and the 10-Year Treasury dips below 4.2%.

Wednesday: Upcoming tariff deadlines are on investor’s minds, as Pres. Trump affirms his non-extension of the July 9 deadline for imposing tariffs. He cast doubt that an agreement could be reached with Japan, although he expects a deal with India. The EU's trade chief is expected to hold talks this coming week with peers in Washington.

Morgan’s Moments:

Per Adam Kobeissi: “This has been one of the worst years in history for the US Dollar. The US Dollar index fell -13% in the first half of 2025, its worst first-half performance since 1973. The U.S. M2 money supply jumped +4.5% YoY in May, to a record ~$22T - marking the 19th consecutive monthly increase.”

Q: “Why is the U.S. Gov’t destroying the purchasing power of its own U.S. Dollar?”

A: So, it can buy as much gold and bitcoin as it possibly can.

Using Bitcoin data from Aug. 2010 to June 2025.

- Bitcoin in July:

o Avg. gain when green: +17.5%

o Avg. loss when red: -8.5%

o Overall July change: 8% with 9 green out of 14 (64%). Upside hits twice as hard as the downside, but the downside still talks trash.

- July vs. The Calendar: It’s the ninth-best month of the year. It beats June’s sulking and September’s doom, but it’s nowhere near November’s fireworks or April’s sugar rush.

- BTC In Q3 == 50/50 Quarter:

o Avg. gain when green: +36.5%

o Avg. loss when red: -23.5%

o Win rate: 50 % (7 green, 7 red).

o Overall Win rate: 50% (7 green, 7 red) with an Avg. +6.5%

- BTC In H2:

o Avg. gain when green: 192%

o Avg. loss when red: -42.5%

o Overall Win rate: 64% (9 green, 5 red) with an Avg. +108.5%

- More Crypto in July stuff:

o July has never gone RED 2 years in a row.

o When June dumps +10% - July’s average rebound is 48%.

o July’s upside punch is roughly double its downside slap.

TIP #1: If July finishes lower, turn into a trader: “Buy the Dip ‘n Sell the Rip”.

TIP #2: If July finishes higher, ride it, but start selling calls and buying puts because the real party doesn’t start until November.

TIP #3: July’s result (higher vs lower) called Q3’s result 12 out of 14 times.

TIP #4: A green July matched a green H2 10 of 14 times.

TIP #5: Remember, Bitcoin liquidity dies in mid-August.

Next Week... Markets behaving badly…

Background: Even the most cockeyed optimist would have to be looking at this market right now and thinking: "I can't believe the S&Ps are trading +6250. And, we just had our second consecutive week of breaching the expected move to the upside." This is not normal market behavior. That means that the options market got it dramatically wrong – two times in a row. Two weeks ago, Nvidia drove markets higher, and last week it was Apple that carried the entire marketplace on its back. [FYI: Tesla = down, Meta = down, and NVDA + Google + Amazon + MSFT = flat.] The Mag-7 have become the proverbial: Whack-a-Mole – where you knock something down and something else pops up for no apparent reason.

With the passage of the BBB and July 9th tariff deadline approaching:

o I’m looking for the bond vigilantes to hit the marketplace hard by selling – because spending is completely out of control and there’s no proof of significantly higher revenues.

o This will drive interest rates higher (closer to 5% on the 10-Year) – cause markets to fade/correct.

o Therefore:

TIP #6: I BOT Volatility (VIX)… the Aug. +$22 / -$32 Call Spread.

SPX Expected Move:

o Last Week (3.5 trading days) = $74 … and we closed +100 points higher.

o Next Week (5 trading days) = $92 … and looking for the Bonds to continue selling off.

TIP #7: Get ready to buy Bond PUTs … soon.

TIPS...

Factually: (a) The S&Ps have broken out to all-time highs, and put in a “Golden Cross” uptrend signal. (b) Seasonality is still bullish, and will turn bearish later in the year. (c) Sentiment is bullish, but policy risk is also rising. (d) And we’re back to investors running record high allocations to tech funds. Per Callum Thomas: This late-cycle reset is running its course via the “re-frothification” of markets. The bullish momentum we’re seeing could have room to run, but we have renewed QE and Trade-War-Truce expirations starting next week. I’d sell: tech, U.S. Credit, and the US dollar. I’d buy: commodities, bitcoin, and precious metal miners.

HODL’s: (Hold-On for Dear Life)

- (+) IBIT – Blackrock’s Spot Bitcoin ETF ($62.19 / in at $24)

- (+) Physical Commodities = Gold @ $3,346/oz. & Silver @ $37.1/oz.

- Bitcoin (BTC = $108,010 / in at $4,310)

- Ethereum (ETH = 2,510 / in at $310)

- (+) GLD – Gold ETF ($307 / in at $212)

Options for Income: De-Risking a Portfolio… (using IBIT for example)

- BUY-n-HOLD the IBIT ETF

- BUY PUTs: 1 Std. Dev. Lower, Expiring = 3-weeks away, OTM (out-of-the-money) for protection.

- SELL Covered CALLs: 0.75 to 1 Std. Dev. Higher, Expiring = 2-weeks away, OTM for income and to finance the PUTs.

‘De-Gen’ Economy:

- SSRM: Silver Miner ... ($13.18 / in at $10.90) – sold the July $14 Calls

- MPLX: Energy … ($51 / in at $50.4 w/ 8% Dividend Yield)

- SLV: Silver… ($33.5 / in at $31.2)

- PALL: Palladium… ($104 / in at $98)

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson