- R.F.'s Financial Newsletter

- Posts

- This Week in Barrons: 8.24.2025

This Week in Barrons: 8.24.2025

We still have issues...

Your goal is to create a brand, a movement, and/or a community… that seeks to work with people. You would welcome the chance to accompany someone on their journey, to manage instead of lead, or to just amplify and narrate. When we help employees, partners & customers get to where they hope to go, persuasion isn’t nearly as important as enrollment and engagement.

The most powerful word in sales is “No” … If you’re serious – say ‘Yes’. If it’s not for you – say ‘No’ and walk away. Per Seth Godin: “Endlessly reconsidering an opportunity without any forward motion is using decision-making as a place-to-hide.”

Teaching is not about authority or assignments... but rather: accountability, understanding, and an approach that allows a willing student to change their mind – and yours. Everything else is: “Just showin’ up.” [FYI: Sooner or later – we’re all self-taught!”]

The Market:

All SPACs ‘n Memes – all the time. Our levels of government spending have created one of the fastest debasements of the U.S. dollar in history. The dollar has lost 28% of its purchasing power in the last 5 years. However, do not buy into the nonsense of using ‘pure speculation’ and ‘meme stocks’ as a way of earning more yield. Just because our government can’t stop printing money and pushing that risk out onto its people – doesn’t mean that you need to ‘put it all on red and let-it-ride’ to be a successful investor.

Healthcare was the best performing sector over the last 30 days… When institutional money starts piling into healthcare while we're still flirting with all-time highs, they're not betting on growth – they’re preparing for trouble.

Tip your baristas… S&P 500 CEOs saw their pay climb 7.7% last year, the fastest pace in four years. Starbucks holds the honors of having the widest pay gap between the top executive and average employee. CEO Brian Niccol’s ~$96m pay package was 6,666 TIMES greater than the avg. Starbucks employee. [FYI: Look no further than employee compensation to figure out why Starbucks is moving in the wrong direction.]

Beijing’s first World Humanoid Robot Games… brought more than 500 robots from 16 countries – pitting their best humanoids against each other in 26 competitions. Next year’s games are already on the books – making the 2026 games a platform offering deeper insights into the immediate potential of humanoids.

Things I Read… Pacaso improves your understanding of owning a 2nd home … Read-n-Learn … R.F. Culbertson

From Italy to a Nasdaq Reservation

How do you follow record-setting success? Get stronger. Take Pacaso. Their real estate co-ownership tech set records in Paris and London in 2024. No surprise. Coldwell Banker says 40% of wealthy Americans plan to buy abroad within a year. So adding 10+ new international destinations, including three in Italy, is big. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Info-Bits…

Apple is gearing up for a hardware blitz on September 9… with iPhone 17, a reimagined Apple Watch, and next-gen AirPods all set to drop. Rumors suggest the iPhone 17 could be the boldest redesign we’ve seen in years. The baseline iPhone 17 could feature a 6.3-inch OLED screen, with a 120Hz refresh rate.

SoftBank’s CEO Masayoshi Son made the news… with a $2B investment in Intel. It’s a strategic bet on U.S. chip supremacy at a critical time for global semis.

If you’re talking with someone… and they keep looking down and to the right – they may be secretly looking at photos. Meta’s $800 Hypernova glasses, are set to be released next month, and will feature a display for accessing apps and pics in the lower right corner.

Novo is slashing Ozempic prices by ~50% … to $499/month for cash-paying U.S. patients.

President Trump confirmed that the U.S. will take a 99% equity stake in Intel… which is burning through $1B a month in cash. This sent INTC shares up 7% and stoked talk of creeping nationalization.

Meta just imposed a hiring freeze… following their major poaching spree.

Chinese firms are moving away from Nvidia’s H20 chips … and seeking domestic options after being insulted by comments from U.S. Commerce Secretary Howard Lutnick.

China is worried about the U.S.’s borrowing & spending… and is calling for less exposure to U.S. debt and more involvement with gold.

Meta just inked a six-year… $10B deal to run its AI workloads on Google Cloud, a rare détente between two ad rivals and a sign of how frantically Big Tech is stockpiling infrastructure to feed its AI ambitions.

UBS analysts anticipate a stagflationary environment … with “below trend” economic growth, sticky inflation, and much higher gold prices.

Mike Maharrey said … inflation, currency debasement, and the illusion of stability are not only persistent but deliberate policy tools of governments and central banks.

July corporate bankruptcies hit 15-year high … as companies struggle in this high-interest rate environment coupled with tariff uncertainty.

Apple is holding talks with Google … about using Gemini to power a revamped Siri, a sign the company may finally outsource some of its AI brainpower after years of delays and high-profile talent losses.

Waymo got the green light to test robotaxis in the Big Apple …

the most ambitious testing ground yet for Waymo as NYC's notorious traffic far exceeds the company’s current markets in complexity. If/when successful, the world's largest and most lucrative urban mobility market will be Waymo’s for the taking.

Crypto-Bytes:

B of A is reporting that… “The average professional fund manager crypto allocation is 0.3% of AUM, and 75% of fund managers have 0% allocation.”

Gemini, led by the Winklevoss twins … filed for an IPO as crypto listings boom.

Ivy League schools including Harvard and Brown … have disclosed that they are among the numerous institutional investors with allocations to bitcoin ETFs (IBIT in specific). That trend is further legitimizing crypto as an asset class and may have some individual investors wondering if they, too, should bank on bitcoin.

Wyoming launched its own digital currency.

Things I Read… I use Uniswap to trade crypto securely … Read-n-Learn… R.F Culbertson.

Swap, Bridge, and Track Tokens Across 14+ Chains

Uniswap web app lets you swap thousands of tokens safely, in seconds. Open‑source, audited code and real‑time token warnings help keep you safe.

TW3 (That Was - The Week - That Was):

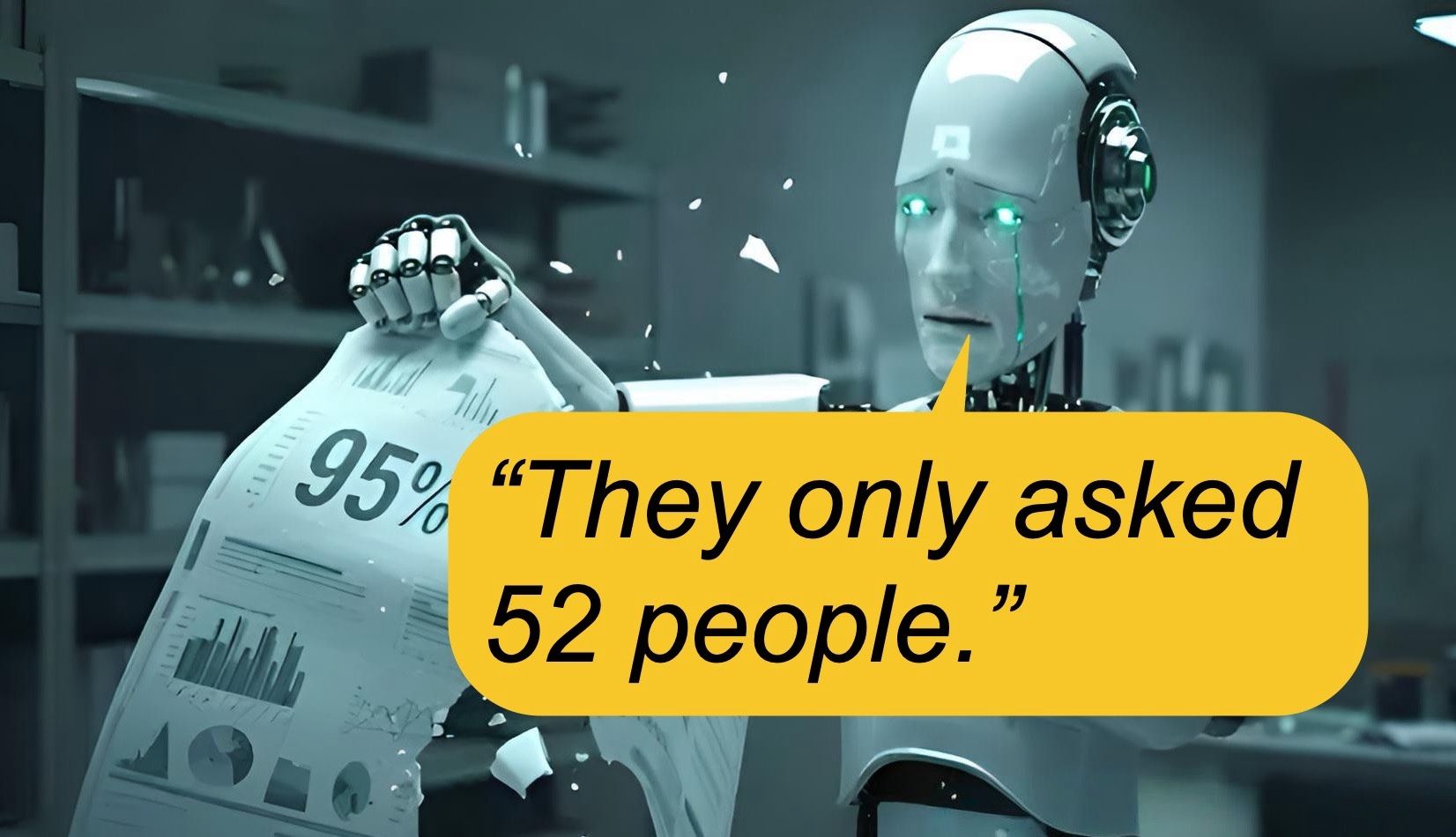

Wednesday: Tech stocks are plummeting over concerns arising from an MIT study (that after interviewing 52 people) found that ~95% of companies are getting "zero return" from their AI investments. This comes on top of Sam Altman’s admission that investors may be getting "over excited" about the AI sector's prospects. This reality check sent Nvidia stock down 3.5%, Palantir plummeting 9.4%, and wiped-out gains across the tech-heavy Nasdaq – which posted its biggest single-day drop since August.

Thursday: The one sector that is doing well is the miners. The GDX broke out nicely, and I'd take some over $59.70. IAG looks good over 8.65. It's still all about Powell tomorrow. He could light a fire or push us under.

Friday: Markets have been sliding for 5-straight days as investors held back on making any big bets ahead of Fed Chair Powell’s Jackson Hole speech this morning. The Nasdaq 100 (QQQ) fell for a 6th straight day – its longest losing streak in ~3 years. On Friday (right on cue), Powell gave us the nod that he believes that it’s time to adjust policy. He implied that he's going to cut, but it's not a foregone conclusion that we just keep cutting. Stocks soared, the dollar fell, and Bitcoin, Gold & crypto all moved nicely to the upside.Morgan Moment(s):

Morgan’s Moments…

Anthropic just equipped Claude with the ability to hang-up & end chats … Since Anthropic is one of the few labs putting serious time into model warfare & welfare – it may be best to stand carefully and observe what happens.

OpenAI's GPT-5 surpassed human medical professionals… on medical reasoning benchmarks – across diagnostic and multimodal tasks. This new-found superiority over medical professionals shows we're approaching a point where physicians NOT using AI in clinical settings could be guilty of malpractice.

Is Bitcoin mining for you? Say you have $250,000 in taxable income for 2025, and an effective tax rate of 23%. By purchasing $250,000 worth of mining hardware, the business owner can fully offset the tax obligation while also stacking significant amounts of Bitcoin. Based on current BTC Prices & Mining Costs, $250,000 worth of miners hosted by Blockware is projected to mine (after electricity costs) ~$420,000 worth of BTC.

DeepSeek’s new model gives everyone a run for their money: The new V3.1 model packs a larger working memory for longer, more coherent conversations. The new model goes toe-to-toe with OpenAI's and Anthropic's flagship offerings while continuing to be completely open-source.

Next Week... We still have issues…

“Staying above 6450 on Friday, will be incredibly bullish going into next week." [FYI: The SPX closed at ~6467, a solid 16 points above that critical level.]

Institutional positioning around FED speeches is largely predetermined. The algos know what they’re going to do. On Friday morning, they dropped Powell’s entire set of prepared remarks to trading firms before he spoke. By the time he approached the microphone, every algorithm on Wall Street had already digested the phrase: "the shifting balance of risks may warrant adjusting our policy stance". Markets exploded because the action/re-action positioning had already been locked and loaded.

This Market ripped 500 points higher on Friday… because our FED admitted that they were lost. "In this environment, distinguishing cyclical developments from trend or structural developments is difficult." Per Garrett Baldwin, our job growth collapsed from 168,000 / mo. to 35,000. That's not a slowdown – that’s hitting a brick wall. Powell called this a "curious kind of balance." Honestly, when our labor market stops making mathematical sense, that's not curious – but terrifying. It speaks to our lack of understanding immigration’s impact on labor supply, and why industrial labor demand has declined.

How ‘bout dem Tariffs … "The effects of tariffs on consumer prices are now clearly visible,” said Powell. So even in the face of higher inflation data, our FED is cutting rates. With $37T in debt, our FED is surrendering instead of fighting. Paul Tudor Jones warned that Tariff Wars will act like a huge trigger. If China retaliates, supply chains will break, and inflation will spike. Our FED will then need to choose between fighting inflation and saving the US markets.

There are no more Bull vs Bear markets … but rather simply liquid vs illiquid ones. That’s why our FED is going to ease rates and let this thing run. Later in September, Powell will tell us how they ended ‘Quantitative Tightening’ – which means that ‘Quantitative Easing’ is now in play. Managing a global economy has turned into betting on which world leader will blink first.

WIIFM (What’s In It For Me?) … Today's hedge funds are loaded up, and back to re-risking. Those same funds that amplified the August selloff by selling – are now piling back in as buyers. This means that the leveraged trades that I’m seeing – will only get bigger. I would not be against the following going forward:

o 20% of your portfolio in gold ‘n silver. [FYI: Gold’s 2026 target is $4,000.]

o 30% of your portfolio in Bitcoin, with an ever-growing segment in altcoins such as: Ethereum (ETH), HyperLiquid (HYPE), Aave (AAVE), and ChainLink (LINK).

The Bottom Line … When our FED admits that there is: (a) confusion surrounding the labor market, (b) tariffs are screwing everything up, and (c) their recipe for success failed harder than expected; the only response our FED knows is to print more money and buy everything that isn't nailed down. We're too leveraged, too indebted, too fragile to take the pain like we could in 1987. So, our FED is going to accommodate everything to try and prevent something big from happening on their watch.

Friday Surprises:

o The NASDAQ (Mag-7) finished lower on the week.

o META, AAPL, MSFT all finished BELOW the lower edge of their weekly Expected Moves.

SPX Expected Move (EM):

o Last Week’s EM = $93 … and we touched the lower edge of the EM – ending the week unchanged / slightly higher by +$16.

o Next Week's EM = $81… but we moved almost $100 on Friday. Again, I’ll take the ‘over’ on that $81 EM.

TIPS...

Tip #1: The 6450 level is critical. If we close below that level = BUY a SPY PUT Spread as we will be revisiting 6250 before going higher.

Tip #2: Tech (Mag-7) led this market higher but watch for the: ‘Bounce-n-Fade’ – specifically in META.

Tip #3: S&Ps are near ATHs, but NVDA’s earnings are on Wednesday.

Tip #4: Buy the VIX Call Spread because Volatility is at its lowest level in a year.

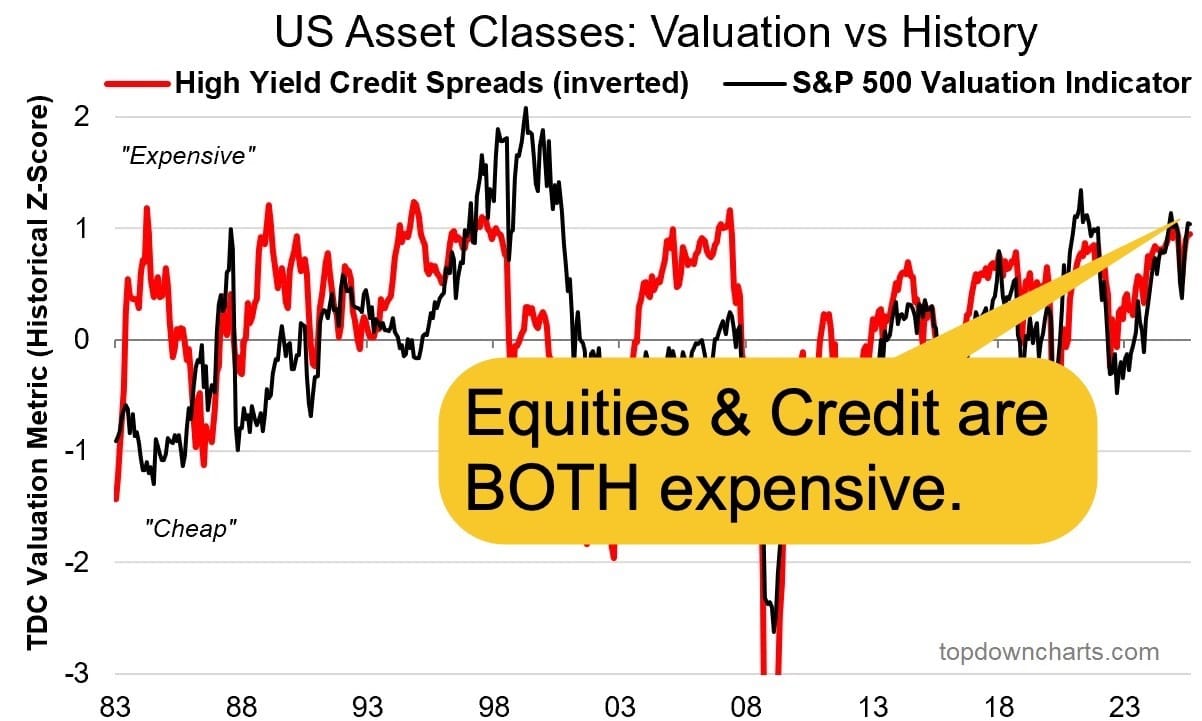

Factually: (a) There is bullish broadening, improved earnings breadth, and bullish rotations as markets trend higher. (b) There are plenty of seasonal risk flags and tech early warning indicators firing off as we head into September. And (c) Credit spreads are at 25-year lows indicating confidence & complacency. Overall, per Callum Thomas: This week’s 3 Key Themes are: (1) Markets are building bullish evidence via their technicals, rotation, and breadth. (2) The big picture risk pressures are also increasing due to expensive valuations, AI hype, and all-in positioning. And (3) The short-term seasonal risk flags are waving. Reconcile these indicators via hedging, risk management strategies, and paying attention to what price is telling you.

HODL’s: (Hold-On for Dear Life)

- (+) IBIT – Blackrock’s Spot Bitcoin ETF ($66.49 / in at $24)

- (+) ETHA – Ethereum ETF ($36.61 / in at $13.5)

- (+) Physical Commodities = Gold @ $3417/oz. & Silver @ $38.8/oz.

- Bitcoin (BTC = $115,700 / in at $4,310)

- Ethereum (ETH = 4,700 / in at $310)

- (+) GLD – Gold ETF ($310.8 / in at $212)

Options for Income: De-Risking a Portfolio… (using IBIT for example)

- BUY-n-HOLD the IBIT ETF

- BUY PUTs: 1 Std. Dev. Lower, Expiring = 3-weeks away, OTM (out-of-the-money) for protection.

- SELL Covered CALLs: 0.75 to 1 Std. Dev. Higher, Expiring = 2-weeks away, OTM for income and to finance the PUTs.

‘De-Gen’ Economy:

- Chainlink (crypto) == LINK: ($25.7 / in at $19.4)

- Aave (crypto) == AAVE: ($343 / in at $254)

- Emerging Markets ETF == EEM: ($50.6 / in at $50)

I’m Thinkin’ about:

- HL … $7.60 = Buy shares / Sell the $10 Call $0.50 for the December

- PEW … $5.35 = Buy shares and sell the January $7.50 Call for $1.10.

- GROY … $3.15 = Buy shares

- GRNY … is Tom Lee's ETF that only includes 35 of the best companies in the S&P. The chart looks promising.

- PEGA … is one of Dan Ives AI must haves. It’s trying to climb back over some moving averages.

- UUUU … is sitting on its upper boundary. Watch to see if it can punch-n-run.

Please be safe out there!

Disclaimer

Expressed thoughts offered within the BARRONS REPORT, a Private and free weekly economic newsletter, are those of noted entrepreneur, professor and author, R.F. Culbertson, contributing sources and those he interviews. You can subscribe by visiting: https://rfsfinanicalnews.beehiiv.com/subscribe.

Please write to Mr. Culbertson at: <[email protected]> to inform him of any reproductions, including when and where copy will be reproduced. You may use in complete form or, if quoting in brief, reference <http://rfcfinancialnews.blogspot.com/> and/or https://rfsfinanicalnews.beehiiv.com

If you'd like to see R.F. in action - please feel free to view the TED talk that he gave on Fearless Investing.

Creativity = https://youtu.be/n2QiPSe_dKk

Sales = https://youtu.be/blKw0zb6SZk

Startup Incinerator = https://youtu.be/ieR6vzCFldI

To unsubscribe please refer to the bottom of the email.

Views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with Mr. Culbertson's other firms or associations. Mr. Culbertson and related parties are not registered and licensed brokers. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Please make sure to review important disclosures at the end of each article.

Note: Joining BARRONS REPORT is not an offering for any investment. It represents only the opinions of RF Culbertson and Associates.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. WHEN CONSIDERING ALTERNATIVE INVESTMENTS (INCLUDING HEDGE FUNDS) AN INVESTOR SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS AND OTHER SPECULATIVE INVESTMENT PRACTICES MAY INCREASE RISK OF INVESTMENT LOSS; MAY NOT BE SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Culbertson and/or the staff may or may not have investments in any funds cited above.

To Subscribe: https://rfsfinanicalnews.beehiiv.com/subscribe

Remember the Blog: <http://rfcfinancialnews.blogspot.com/> and/or

https://rfsfinanicalnews.beehiiv.com.

Until next week – be safe.

R.F. Culbertson