- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 8.17.2025

This Week in Barrons: 8.17.2025

Buckle Up ... Summer's over.

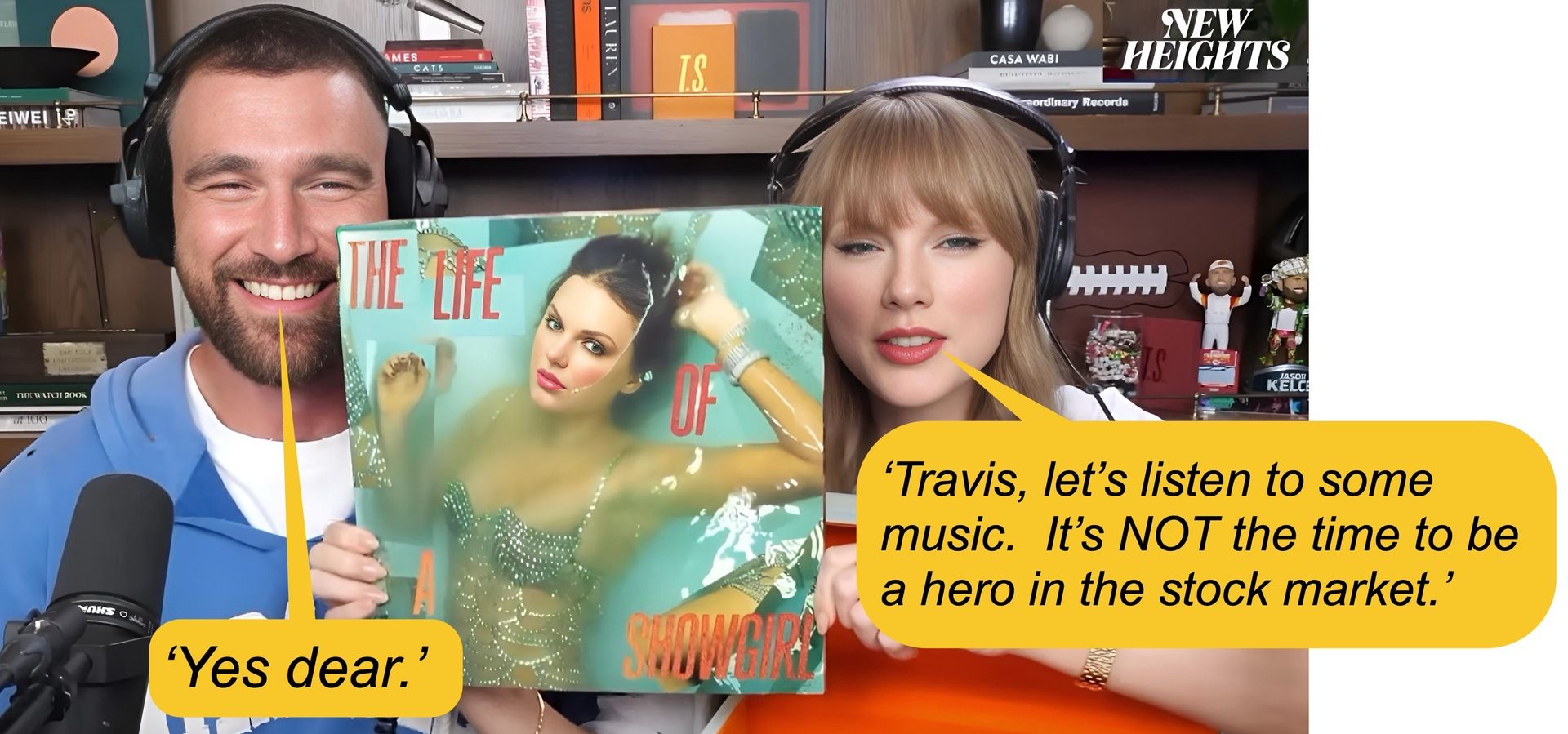

I took the week off… in order to take a break from this market. As you’ll see by this post, valuations are becoming ridiculously stretched – going into the worst timing of the year = September & October. [FYI: If you haven’t heard the above podcast - I highly recommend it.]

I have a deep love for Martha’s Vineyard (MVY) – and this year marks the 50th anniversary of the release of the movie: ‘JAWS’. The Free Press’ Peter Savodnik wrote a great piece about that magical moment – in the summer of 1974, when MVY was transformed into the fictional Amity Island. The movie was never about a shark, but rather about man’s continued inability / refusal to confront his own fears. As Peter says: “We live in an age where safety reigns supreme: We don’t want any bumps, bruises – or even words or ideas that might upset us. We understand that our quest for this perfectly manicured, curated, cordoned-off sort of life - has cost us dearly.” And that alone explains why we still watch ‘JAWS’ – the seventh highest-grossing movie of all time.

I’ll be back ‘in the saddle’ next week… enjoy the abbreviated blog post.

The Market:

… the above courtesy of H. Thompson.

Keep saying to yourself: “As long as the world allows our dollar to be the global reserve currency, and our government to print money to buy its own bonds – our stock market will move higher.

Things I Read… Pacaso improves your understanding of owning a 2nd home … Read-n-Learn … R.F. Culbertson

Former Zillow exec targets $1.3T

The top companies target big markets. Like Nvidia growing ~200% in 2024 on AI’s $214B tailwind. That’s why the same VCs behind Uber and Venmo also backed Pacaso. Created by a former Zillow exec, Pacaso’s co-ownership tech transforms a $1.3 trillion market. With $110M+ in gross profit to date, Pacaso just reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Info-Bits…

All eyes are on Jackson Hole, Wyoming… as Powell is scheduled to speak at the Jackson Hole Economic Symposium on Friday, August 23, at 10:00 a.m.

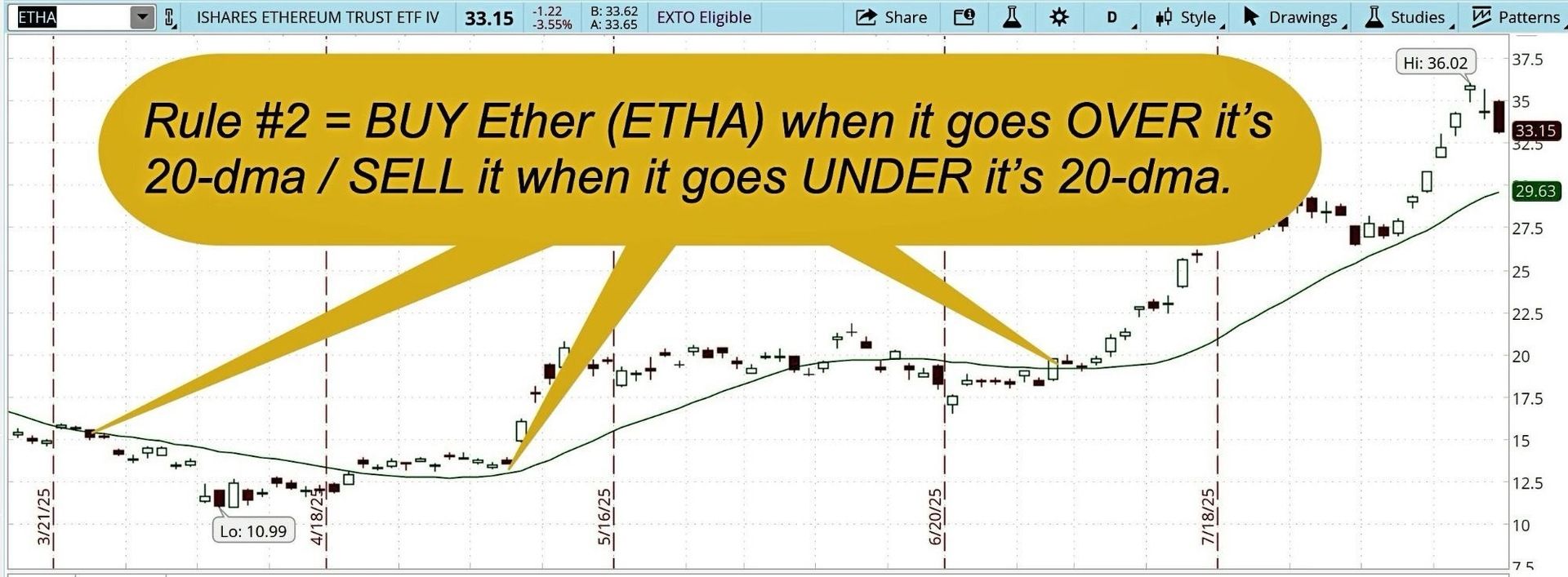

Crypto-Bytes:

My easy rule for Crypto is… Whatever crypto you buy – make sure it has a liquid OPTIONS market for actively managing your risk.

Things I Read… I use the Elite Trade Club for my early AM info-boost … Read-n-Learn… R.F Culbertson.

Missed the Market’s Big Moves?

The market moves fast - we make sure you don’t miss a thing.

Elite Trade Club delivers clear, no-fluff market intel straight to your inbox every morning.

From stocks to big-picture trends, we cover what actually matters.

Join 100,000+ readers who start their day with the edge.

TW3 (That Was - The Week - That Was):

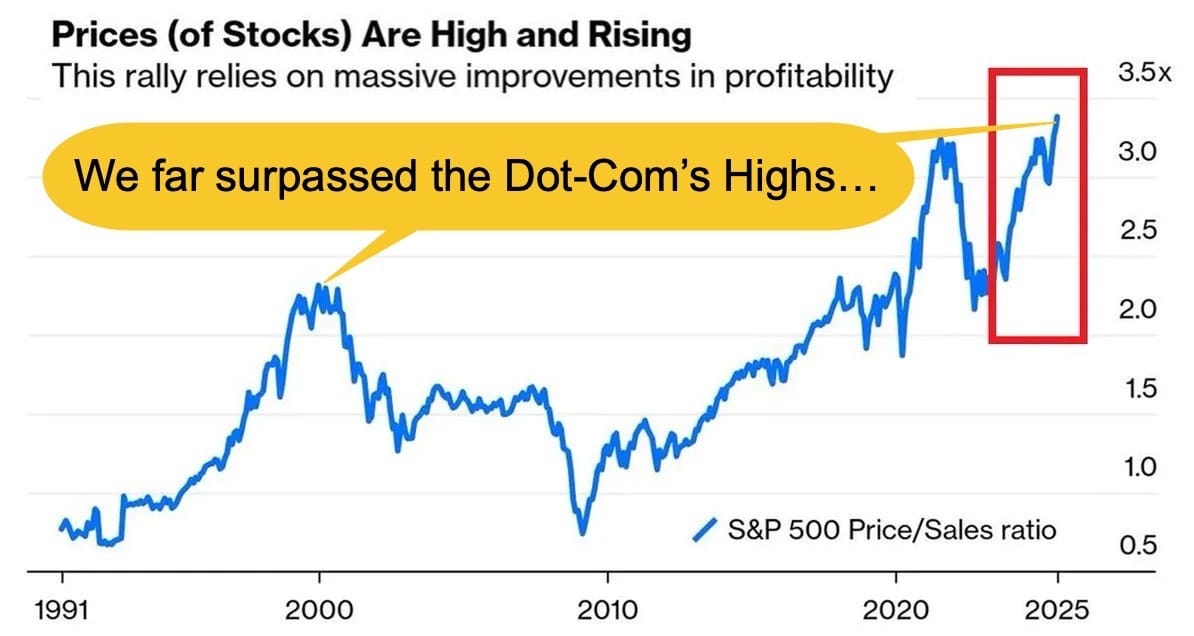

When you consistently track the breadth of overvaluation… you’ll see things getting particularly extreme, and you’ll notice their warnings: hiding in plain sight.

Morgan Moment(s):

Once you enter the later stages of a market’s cycle… more and more investors negotiate with facts. Investors will say: (a) Profit margins are higher now (true), (b) The largest companies are less capital intensive (true) and have a greater proportion of intangible assets (also true), and (c) The index composition is now skewed more toward companies with those characteristics (also true). Per Callum Thomas: These things always start with good reason, and end abruptly – when they get unreasonable.

Next Week... Buckle-Up … Summer’s over.

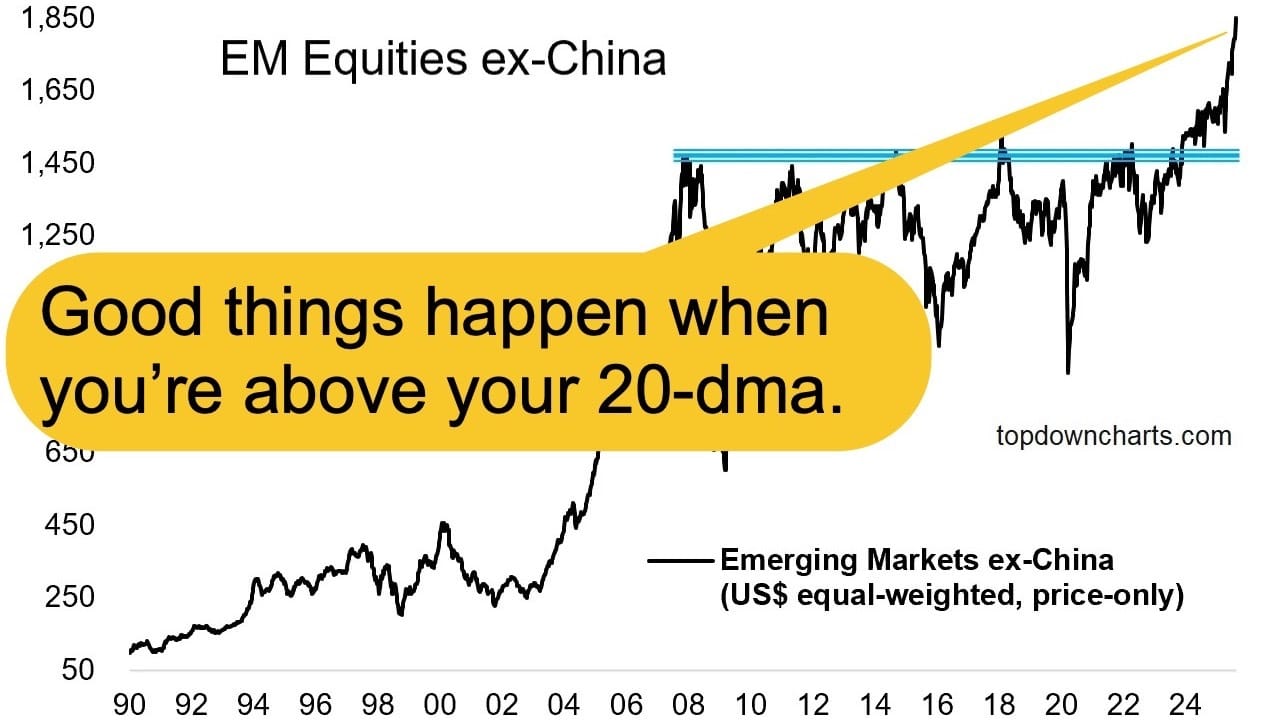

Emerging markets (EEM) have already broken-out… and are entering their bull-market phase. EEM has always been a value-trap, and only recently added the technical, bull-market breakout piece to its resume. At this point any more additions are simply an exercise in conviction building and risk management.

SPX Expected Move (EM):

o Last Week’s EM = $93 … and we touched the upper end of the EM – ending the week higher by +$70.

o Next Week's EM = $91… and with the VIX having nowhere to go but higher – I’ll still take the ‘over’ on that $91 EM.

TIPS...

Factually:

- Sentiment is slipping as we head into a seasonally ‘slippery’ part of the year.

- Valuation indicators are reaching ‘stupidly’ extreme / expensive levels.

- More people are ‘negotiating’ with the facts.

- Emerging Market equities are cheap and breaking out.

Overall, per Callum Thomas: It’s just another day in the late stages of the market cycle. Aside from the speculation, there’s a bull market in the number of charts showing valuation extremes and pressure points. More people are ‘negotiating’ against those facts using phrases like: “valuations don’t matter” and “it’s different this time”, but the facts are ironically what tend to give valuations a greater weight and meaning...

HODL’s: (Hold-On for Dear Life)

- (+) IBIT – Blackrock’s Spot Bitcoin ETF ($66.65 / in at $24)

- (+) Physical Commodities = Gold @ $3313/oz. & Silver @ $33/oz.

- Bitcoin (BTC = $117,500 / in at $4,310)

- Ethereum (ETH = 4,400 / in at $310)

- (+) GLD – Gold ETF ($307.4 / in at $212)

Options for Income: De-Risking a Portfolio… (using IBIT for example)

- BUY-n-HOLD the IBIT ETF

- BUY PUTs: 1 Std. Dev. Lower, Expiring = 3-weeks away, OTM (out-of-the-money) for protection.

- SELL Covered CALLs: 0.75 to 1 Std. Dev. Higher, Expiring = 2-weeks away, OTM for income and to finance the PUTs.

‘De-Gen’ Economy:

- Chainlink (crypto) == LINK: ($22.7 / in at $19.4)

- Aave (crypto) == AAVE: ($296 / in at $254)

- Ethereum ETF == ETHA: ($33.6 / in at $19.9)

- Emerging Markets ETF == EEM: ~$50

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson